If you are a self-employed individual or have additional sources of income, you may be required to submit the provisional tax to SARS (South African Revenue Service). Filing and paying your provisional tax on time is essential to avoid penalties and interest charges. This article will guide you through submitting your provisional tax return to SARS.

Let’s get started!

How do I submit my provisional tax to SARS?

- ADVERTISEMENT -

It may seem challenging to submit your provisional tax return to SARS, but with technology and a few straightforward procedures, it can be a breeze. The first step is to sign up for SARS eFiling, the online service that enables you to submit documents and make payments while also allowing you to request an IRP6 return. Doing this will save time and effort, and SARS will also handle your submission more quickly.

After signing up for eFiling, you can add the provisional tax to your profile to enable online access to and file your IRP6 return. Thanks to this straightforward approach, you may finish your application with just a few clicks and in a fraction of the time it would take you to do it manually.

Besides this, you can register for all of the various tax types at once using the client information system that is part of the eFiling service. This feature makes the process even more convenient because you can manage all your tax submissions in one location.

How do I add tax types on eFiling?

If you haven’t previously, you might need to add tax types to your profile if you’re utilizing eFiling to send your provisional tax return SARS. On eFiling, adding a tax type is quick and straightforward, and here’s a short guide on how to accomplish it:

Go into your eFiling account first, then choose the correct taxpayer from the “Taxpayer List.” Once inside, select the “Organisations” tab and select “Organisation” from the menu. Choose the “Organisation Tax Types” sub-menu from that page.

A list of the various tax categories should be visible. Now check the box next to the necessary tax type, input the tax reference number, and click “Register.”

You must add tax types if you need to file returns for extra taxes, such as provisional tax. After a tax type has been added, it will be accessible through your eFiling profile, and you can use it whenever you need to file your returns.

When can I submit my provisional tax return?

Provisional taxpayers must know the reporting deadlines to prevent fines and interest on unpaid taxes. The first provisional tax return was due by August 31, 2025, and the second is due by February 28, 2025, both for the 2025 tax years. You have until September 29, 2025, to submit a top-up payment. The last deadline is January 23, 2025, when you must file your income tax return.

Observe that the due dates for the 2025 tax year are already past. As a result, if you haven’t filed your tax returns for that year, you could be subject to fines and interest. It’s usually a good idea to pay attention to these due dates and submit your taxes as soon as possible to avoid unfavourable outcomes.

Do I need to register for provisional tax?

You must register for provisional tax if you earn income outside of a salary or allowance. This step ensures that you pay tax in advance in at least two amounts during the assessment year based on estimated taxable income. Also, this is important because it allows SARS to collect tax revenue throughout the year instead of waiting for a lump sum payment at the end of the year. Treading the tax payments helps ease the burden on taxpayers, especially those with large tax bills.

It is worth noting that companies automatically fall into the provisional tax system, but individuals who earn other forms of income must register. Failure to register as a provisional taxpayer when required may result in penalties, interest, and even legal action from SARS.

How do I submit IRP6 online?

Filing your IRP6 return on SARS eFiling is quick and easy. Here’s a step-by-step guide:

