In simple steps, learn how to request a correction on SARS eFiling. Avoid penalties, interest, or legal action by correcting errors on your tax return. Find out how to check your correction request status and what happens after you submit it.

The Request for Correction process is a crucial tool for anyone who has made an error on their SARS eFiling tax return. This process allows you to fix mistakes on a previously submitted return/declaration, which can help you avoid penalties, interest, or even legal action.

So, if you’ve realized that you made a mistake on your tax return after submitting it, don’t worry. You can use the Request for Correction process to correct the error and make sure that your tax affairs are in order. However, taking action as soon as possible is essential, as delaying the correction process could result in further complications.

In this post, I’ll take a closer look at the Request for Correction process on SARS eFiling, including the steps you need to follow to correct an error and the documents you’ll need to provide. I’ll also provide some helpful tips to help you avoid common mistakes and ensure your correction request is processed as smoothly as possible.

So, whether you’re a first-time user of SARS eFiling or a seasoned filer, read on to discover everything you need to know about correcting errors on your tax return with the Request for Correction process.

How Do I Request A Correction On SARS Efiling

Requesting a correction on SARS eFiling is a relatively straightforward process. Follow these steps to correct an error on your tax return:

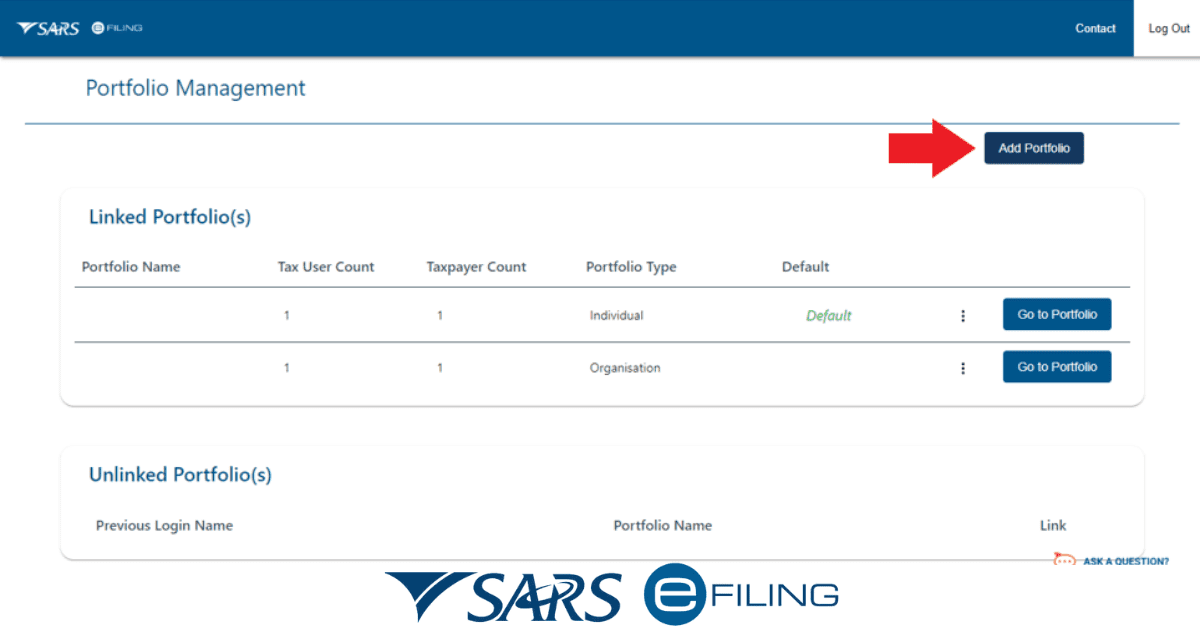

- Log in to your SARS eFiling account

To access the Request for Correction service; you’ll need to log in to your SARS eFiling account. If you haven’t already registered for an account, you’ll need to do so before you can request a correction.

- Navigate to the “Returns” tab

Once you’ve logged in, click on the “Returns” tab to view your returns.

- Select the applicable type of tax.

Depending on the type of tax you need to correct, select the relevant option, such as Income Tax

- Select the applicable return/declaration.

Select the specific return or declaration that contains the error you need to correct. Click “Open” on the far right to access the work page.

- Request a correction

On the work page, select the “Request Correction” button to begin the correction process.

- Complete the correction form.

You’ll then be prompted to complete a correction form, which will require you to provide details about the error you need to correct. Ensure you provide all the necessary information and double-check that you’ve entered everything correctly.

- Upload supporting documents

Depending on the type of error you need to correct, you may be required to upload supporting documents, such as a revised tax certificate or a statement of account. Be sure to check which documents are required and upload them along with your correction request.

- Submit your correction request.

Once you’ve completed the correction form and uploaded any necessary documents, you can submit your correction request. SARS will then process your request and send you a confirmation once the correction has been made.

What Does Correction Filed Mean On SARS Efiling?

Correction filed on SARS eFiling typically means that your correction request has been successfully submitted and received by SARS. It’s important to note that a correction request is not a guarantee that your tax liability or refund will change. SARS will review the information you’ve provided and decide based on their assessment. If SARS determines that the information you’ve provided is inaccurate or incomplete, they may request additional information or documentation before making a final decision on the correction.

What Happens When You Request A Correction From SARS?

After submitting a Request for Correction or Notice of Objection to SARS, they will review your request and make a decision. If SARS approves your Request for Correction, you’ll receive a new IT34, which reflects the changes you requested and the revised amount of tax you owe or refund you’re entitled to.

Similarly, if your Notice of Objection is accepted, you’ll receive a new IT34, which reflects the changes requested in your Notice of Objection.

However, if your Request for Correction or Notice of Objection is rejected, you will receive a written notification explaining the reasons for the rejection. In such cases, if you disagree with the decision, you can use the dispute resolution process to pursue your case further.

Can You Edit A Tax Return After Submitting?

Yes, you can edit a tax return after submitting it, but you will need to request a correction from SARS. This correction process allows you to rectify any errors you made on a previously submitted tax return or declaration.

How Long Does A Tax Correction Take?

The time it takes for SARS to process a tax correction request can vary depending on various factors, including the complexity of the correction and the current workload of SARS officials. However, it can generally take anywhere from a few weeks to several months for SARS to process a correction request. After submitting your correction request, you can check the status of your request on the SARS eFiling platform under the “Returns History” tab. If your correction request has been received and is being processed, the status will show as “Correction Filed”.

How Do I Check If My Tax Return Is Corrected?

To check if your tax return has been corrected, log in to SARS eFiling and go to the Returns section. Under the Returns History tab, you can view a history of all the tax returns you have submitted in the past.

If your tax return has been corrected, you will see a new assessment in the form of a new IT34. You can access the new IT34 by clicking on the relevant return or declaration and selecting “View Assessment” or “View Return”.

If your tax return has not been corrected yet, the status of your correction request will show as “Correction Filed” under the “Returns History” tab. This means that SARS has received your request and is in the process of reviewing it.

Can I Delete My Tax Return And Start Again?

In general, once you have submitted a tax return on SARS eFiling, you cannot delete it and start again. However, you may be able to make changes or corrections to your submitted tax return using the “Request for Correction” process.