Every processing and documentation required information. The information is captured to identify an entity to a particular process or document.

Although the credit score information is centred on credit history, account type, account details and more, the main focus is on the individual.

Once you apply for a credit card, a credit score is generated in the system, using the information provided. This information includes name, address, occupation, and income details.

This information is captured into the system to identify every individual. The unique identity of every person is used for the documentation and processing of other transactions.

You may calculate your credit score by looking at your credit history, which includes details such as the number of accounts you have, the total amount of debt you have, your repayment history, and other aspects.

How do I update credit score information?

Your credit score information is tied to your social security number. Whatever information captured on your special security is directly linked to your credit score.

So how can one update his or her credit score information? Let us delve into this.

You have limited control and management over updating your credit score information. Credit reporting companies determine your credit score based on factors such as your payment history, credit utilisation, credit history length, types of credit accounts, and recent credit activity.

Credit reports contain valuable information that helps identify individuals, including their credit accounts, credit inquiries, and any presence in specific public records. Your credit profile relies heavily on both your credit score and a comprehensive record of your credit history. However, your personal information is also crucial. If the information in your report is incorrect or outdated, it may impact your creditworthiness.

If you wish to update your personal information on your credit report, you can easily do so by contacting the relevant companies. For example, if you relocate, it is important to inform your creditor about your new address so they can send your mail, including your monthly bills, to the right place. The creditor will send your new address to the credit bureaus when they share their information next time. You can include this in the section of your credit report that contains your personal information.

If individuals wish to update their credit score, they may directly reach out to their credit companies and provide the appropriate proof to allow for the needed change.

How do I start a new credit score?

Starting a new credit score can be very difficult at times especially being the first time.

It might help to know a few things about credit before you start your first credit score.

Your credit history shows how you have paid back debts and handled your money in the past. Credit bureaus gather information about your loans and credit card accounts and put it on this report. That information is added to your credit record by the credit bureaus as soon as they get it.

- Applying for a credit card is one way to build credit. If you are new it can be difficult to get a credit card but there is an option available to help you start a new credit score which is an unsecured credit card.

- A family member or friend who knows you could add you as an authorised user to their credit card account if they want to. As an authorised user, you can make purchases, but the main payer is still responsible for paying for them.

- Community banks and credit unions may give loans to help people build their credit. These are small loans, from $100 to $500, that are meant to help you build your credit.

How long does it take to correct your credit score?

When you look at your credit history, you can get an idea of how well you correct your credit score. If you want to know if you are eligible for a loan, lenders will look at your credit score. If you have a low credit score, your alternatives for financing will be limited, and you will be subject to higher interest rates.

Typically, if you are in need of a car loan in order to purchase a vehicle, you will be required to have a high credit score in order to obtain the loan. The higher your credit score, the more favourable it will be for you, as it will enable you to obtain loans with cheaper interest rates and larger quantities.

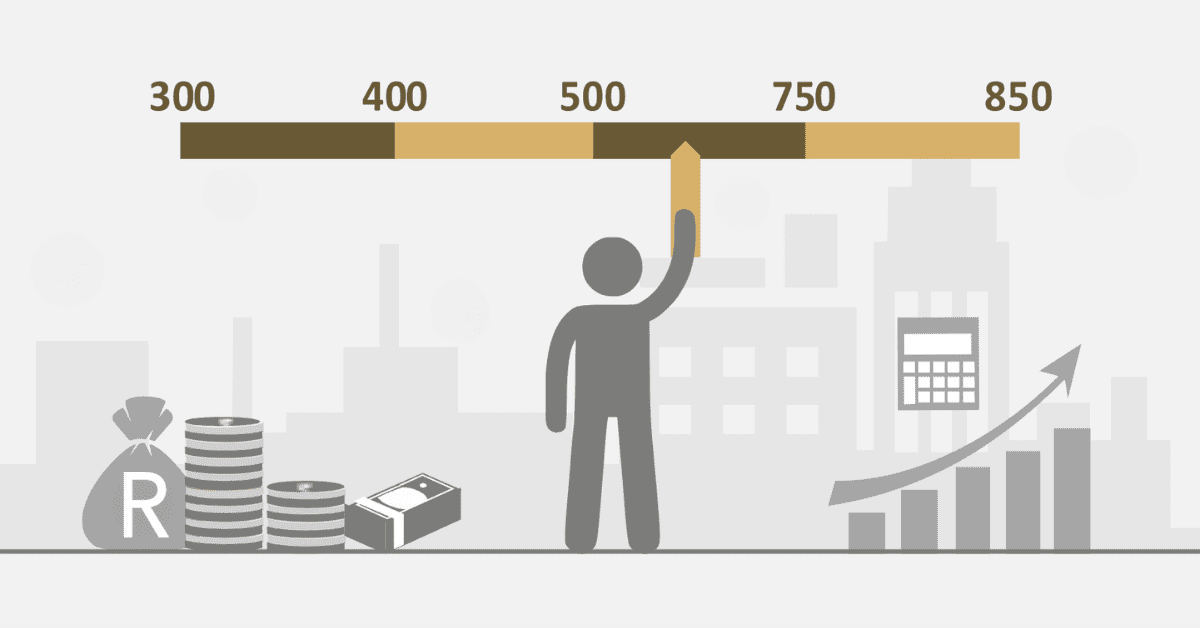

The process of improving one’s credit score is unique to each individual; but, if you manage your finances wisely, you can correct and improve your credit score from 500 to 700 between 6 months to 18 months. There is a possibility that it will take several years to improve your credit score from 500 to something better, but the majority of loans will become available to you before you reach a credit score of 700.

Generally, the amount of time it takes to correct your credit score might range anywhere from one month to ten years, depending on where you are starting from and how you handle your finances.

Can I update my credit report online?

The concept of credit report is generated to provide conventional discipline among individuals. Updating your credit report could mean making changes to your personal details.

If you wish to update the credit report generated by the credit bureau online; the best solution is to contact your bank and credit bureau depending on the situation.

In a nutshell, generated credit report can not be tampered with unless you dispute to your credit bureau to make the necessary update.

How can I fix my credit score in SA?

Wherever you find yourself, fixing your credit score can take a ton of effort and time. These measures metered out to support credit fixing must be done continuously and diligently.

Here are a few tips to help you fix your credit score in South Africa. Applying these measures consecutively can give you a great advantage in fixing your credit score.

- Ensure timely payment of your bills

- Consider closing any credit accounts that you no longer use.

- Obtain a copy of your credit report and carefully examine it for any inconsistencies or errors.

- It is always a good idea to maintain a credit balance that is less than half of your credit limit. This will work to your advantage.

- Avoid maxing out your credit limit all at once.

- Do not apply for credit all the time, as an inquiry by a lender could be a disadvantage and affect your credit score.

- Seek credit repair counselling and advice from your credit bureau or professionals.