- Step 1

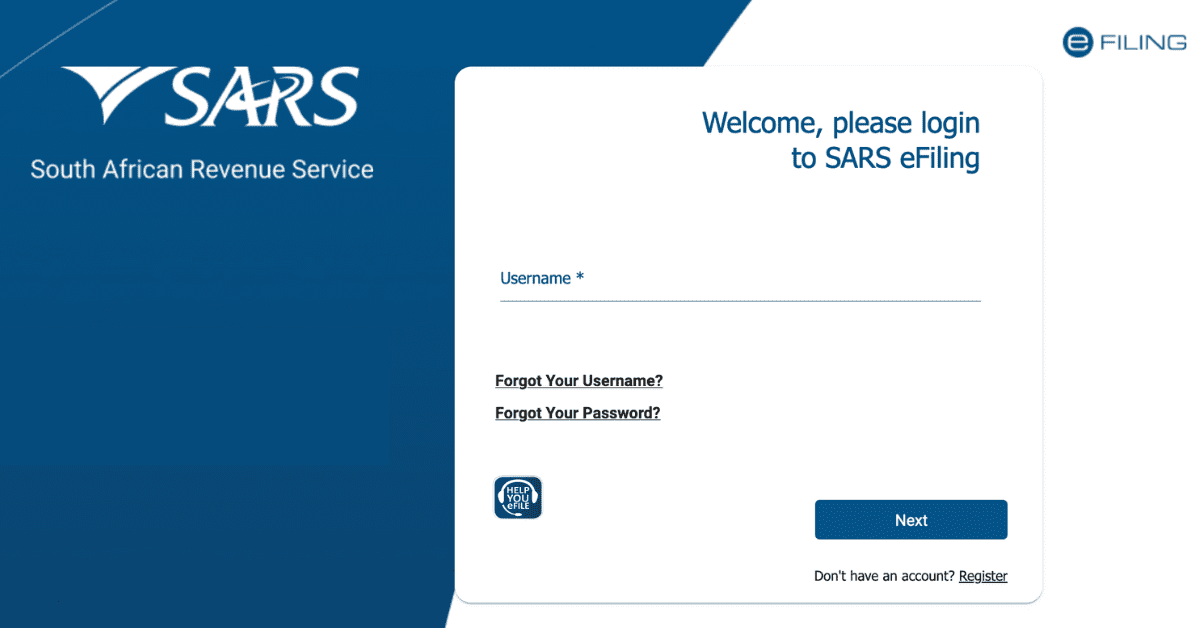

Log in to your eFiling profile by visiting www.sarsefiling.co.za and entering your username and password. If you still need to register, you can do so on the same page.

- Step 2

Once you’ve logged in, ensure your name appears at the top under “Taxpayer List.” Click on the “Returns” button and select “Provisional Tax (IRP6)” from the list of options on the left-hand side of the page.

- Step 3

If you haven’t yet created your IRP6 provisional tax return for the relevant year, select the year and applicable period (either 01 for the payment due at the end of August or 02 for the second payment due at the end of February) from the dropdown selector box on the right-hand side of the page and click “Request Return.” SARS will generate the return for you.

- Step 4

Once you have your return, complete the form by entering the necessary information. When you’re finished, click the “File” button to submit.

- Step 5

If you need to pay to SARS, click the “Make Payment” button and follow the instructions.

You can contact SARS for assistance if you face any issues while filing your return. Remember, you must submit a provisional tax return if you earn income other than a salary or an allowance. And make sure to submit your return on time to avoid penalties and interest.

How do I pay my SARS provisional tax?

You have several options if you’re a South African taxpayer and must pay your SARS provisional tax.

Firstly, you can pay at one of the central banks in South Africa, including Absa, FNB, Nedbank, Standard Bank, and Capitec. Remember to quote the correct beneficiary ID and payment reference number (PRN) to ensure your payment is allocated to the valid account.

Another convenient option is to pay through eFiling, SARS’ online tax-filing system. With a credit push, you, the bank account holder, can initiate the payment request to SARS through eFiling, which will reflect the amount that needs to be paid on the relevant bank product. You then authorize this request through your bank’s app, and the bank makes the payment to SARS. Other payment methods are available through eFiling, such as credit cards and Instant EFT.

You can also pay through the SARS MobiApp using your Statement of Account or Notice of Assessment (ITA34). When making a payment from your Statement of Account, you may pay any amount you decide to SARS. However, you must pay the total amount due to SARS when making a payment from your Notice of Assessment.

If you prefer internet banking, you can make an Electronic Funds Transfer (EFT) using the standard drop-down listing of pre-loaded beneficiary IDs provided by your bank. All SARS beneficiary IDs are prefixed with “SARS-.” Make sure to correctly reference your payment to ensure it is allocated to your account.

Finally, if you are a foreign taxpayer, you can make an electronic payment into SARS’ bank account using the SWIFT 103 message and the Beneficiary ID/Account Number “SARS-FOR-999”. This method is only supported by FNB and should only be used if no other payment options are available.