Individuals that have a higher net worth or hold local and foreign investments need to be aware of the Withholding Tax on Interest (WTI), which was introduced by SARS in 2015. This is a type of tax that makes a person who was originally from South Africa liable for the interest of the tax paid by a foreign source.

This process requires both parties to honour so that SARS is successfully paid the money they are owed. But what exactly is withholding tax on interest, and how do we pay it?

Here’s what you need to know.

What is Withholding Tax on Interest?

On the 1st of March 2015, the new Withholding Tax on Interest (WTI) ruling came into effect. This is a type of tax that is charged on interest that has been paid after the date of the ruling.

WTI is payable by any person from a source within South Africa to or for the benefit of a foreign person. The foreign person can include individuals, companies, or trusts. The foreign person or company will be liable for the tax; however, the amount needs to be withheld by the person that is making the interest payment.

The interest paid is taxed at the final tax rate, which is 15%, and is paid to SARS. WTI is just one of many withholding taxes applicable to South Africa. Other related taxes include:

- The royalties withholding tax.

- Withholding tax on dividends.

- Withholding tax on profits accumulated from the disposal of immovable property.

How To Pay WTI (Withholding Tax on Interest) on eFiling

WTI is payable to SARS via the official e-filing website only and requires the payor to complete and submit the relevant return, known as the WT002. The W002 return is a summary of all the interest payments made and taxes withheld during the specified period, usually a month.

In order to pay WTI, you will need to be registered with SARS and have a valid Income Tax number. If you have forgotten your reference number, you can call the SARS Contact Centre or visit a SARS branch for assistance.

Payments for WTI cannot be made at a SARS branch or Bank; therefore, you must ensure that your banking details are set up correctly on eFiling, as this is the only accepted method to make payments.

Here is the process to access and make WTI payments:

- Log into your eFiling profile.

- From the Menu option, click on ‘Non-Core Taxes.’

- Click on “Withholding Tax on Interest.

- Choose the return you require to pay and click on ‘Open.’

You will be directed to the Payment Summary Screen and will notice the ‘Amount’ field reflecting the outstanding amount due, but you can change this amount if you wish.

- Once you’ve chosen the amount you wish to pay, click on ‘Pay Now.’

- A pop-up screen will then be displayed to proceed with the payment. Click on ‘OK’ once you’re happy to proceed.

Next, the Payment Details screen will appear. Here’s how to complete your payment:

- On the Payment Details screen, you will need to select the bank account that you would like to make payment from the dropdown list.

- Select the payment request date for the payment to be made.

- Click on ‘Pay Now.’

- You will see the ‘Confirm Payment Inititation’ screen with a summary of the payment details. Double-check all the information.

- If all the information is correct, to complete the payment, click on ‘Confirm.’

- A Final pop-up message will appear for you to confirm that the amount, date, and account details are all correct. Click on ‘OK’ to proceed.

Once complete, you will likely be sent an authorization request to your banking app and will need to log on to your bank account and accept/ authorize the payment.

To check that the payment was completed, you can check the payment status on eFiling. If the payment was authorized and completed successfully, the payment status would have changed to ‘Payment ‘Successful’.

How to Activate WTI on eFiling

:

Once you’ve registered for Income Tax, you will need to activate WTI on eFiling. To do this:

- Click on ‘Returns.’

- Click on “Activation.’

- Click on the subheading’ Non-Core Taxes.’

- Click on ‘Withholding Tax on Interest.’

Next, the Activation Screen will appear. Once on this page, you will need to:

- Check that the prepopulated ‘Taxpayer Information’ is correct. If any information is incorrect, click on ‘Update Details’ and make the necessary changes.

- If the information is correct, select the checkbox for the disclaimer. It should say, “I confirm the information above is correct and true for the taxpayer concerned.”

- Click on ‘Activate’.

Thereafter you should see a pop-up message appear asking you to confirm that you want to activate the tax number for WTI.

