Mining of Bitcoin is of particular interest all over the world, including South Africa. This exhaustive guide explains the feasibility of Bitcoin mining in the country first, followed by the steps to carry out the process, the time consumed, bank transfers, and how to exchange Bitcoin into the domestic currency.

Can You Mine Bitcoin In SA?

- ADVERTISEMENT -

Yes, it is possible to mine BTC in SA. The country is relatively stable, with plenty of viability for mining activities. The cost of electricity is one of the key aspects. In 2018, the charges in SA were averaging $0.09 per kilowatt-hour, which is slightly more than elsewhere. It can be a significant factor in mining profitability since mining has to deal with enormous energy.

The availability of specialized mining hardware called ASICs (Application-Specific Integrated Circuits) is also essential. Although locals provide them, the price of this hardware may be enormously restrictive. Upcoming miners must weigh the above carefully to see if Bitcoin mining is viable according to their financial requirements and operational needs.

How Can I Start BTC Mining and Earn Cash From It?

Beginning BTC mining in SA involves several key steps:

- Research and Planning: Begin by understanding the process of Bitcoin mining in detail. It consists of resolving complex algorithms to validate Bitcoin transactions within the Bitcoin network that require enormous processing power. Research the current market scenario, Bitcoin price volatility, and difficulty in mining to estimate the probable profitability.

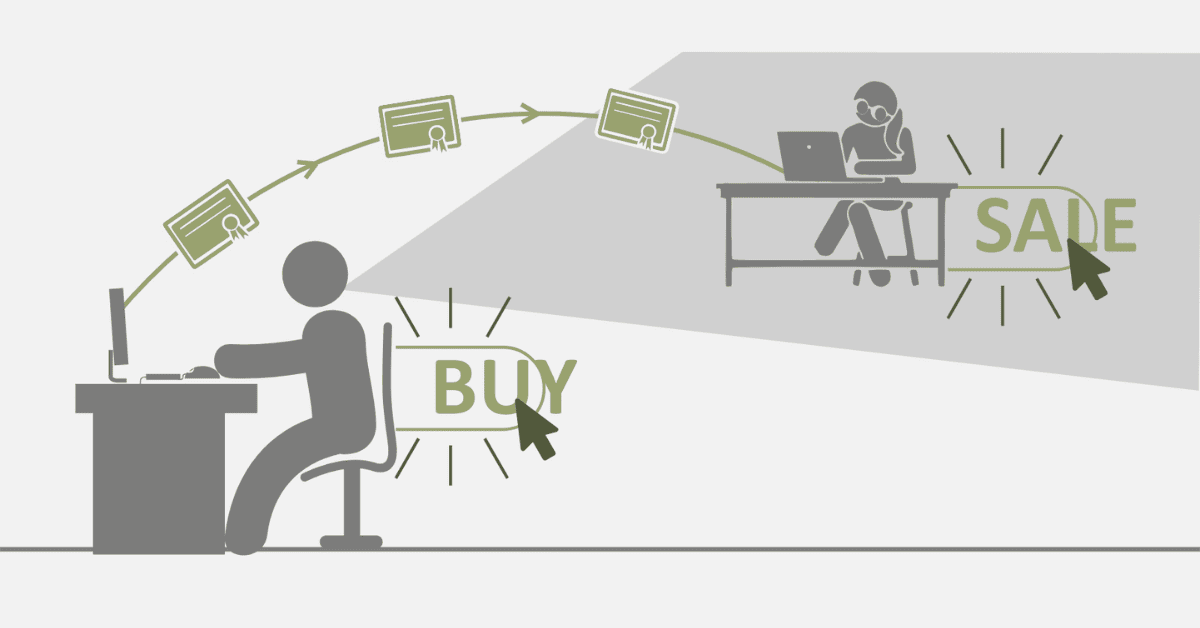

- Hardware and Software Securing: Invest in affordable mining hardware. The specifically designed ASIC miners are the best hardware for mining Bitcoin. In South Africa, Bitmart is one of the firms that trade with the sale of hardware for cryptocurrency and blockchain products. Additionally, secure mining software compatible with the hardware should be installed to run mining effectively.

