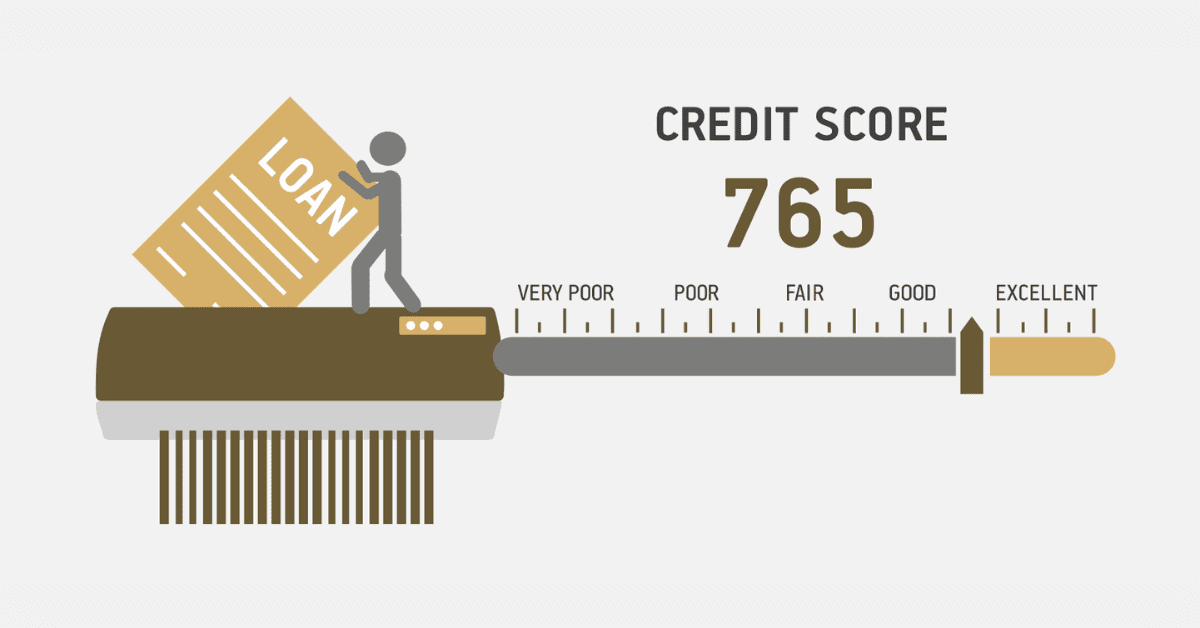

In South Africa, the average credit score is 650, and it allows you to apply for auto loans, mortgages, personal loans, and others from different lenders like banks and other financial institutions. With a poor credit score, you may not qualify for these loans, but small credits like payday loans with high-interest rates. Fortunately, you can fix your credit score to enjoy more benefits, but this process usually takes time. Here are the steps you can take to repair your credit score.

Can I Fix My Credit Score by Myself?

The only person who can perfectly fix your credit score is none other than yourself. This may seem an overwhelming task to accomplish, but the good thing is with commitment, you can do it better than a professional. No credit repair company can repair your score better than yourself, so stop wasting your time and money looking for professionals.

How to Repair Your Credit Score Yourself

Repairing your credit score is a process that can take time, but the good thing is that it is doable. First and foremost, it is important to remember that your payment history contributes 35% of your total score. Therefore, you should know that bill payment precedes everything when it comes to repairing your credit score. Be sure to make timely payments of bills and other recurring monthly payments like insurance premiums, retail debts, or mobile phone debts. It is a good idea to automate your payments so that you can be in total control of your financial affairs.

You should check your credit score and credit report for mistakes. You can obtain a free credit report from each of the four credit reports operating in South Africa. If you identify mistakes or any suspicious activity on your report, make sure you dispute to any of the credit bureaus so that it is removed.

Credit bureaus often make mistakes that can affect your score. For example, your account can be attributed to incorrect payment history, wrong identity details, or inaccurate credit reporting. When you check your credit report, you will be able to identify all the transactions you have not performed.

In some cases, identity theft can lead to fraudulent activities on your account, which will affect your credit score. When someone steals your identity documents, they can open credit accounts without your knowledge or consent. This will cause more harm to your credit score even when you’re trying to repair it. Report any fraudulent activities to maintain an error-free report.

Avoid maxing your credit card when you’re still trying to repair your credit score. Your credit utilization ratio must not exceed 30%. Lenders often check this ratio to establish how a potential borrower manages their finances. If you exceed this ratio, you may end up failing to repay your credit. As a result, you may be charged interest.

When you have other outstanding debts, you should pay them to improve your credit history. Depending on your financial situation, you can start paying off smaller debts or focus on debts with higher interests. Debt consolidation is another effective method you can consider to repay outstanding credits. This option allows you to consolidate your debts into a single manageable loan. The loan usually comes with a lower interest rate, which helps you save money in the long run while improving your credit score.

If you have old credit card accounts you no longer use, you should not close them. They will contribute to your credit history when you keep them open. Credit history contributes 15% to your credit score. However, the issuer will close the card after a long period of inactivity.

When you are in the process of repairing your credit score, you should avoid taking new credit unless you want to cover other pressing issues at hand. Obtaining a new credit will only worsen your financial situation because you will stay in debt for an extended period. Additionally, your credit score will take a dip whenever you apply for credit because the lender wll conduct a credit check on your account. Your score will lose some points for each hard inquiry performed on your account. Therefore, the golden rule is to avoid applying for new credit when you have an issue with your credit score.

Can You Pay a Company to Fix Your Credit?

Credit repair companies claim that they can fix your credit, but this will only be a small percentage of your total credit score. For example, these companies are responsible for monitoring client accounts and deleting negative information from their credit reports. You can still do this even without enlisting the services of a professional. It is faster to dispute the errors on your report yourself.

Credit repair companies are expensive, but they can only fix one aspect of your credit score. They cannot rectify major issues that affect credit scores like late payment, credit history, and others. The account owner is the only person who can deal with these issues. Against this background, credit repair companies offer very little in terms of fixing your credit score. Seeking assistance from a not-for-profit credit counselor is a better option than enlisting the services of a credit repair company.

How Long Can It Take To Fix a Bad Credit Score?

There is no fixed timeline for fixing your credit score. It can take longer than you expect to fix your score. However, if you take appropriate action to repair it, it can take up to six months, and you will continue witnessing positive changes if you maintain the effort to repair it. What you should know is that fixing your credit score is a process that takes time. You should be patient if you want to achieve your desired goals.

A good credit score comes with numerous benefits since it is used by lenders to assess a potential borrower’s creditworthiness. If your score is below average, you can take the steps explained above to fix it. Remember, this is a long-term process, so you need to be patient.