- Click on ‘OK’ to confirm

Once you confirm the activation request, it will be validated by the system, and you will receive a message either confirming your activation or letting you know that your WTI activation is pending approval.

- In the event that the taxpayer information does not match SARS records, you will see the following message: “Unfortunately, we could not match the details supplied…” In this instance, double-check all the information and update any details that appear incorrect. If all the information seems correct, and you receive the message above, contact the SARS contact center on 0800 00 7277 for further assistance.

- A ‘pending approval’ status is fairly common; therefore, there is no need for concern if you see this displayed. Simply check back after a while, and your activation should be approved within 24 – 48 hours or even sooner.

- If all the information is correct and validated for WTI, the status will display as ‘Successfully Activated.’

How to Deactivate WTI

In the event that you need to deactivate WTI from your profile, this can be done in the following way:

- Click on ‘Returns.”

- Click on ‘Non-Core Taxes.’

- Click on “Withholding Tax on Interest.’

- Click on ‘Activation.’

You will then see the activati on screen displayed:

- Click on ‘Deactivate.’

- A pop-up message will appear asking you to confirm the deactivation. Click on ‘OK.’

Once you confirm the deactivation, you should see a notice reading, “Deactivation for Withholding Tax on Interest has been successful.”

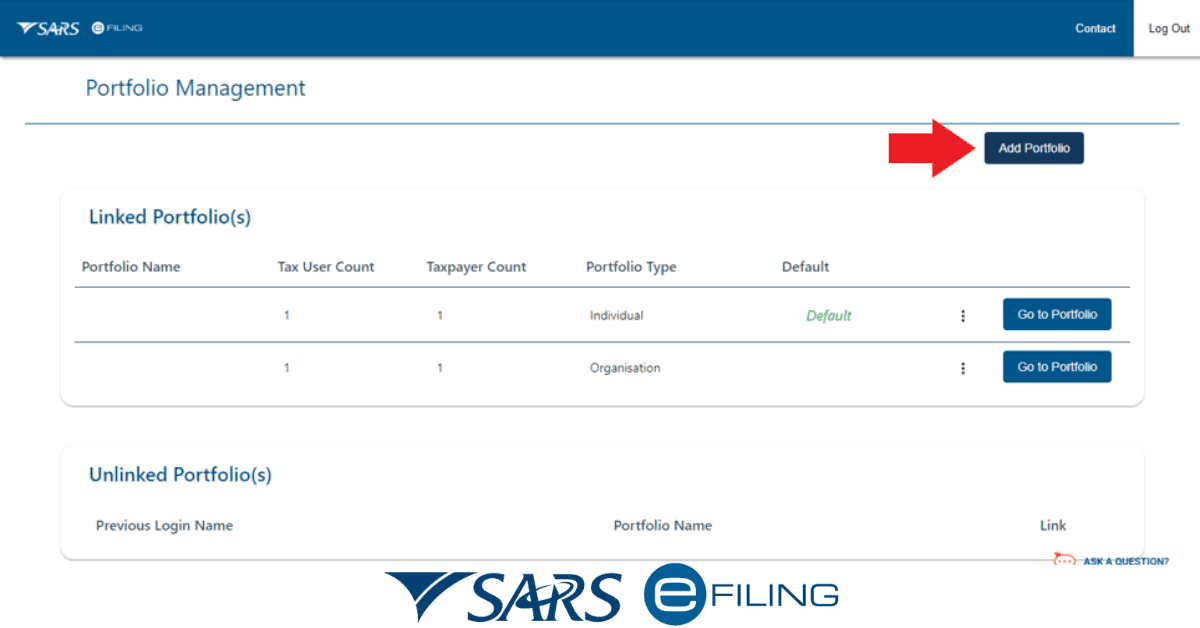

How do I initiate a tax-type transfer on eFiling?

