This must be a kickoff for any capitalist in this field. Whether you aim to grow wealth, retire, or finance a significant life event, you must do this. There are several mutual funds available to capitalists in SA. These are all for different capitalist needs, risk appetites, and time horizons. Each requires careful consideration of factors such as your venturing objectives, risk tolerance, and scheme performance history.

Guide to Selecting the Perfect Mutual Fund

The first thing you should do is to define your venture objectives. Are you saving for a short-term goal, such as securing a home? Or a long-term one, like retirement? Your objectives will help determine your risk tolerance and the kind of fund to suit your needs. For instance, if you have a high tolerance for risk and an investment horizon in the long term, equity mutual funds may be suitable. Income or money market funds are for more conservative investors.

Another vital factor to consider is past performance history. While it does not predict future performance, it provides evidence of the fund’s functioning in good or bad market conditions. Look at consistent performances over three to five years rather than short-term gains.

You should also review the fund’s expenses. If the management and exit fees are higher, your returns could erode over time. It is, therefore, essential to understand the cost structure. Finally, there is a manager’s track record. A seasoned manager with experience leading through different market conditions is the best. He/she can make all the difference in performance.

How Does One Decide if a Mutual Fund is a Perfect Investment?

This requires more than checking its past performance. The first of many things you need to check is the scheme’s expense ratio. This is the annual fee taken by the fund manager to manage your venture. A higher ratio can gobble into your returns, and as a result, it will be hard for your venture to grow. In SA, mutual funds with low expense proportions are apt to do better in the long run because less cash is being taken out for your venture to pay the management cost.

Otherwise, the risk-adjusted return of the scheme, keeping in mind how much risk the fund is taking to achieve those yields, is another pivotal element. Generally, a mutual fund is more desirable if it gives higher returns with low volatility. Funds performing well on risk-adjusted metrics, such as the Sharpe ratio, which stands for return per unit of risk taken, are desirable.

