Has a filing deadline for SARS crept up on you unexpectedly? Don’t worry, it happens! Fortunately, SARS provides a process for requesting an extension on your filing, ensuring that you can fulfill your tax obligations without added penalties. Today, we will walk you through how to submit a request for an extension on SARS eFiling

How to Submit a Request for Extension on eFiling

If you need more time to complete and submit your tax return, here’s how to request an extension on SARS eFiling.

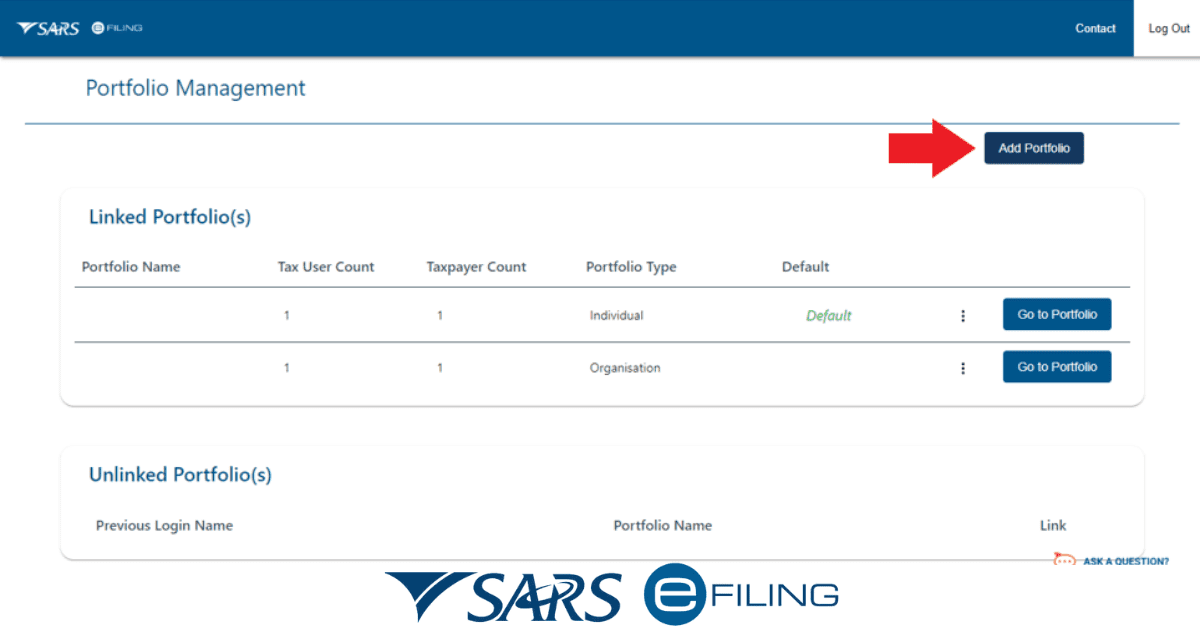

Login to your eFiling account, head to the ‘returns’ tab, and find the tax return you need an extension for. You may need to request the return from the dropdown menu. Click into it, as if you were going to edit it. Along the buttons underneath the return, you will see ‘request for extension’.

When prompted, explain the reasons why you need an extension. Be clear and concise in your explanation. SARS offers some options for you to choose from. Once you’ve filled in the prompts, click submit. All you need to do now is wait to hear an answer from SARS. Once approved, they will communicate the new deadline to you. Easy, right?

When Can I Submit my SARS Tax Return 2026?

When you can submit your SARS tax return is a common question. It’s also very common to get confused about which year you are submitting your return for. In general, for most individuals, the so-called ‘tax season’ opens in July, and closes at the end of October. The deadline is slightly longer for some business types, such as provisional taxpayers, extending into January. You can always check the exact dates for each year on the SARS website. If you have a tax practitioner, they will also typically let you know when tax season is opening and ending.

In 2026, you can subm it your SARS tax return

How Do I Submit An Outstanding Tax Return?

Have you realized you have an outstanding tax return for another year? Luckily, it is easy to fix the situation. Of course, you will need the financial information from that year on hand to refer to.

Log in to eFiling and again head to the ‘returns’ section. Select the return that is missing from the dropdown menu and request it. Carefully check the year to make sure you have the right return. You will notice the ‘due by’ column is red, indicating the missed deadline.

Nevertheless, please carefully fill in the tax form, which is overdue. Ensure that all income, deductions, and credits are reported correctly. When you are satisfied, submit the return, and SARS will process it. You will be issued a notice of assessment for that return and can make payment at that point. Be sure to use the correct reference number for the backdated payment. Of course, you will inevitably face some interest and fees for the late payment, but these are not typically too punitive.

How Long Do I Have to Pay Back SARS?

Theoretically, you should pay SARS their monies due as soon as you receive a ‘notice of assessment’ you are happy with and do not want to dispute. If you are filing an outstanding return, they will expect payment immediately. For current returns, you typically have 30 days after filing the return to settle the full amount or make a payment extension request. For those who have been auto-assessed for tax, this is a little different. You have 30 days from the middle of October (technically, the week before tax season closes). This is to give you the time to review and, if necessary, dispute the auto-assessment.

These guidelines are for returns without a payment arrangement in place. If you cannot meet your tax payment obligations, in some cases, SARS may grant extensions or allow for instalment payments. If this is the case for you, it is essential that you comply with the payment dates, amounts, and timeline you agreed on with SARS, or they have the right to revoke the payment arrangement. If that happens, the remaining amount will be due immediately.

Mistakes happen. However, the quicker you act to correct them, the quicker you can become tax-compliant again. Luckily, you have the ‘request for extension’ option on eFiling to help avoid unnecessary penalties and other issues from occurring. So don’t be shy about using it as needed.