There are a few steps involved for those that want to transfer a taxpayer. Here’s what you need to do:

- Once you log into eFiling, click on ‘Organisations.’

- Click on ‘Register New.’

- Complete all the information required and click on “Continue.’

Once loaded, you should see a screen that reads “Requests for Taxpayer’s Return Types.’ You will need to:

- Tick the tax type box.

- Fill in the relevant tax number.

- Click on ‘Register.’

You should now see another message advising that the taxpayer is registered. Thereafter:

- Click on ‘Request Tax Types.’

- Click on ‘Create New.’

- Click on ‘I agree’ under the declaration if you wish to accept it and proceed.

- Fill in the reference number in the column next to the relevant tax type.

- Click’ Request.’

The Taxpayer or Registered Representative will then receive a notification via SMS and email to transfer the selected tax type to the requestor and will need to approve this transfer request.

This is done by:

- Logging on to www.sars.gov.za.

- Click on ‘Manage Tax Type Transfer.’

- Complete the online form.

- An OTP will be sent to the taxpayer.

- The taxpayer will need to insert the OTP into the system.

After inserting the OTP, an online Power of Attorney (POA) request will be sent to the Taxpayer or holding user. They will have to “Accept’ the request in order to proceed.

Is tax paid the same as tax withheld?

This question can often cause some confusion, but it can be explained fairly simply.

Your tax paid is the amount that SARS calculates that you have to pay based on your income and deductions for the year.

To make the tax payment above, employers (or the originator of the funds) deduct an amount from your pay and send it to SARS. This is known as tax withheld.

The amount of tax withheld may be more or less than the amount that SARS stipulate according to their calculations, and the difference between the two will either result in a refund/ rebate owed to you or a deficit that you will then owe SARS.

What happens if you don’t pay withholding taxes?

As with any tax form, non-payment of owed tax can have major consequences.

A South African that is found guilty of this offense can lead to tax liability for the party charged and the imposition of penalties and interest on unpaid taxes.

Fixed-amount penalties can be imposed for outstanding returns or the failure to disclose information in respect of a ‘reportable arrangement’, while percentage-based penalties will be imposed when a payment is received late.

SARS administrative penalties can vary between 5% and 200% of the tax that was not paid or can range from R250 up to R16 000 per month for each month for up to 35 months that the non-compliance continues.

According to the Income Tax Act, employers are required to pay withheld taxes to SARS by no later than the seventh day of the next month. Failure to do so will result in the employer becoming subject to a 10% penalty as well as interest unless a deferral arrangement is in place.

These penalties generally fall into one of the following categories:

- Percentage-based penalties.

- Fixed amount penalties.

- Reportable arrangement penalties.

- Understatement penalties.

How do I avoid withholding penalty?

SARS has become much more strict in recent years, levying heavy penalties for non-compliance regarding income tax payments are concerned. Individuals should therefore take every step necessary to remain compliant to avoid these steep penalties.

Taxpayers that become aware that they are liable for payment or have made an error resulting in them becoming non-compliant should contact SARS as soon as possible to rectify the error. By doing this, you may be able to avoid penalties and additional interest charges once the correct process is completed.

The most common mistakes to avoid by taxpayers are:

- Not knowing your provisional taxpayer status and the obligation to file.

- Filing returns late or not at all.

- Underestimating the taxable amount.

In some instances, taxpayers may be guilty of a combination of the above reasons, which can make matters worse.

In order to avoid the repercussions of non-payment, taxpayers should be aware that they are required to declare their taxable income within 6 months of the tax year and their total estimated annual income before the end of the tax year.

When Should withholding tax be paid?

Withholding Tax on Interest can be paid to SARS via eFiling only.

You will need to submit the relevant document (WT002), which summarizes the total of all interest payments made and the amount of tax that was withheld during the month.

Both the payment and the WT002 must be submitted to SARS before the end of the month following the month in which the interest was paid.