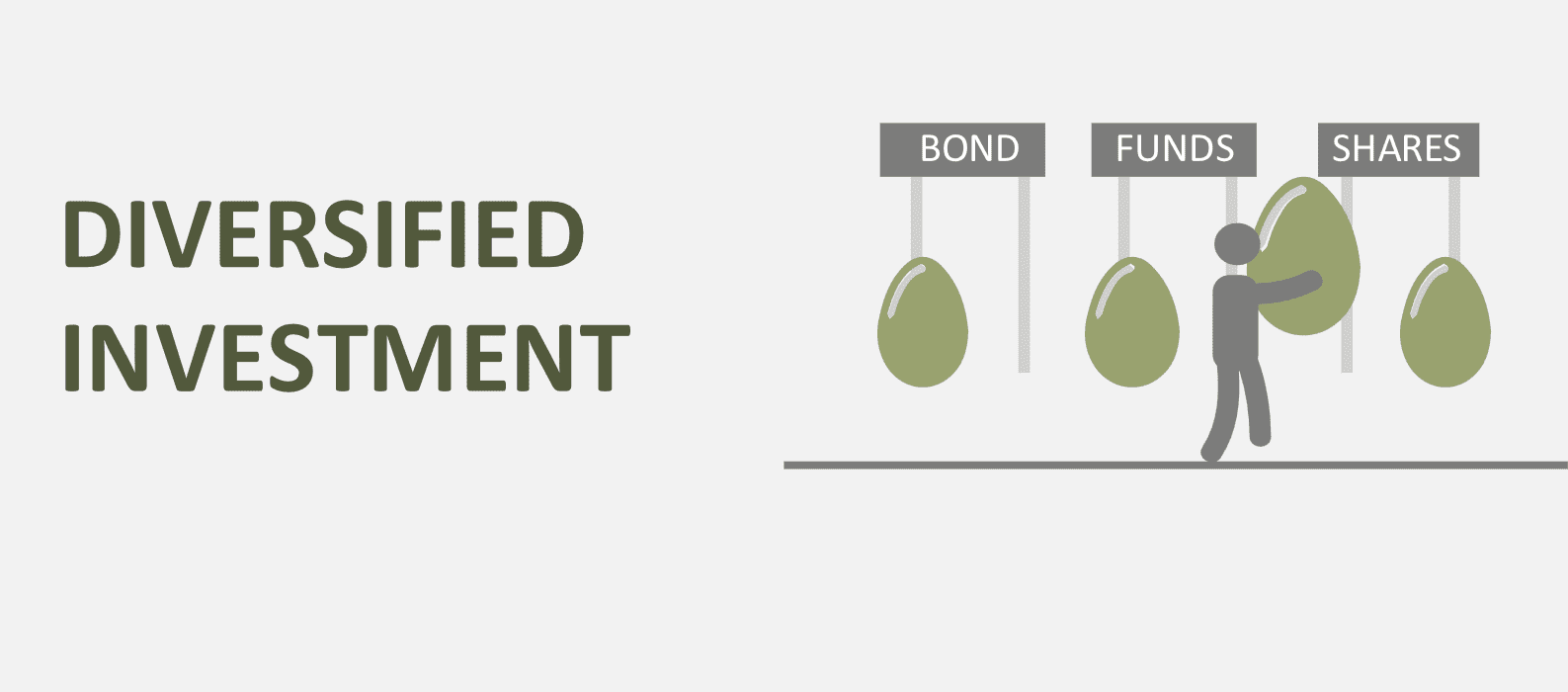

Also, look at the fund’s portfolio composition. It would be well diversified, spreading investments over various sectors, geographies, and classes of assets, which could meaningfully diversify the risk. Schemes concentrated in one or two industries or asset classes will exhibit more volatility and, therefore, are riskier. Finally, pay attention to what the scheme invests in, its venturing strategy, and if it aligns with your goals. This implies that if one scheme takes too much risk to outperform the market, that may not be appropriate for a more conservative capitalist.

What Are the Types of Mutual Funds?

They include the following:

- Socially Responsible Mutual Funds: These would invest in only such companies that reach the minimum standards of ethical, environmental, and corporate governance behavior. Capitalists who want to fund business practices imbued with sustainability and responsibility will find these schemes attractive.

- Sector and Theme Mutual Funds: Ideal for specific industries of technology, health care, real estate, or themes of clean energy or innovation. It’s pretty volatile but has a high return potential if everything works well with the sector.

- Regional Mutual Funds: These funds invest in target geographic areas such as Africa or Asia. They are appropriate for those investors looking for growth in emerging markets or developed economies outside of South Africa and are acceptable in terms of risk.

- International Equity Funds: These funds invest in companies and assets whose homes are in jurisdictions other than South Africa. This allows investors to diversify internationally. International funds are a means of exposing yourself to foreign markets and currency. That would help lessen domestic risks.

- Fixed-Income Funds: These usually generate regular income for the capitalists through dividends or bonds with interest incomes. They are suited for conservative capitalists looking for a steady yield.

- Money Market Mutual Funds: The low-risk scheme ventures in short-term debt securities and those of high quality. This would serve investors who seek high liquidity and want capital preservation.

- Balanced Funds: These invest in equities and bonds, balancing growth and income. They are designed to offer investors moderate risk and reward that fits their needs for stability and growth.

- Index Mutual Funds: These track the movement of a particular market index, such as the JSE Top 40. These offer broad market exposure, and the fees are generally much lower due to passive management.

- Bond Funds: They invest in government or corporate bonds. They suit capitalists who want to earn a stable income with a low risk associated with equity funds.

- Stock Funds: These schemes are ventured into the shares of companies listed on the stock exchange. They are more volatile but assure higher growth with a corresponding high risk and, therefore, are suitable for capitalists with a higher risk appetite.

How Does One Tell if a Mutual Fund Is a Perfect Investment?

First, long-term performance is checked compared to its benchmark index. If a fund consistently outperforms its benchmark, it will be a good investment vehicle. Check the total returns for the fund and check on consistency across different periods: a fund that maintains steady returns with lower volatility is more predictable than one that exhibits extreme highs and lows.

The second important factor involves the manager of the fund. Efficient, experienced senior managers are the best ones. They are better positioned to tackle market volatility and make tactical decisions regarding the venture. Research the scheme manager’s track record in bullish and bearish markets to see whether they can add value in different conditions.

The underlying holdings of the scheme should also be consonant with your venturing objectives. If you want long-term growth, a fund that invests significantly in high-growth sectors like technology or healthcare could be one fit. If you prefer stability and income, a fund with a considerable allocation to bonds and dividend-paying stocks would lean toward that end.

![What are ETF [Exchange-Traded Funds]?](https://www.searche.co.za/wp-content/uploads/etf.webp)