Weigh your credit score as an enchanted number that displays your ability to repay promptly. The ability to receive loans, such as loans, credit cards, or mortgages, is close to possessing a key. It may further have an effect on the conditions and interest rates that are offered to you.

A good credit score may be your pivotal colleague whether you’re attempting to launch a business, buy a house, or execute other significant financial decisions. However, it may seem challenging if your credit score is bad. Issues can include paying higher interest rates, not having authorized for credit, or being needed to provide collateral or a guarantor.

In this writing, we’ll go over how to boost your credit score in South Africa and why it’s a pivotal step. Along with sharing some advice on how to raise your credit score, we’ll also address some frequently asked questions. Let us now begin!

How To Raise Your Credit Score

Do you want to raise your credit score? These are a few helpful pointers:

Start small. Open a low-limit store account or credit card and exercise responsible usage. Don’t run the balance; pay it off in full each month. This shows that you can manage credit and grow your score over time.

Remit payment on time. Make sure all dues and invoices are cleared on time and in toto. Through this, you can be credible and counted on. Additionally, it keeps information harmful to your credit score, including late payments, defaults or judgments, from being shown on your credit report.

Limitation on use of your credit. Your credit utilization is simply what portion of your available credit you take advantage of using. The rate is low whenever your score is better. It shows that you are not dependent on credit and make enough money to manage your needs just as well. Try to keep your purchases under 30% of your credit limits.

Borrow only what you need. Too many credit applications in a short while can mess up your credit score and suggest that you are needy. Do not borrow more than you need or can pay back. Prevent hard inquiries and credit report checks carried out by lenders to ascertain your creditworthiness. Too many hard queries can lower your score and remain on file for two years.

Check your credit score. All primary South African credit agencies, like TransUnion, Experian, and Compuscan, must offer you one free annual credit statement. Utilize this record to understand more about your credit history, score, and status. Plus, question any false or out-of-date information that could lower your score and ask the credit bureaus to delete or correct it.

What Bank Helps Build Credit?

Looking to build that credit score in South Africa? Numerous banks offer products such as credit cards, personal loans, and overdrafts to help you out. However, not all the banks stand equal. They set different criteria, fees, and interest rates and provide various benefits. Therefore, you must compare different variants and pick the one that fits your needs and budget. Below is a list of banks that can help you to build your credit score:

- Discovery Bank. They reward you with lower interest rates and offer higher cashback with good credit management and improved financial behaviour.

- FNB. Have a range of credit cards, personal loans and overdrafts. They give you a free credit statement and score service tailored to help you monitor and control your creditworthiness status.

- Absa. Provides affordable charges and competitive interest for their credit cards, personal loans, and overdrafts. Moreover, they have a credit protection program where, in the event of any occurrence of death, disability or retrenchment, your due is covered.

- Capitec. They give transparent credit cards and personal loans with minimal monthly charges and flexible repayment conditions. Besides, they have a top-notch rewards plan that pays you cash back for maximizing your credit card.

- Standard Bank. Hand an array of overdrafts, personal credits, and credit cards with diverse facets and advantages, like zero-cost travel insurance, offers, deductions, etc. They also give a credit health statement that helps you learn and enhance your credit scoring.

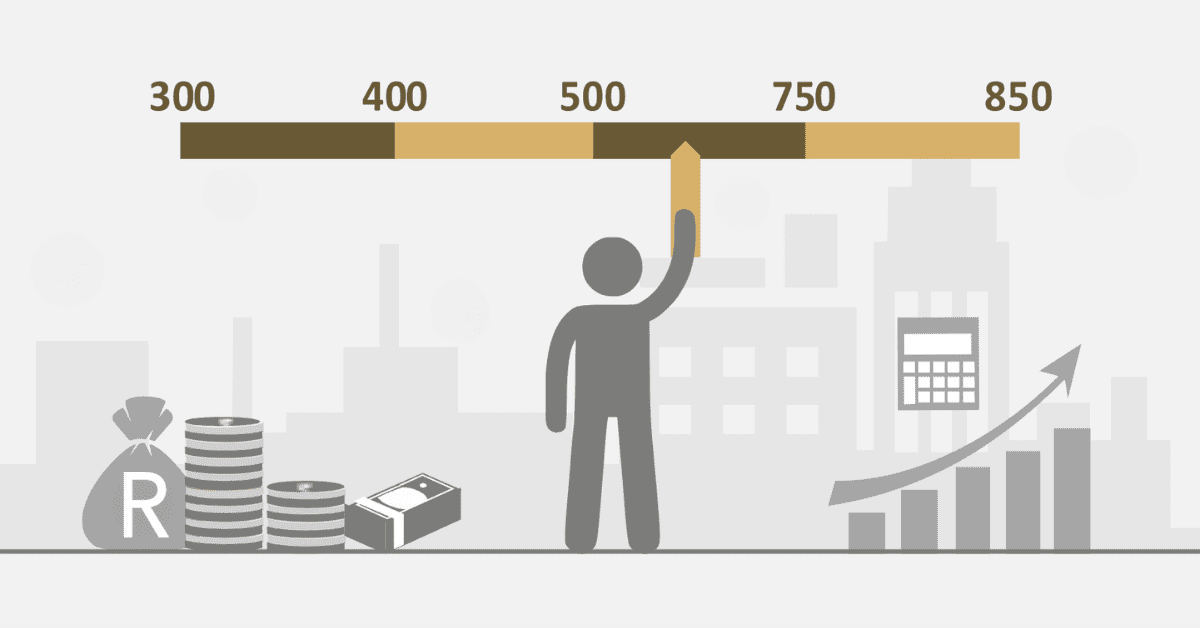

What’s A Good Credit Score?

A 650 credit rating is mainly highlighted as good, and a 700 credit rating is marked as excellent. View the credit score as a type of grade report for your money matters. This figure indicates your level of debt management and bill payment. Your financial life depends heavily on this score. Your creditworthiness, the loan interest rates, and the conditions you are given can all be affected.

Can I Pay Someone To Fix My Credit?

You may be considering compensating someone to correct your credit, mainly if you have a poor credit record and require credit urgently. But stay put, that’s not a good idea. Several cons and fraudulent firms guarantee to wipe your credit history for a fee. But everything they do is for your cash and do zero work. The only real way to fix your credit? Pay off your debts and work on improving your credit behaviour.

What Can Harm Your Credit Score?

Your financial situation is reflected in your credit score. The credit score may be affected by missing or delayed payments, countless credit requests, a high credit usage ratio, and a poor credit blend. It can be boosted by making prompt payments, restricting credit usage to 30%, and maintaining a healthy credit blend. Recall that hard inquiries remain on your record for two years and missed payments for five years. Thus, to keep your credit score high, handle your debt sensibly.