When lenders check your credit score, they will determine whether you are capable of paying back the loan or not. Although some people may think that borrowing regularly and repaying the money is a viable method of increasing their credit scores, this is not true. You can boost your credit without debt. Read on to learn more about how to maintain a credit score without debt.

How to Maintain Credit Score Without Debt?

When calculating a credit score, the amount owed and payment history are two major factors considered. However, it is possible to maintain your credit score without debt contrary to what other people believe. Be sure to pay your debt in full and on time so you stay with no credit. Your score will not be affected when you have a good payment history.

It is critical to know your limit to avoid unnecessary debt. If you intend to borrow some money, make sure you pay it in full within the expected period. You can maintain this by requesting a high-limit credit card from your credit card company. Ask for a limit increase at least every six months. You can also maintain your credit score by avoiding too much debt at the same time.

Can You Get a Credit Score Without Debt?

It is a myth that one can build an excellent credit score by having some debt and continually repaying your lenders. You can get a credit score without any debt. A credit score is built based on the following variables.

- 35%: Timely payment of your debts.

- 30%: Total debt you owe.

- 15%: The time you have with credit.

- 10%: The types of credit you have.

- 10%: Have you recently applied for credit?

As long as you pay your debts on time, you will have a credit score. For example, you can set a reasonable limit on your credit card and automatic recurring payments every month to ensure that you don’t miss any payments. This strategy will help you stay out of debt but with a good credit score.

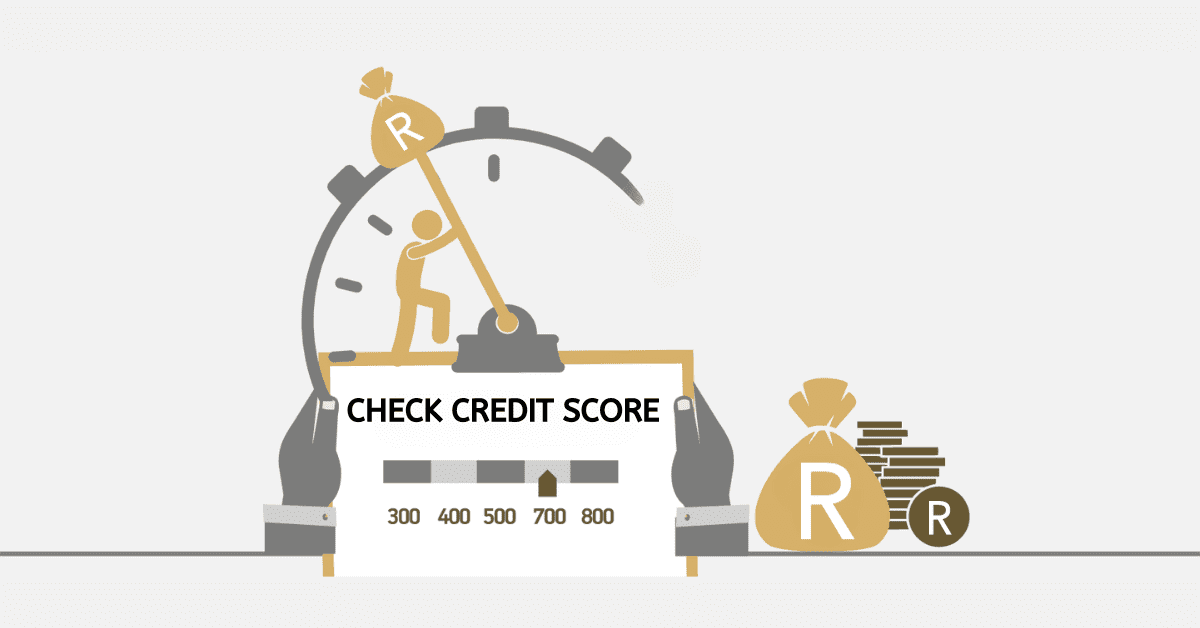

How Many Months Does It Take To Improve Your Credit Score?

When your credit score is poor, you can improve it in three to six months depending on your current financial status. You can achieve this by taking the following measures.

- Pay your bills on time.

- Clear outstanding bills.

- Pay outstanding credit card debts.

- Learn to pay more than the required minimum installment on your bills.

- Avoid opening new credit accounts.

- Don’t use more than 30 % of your credit limit.

- Pay off all your credits including auto loans, bank loans, mobile phone credit, and others.

- Close the account once you clear the balance.

- Check your credit report for errors.

Is Having No Debt Bad for My Credit Score?

Staying in debt does not translate into a good credit score, and having no debt is not bad for your credit score. In other words, you can still maintain a good credit score without debt. If you can afford to pay your monthly credit card balance on time, there is no reason to pay interest.

When you have a high credit card balance, your utilization rate will also be high, which can negatively impact your credit score. Therefore, it is a good idea not to have debt to maintain a good credit score. You don’t need a revolving debt to build a good credit score.

What Are Ways to Keep a Good Credit Score?

You can consider different methods to keep a good credit score. Make sure you pay your bills and loans on time. Avoid late payments or missing payments since this will negatively impact your credit score. One way to achieve this is by setting automatic reminders or automatic payments, so you do not miss your payments.

When using a credit card, know your limit and avoid getting too close to it. Keep your balances low and manageable to avoid trapping yourself in a cycle of debt and high interest on credit card balances. Paying off your monthly credit balances helps you obtain the best scores instead of maintaining debt.

You need to keep your old credit card accounts open even if you no longer use them to create a long credit history. The experience of repaying your debts shown on your credit report plays a crucial role in proving your capability of paying your loans on time. Therefore, maintaining a long credit history is good for your credit score.

If you still have outstanding debt, avoid applying for new debt. Applying for too much credit over a short period will reflect negatively on your financial status. Your current credit activity helps lenders determine if you are credit-worthy. With a large income-to-debt ratio, you may not be able to maintain a healthy credit score.

It is imperative to check your credit reports for errors to keep a good credit score. Dispute all issues on your report. Identity theft is another issue that can affect your credit score. Someone can steal your details and use them to access loans from different lenders without your knowledge. Unfortunately, the fraudulent transactions will appear on your credit score. Therefore, keep a close eye on your credit report to avoid such issues.

If you are still new to the world of credit, you should know that it is possible to maintain a good credit score without debt. It is essential to choose a product that can help you build credit. Timely payment of your bills and loans will help you maintain a healthy credit history. All you need is to ensure that you do not exceed the maximum limit on your credit card.