Tax practitioners handle various taxpayers’ portfolios on eFiling. You can add or transfer a taxpayer’s portfolio on eFiling by following a few steps. In this post, we explain everything you want to know about how you can transfer a profile on eFiling.

How Do I Transfer My Profile on Efiling?

Follow these steps to transfer a taxpayer.

- Log in to eFiling

- Select: Organizations, Organisation and Register New

- Complete the details required and click “Continue” on the tab below the page

- Choose the tax type box, enter the tax number, and then click “Register”.

- A message showing that the taxpayer is registered will appear on the screen.

- On the left menu, click “Request Tax Types”.

- Choose “Create New”

- Under the declaration, choose “I Agree”, or I do not “Agree”.

Enter the reference number, click “Request”, and then type transfer for personal income tax. An automatic email or SMS notification will be sent to the taxpayer or registered representative of the taxpayer to transfer the text type to the one who has requested it.

The registered representative or taxpayer will receive an SMS or email and approve the transfer request by following these steps:

- Log in to www.sars.gov.za

- Choose “Manage Tax Type Transfer”

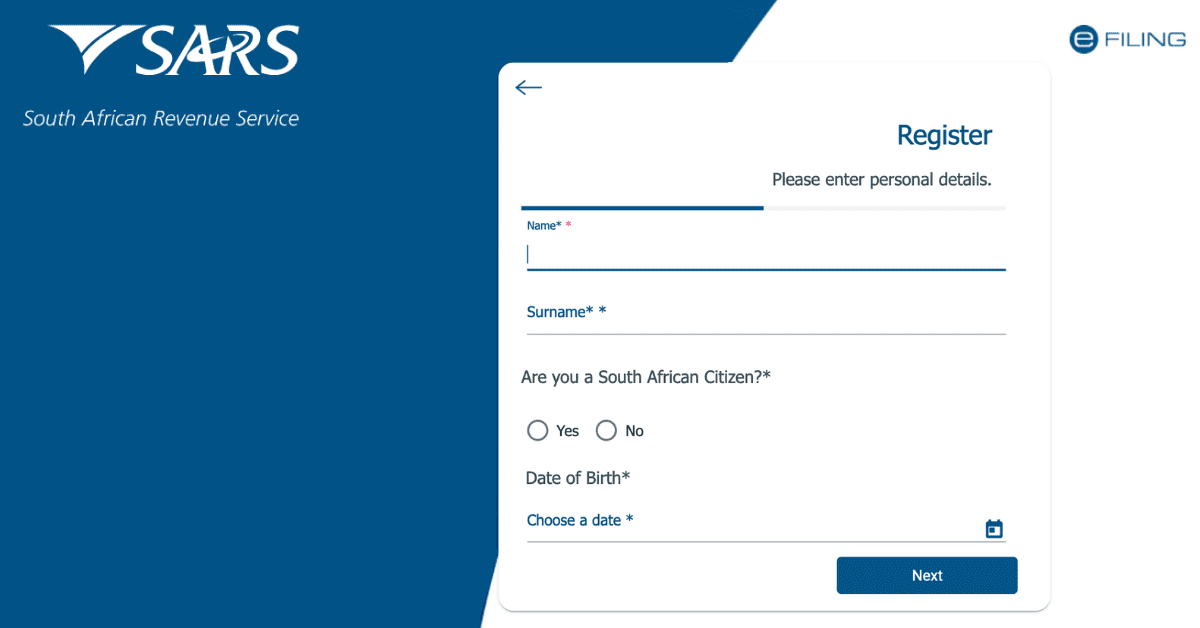

- SARS eFiling registers new

- Complete the online form by entering your tax reference number and ID/passport number.

- The taxpayer will receive a one-time-pin (OTP)

- The taxpayer will get an online POA to “Accept” or “Decline” the transfer request.

If the request is not accepted or declined within five business days, the registered representative or taxpayer will receive another reminder to action the request. Once the taxpayer has “Accepted” or “Declined” the request, the requestor will be notified. The requestor can also ask for an override code from SARS if the request is not accepted within five days.

How Do I Request a SARS Profile Transfer?

The Tax Type Transfer process for personal income tax helps improve the tax types between taxpayers, registered representatives, and tax practitioners on eFiling. The approval goes directly to the taxpayer or registered representative of the personal income tax to transfer the tax type.

Once the taxpayer or registered representative receives an email or SMS, they must approve the request by:

- Visit www.sars.gov.za

- Choose “Manage Tax Type Transfer” on SARS eFiling space.

- Complete the online form, tax reference number, and passport/ID number.

- An OTP is sent to the taxpayer.

- The taxpayer will be presented with an online POA to “Accept” or “Decline” the transfer request. The requestor gets notified once the taxpayer accepts or declines the transfer request.

If the requestor is not a registered representative or registered tax practitioner for the requesting taxpayer, a tax-type transfer will be declined.

How Do You Add a Profile to SARS?

If you are a Tax Practitioner, you can add clients to your SARS eFiling profile by following a few steps. You must log in to your eFiling account, select the “Organization” tab, and then click on “Register New.” The “Register New Organisation” page appears on the screen for you to add new clients to the eFiling profile.

The fields to complete significantly differ depending on the selection of the type of taxpayer. Some taxpayers you can choose include individual/sole proprietor, company, trust, partnership, fund, etc. Complete all mandatory fields and click “Continue.”

If there are specific groups on eFiling, you must select the relevant group where the taxpayer belongs and click “Continue.” If the taxpayer is added, they will reflect in the taxpayer field list. Ensure the client’s details are correct and up-to-date to add them to your profile. The tax practitioner can update the registered details on behalf of the client except to change their ID number.

How Do I Delete My SARS Efiling Profile?

You can cancel your employee’s registration for tax from your SARS eFiling profile for different reasons. You must take the following steps to delete a client from the SARS eFiling profile.

- Indicate on your final EMP501 reconciliation that you intend to deregister an employee for tax. Provide a valid reason for deregistration.

- Utilize the deregistration feature on eFiling

- Send a written notification together with EMP123/EMP123T form to SARS. You can send these details via post, fax, or email to the regional office where the business is registered.

If you want to cancel the registration of businesses, you should submit the EMP123 form. You must submit the EMP123T Form if you want to cancel the registered division or branch separately. Provide the reasons why you are cancelling the registration of your business. Ensure there are no outstanding returns before you cancel your business. If you owe any money to SARS, you will still need to pay it before deleting your profile.

How Do I Add a New Taxpayer to Efiling?

A tax practitioner can add new taxpayers to eFiling, and the process is straightforward. Before adding a taxpayer, ensure they will add value to your profile so their details can easily go through to SARS. Follow the steps below to add a new taxpayer to eFiling.

Select the “Organization” tab and click on “Register New.” The “Register New Organisation” page is displayed so that you can add new taxpayers to eFiling.

Complete all relevant fields and click continue to proceed to the next stage. If there are groups already created on eFiling, you need to select the relevant group to which the taxpayer belongs. Click continue, and the added taxpayer will appear on the list of taxpayers.

If you are a tax practitioner, you can add or transfer client profiles by following a few steps on eFiling. The taxpayer or their registered representative must accept or decline the request before you proceed to add them to your profile. Ensure the client’s details are correct and up-to-date on the SARS system. Failure to meet all the requirements can lead to the denial of the request for client transfer.