- Estimating Electricity Cost: Electricity cost is a significant component of mining operations. As electricity averages $0.09 per kWh in South Africa, whether the potential mining returns will be sufficient to cover the cost is a prerequisite. Using renewable electricity sources or areas with low electricity rates in the country can boost profitability.

- The best way to address the competitiveness of individual mining is by participating in a mining pool. Using a mining pool, the miners can pool their processing power for an improved chance of earning Bitcoin rewards together. Find a reputable mining pool that best fits the function you want to accomplish.

- Setting up a Secure Wallet: Install a secure digital wallet to hold mined Bitcoins. It could be a hardware wallet that stores keys offline to provide added security or a software wallet downloaded on the device.

- Remaining Up to Date with the Regulations: Cryptocurrency is regularly regulated in South Africa. Remain current with the newest legal requirements or instructions by monetary companies. That’s necessary to remain compliant and steer clear of potential legal issues.

How Long Do You Wait to Mine 1 BTC?

Diverse factors influence the time. These include processing speeds of mining equipment, mining difficulty at the time of mining, and mining participation in pools. Under normal circumstances, the BTC blockchain aims to produce a block every 10 minutes with a reward of 6.25 Bitcoins after the most recent halving event. It would be very time-consuming for a single miner to mine a complete Bitcoin, with little possibility of success in a small mining operation.

The time is based on the overall hashing rate of the network and the user mining rate of the overall hashing rate of the network. To prevent this, most miners are involved in mining pools where they donate their processing rate to others. In mining pools, the gamers are paid an equal amount of the Bitcoin mined depending on the processing power they have put in. It is a typical payment, albeit less than in solo mining.

Which SA Banks Accept BTC?

While SA banks do not accept BTC payments directly, some have taken a crypto-friendly approach by enabling their customers to interact with crypto exchanges. In particular:

- Standard Bank: The bank collaborated with crypto exchanges so that their customers could buy and sell Bitcoin via their bank account. Through the collaborations, the bank provides an accessible method of entry to the crypto market by their clients.

- Capitec Bank: Payments to trustworthy crypto exchanges are facilitated by Capitec as digital assets grow more popular, making it easy to transfer cash to buy cryptocurrencies.

- FNB (First National Bank): FNB enables its customers to interact with crypto sites by facilitating transfers to and from legitimate exchanges to simplify purchasing and selling digital currencies.

How Do I Withdraw Bitcoin in South Africa?

Converting BTC to ZAR is a multi-step process:

- Choosing a Trustworthy Exchange: Choose one that supports ZAR withdrawal. Platforms like Luno and VALR are popular, with simple-to-navigate interfaces and compliance with local legislation.

- Account Verification: Sign up for the chosen exchange and complete the required verification process. It typically entails providing identification docs to meet the Know Your Customer (KYC) requirements.

- Transferring BTC to the Exchange: Transfer the BTC you will cash out from your wallet to the exchange wallet. Double-check the addresses to prevent errors.

- Selling Bitcoin to ZAR: Once you have received the Bitcoin deposited into the exchange wallet, place a sell order to trade the Bitcoin for South African Rand. You can sell at the market price or a specific price (limit order).

- Withdraw to Your Bank Account: After selling, withdraw the ZAR to the bank account with which you funded the exchange. Be cautious of the processing time and the potential withdrawal fee that the exchange may charge.

Final Thoughts

Bitcoin mining presents a challenge and an opportunity for SA. SA’s stable regulatory position and growing use of cryptocurrencies are good signs. At the same time, the price of electricity is a possible drawback that can undermine profitability levels. Future miners will have to conduct their research well, consider participating in mining pools, and monitor the evolving nature of the regulation environment. One must also be aware of the means of Bitcoin to regional currency exchanges and regional banks to enable smooth access to the virtual world of the currency.