When it comes to investment, it always seems to be accompanied by the wealthy; it is more of a luxury, but in the real sense, this is not it. In fact, if an individual has good strategies and understanding, even a little money invested can be extremely rewarding. All that is required is starting early and making intelligent choices. In this article, we will show you how you can invest with very little money in South Africa. Remember, everyone has to start somewhere, and small investments do grow into something more significant.

How to Invest Without Much Money in South Africa

Below is how you can do that:

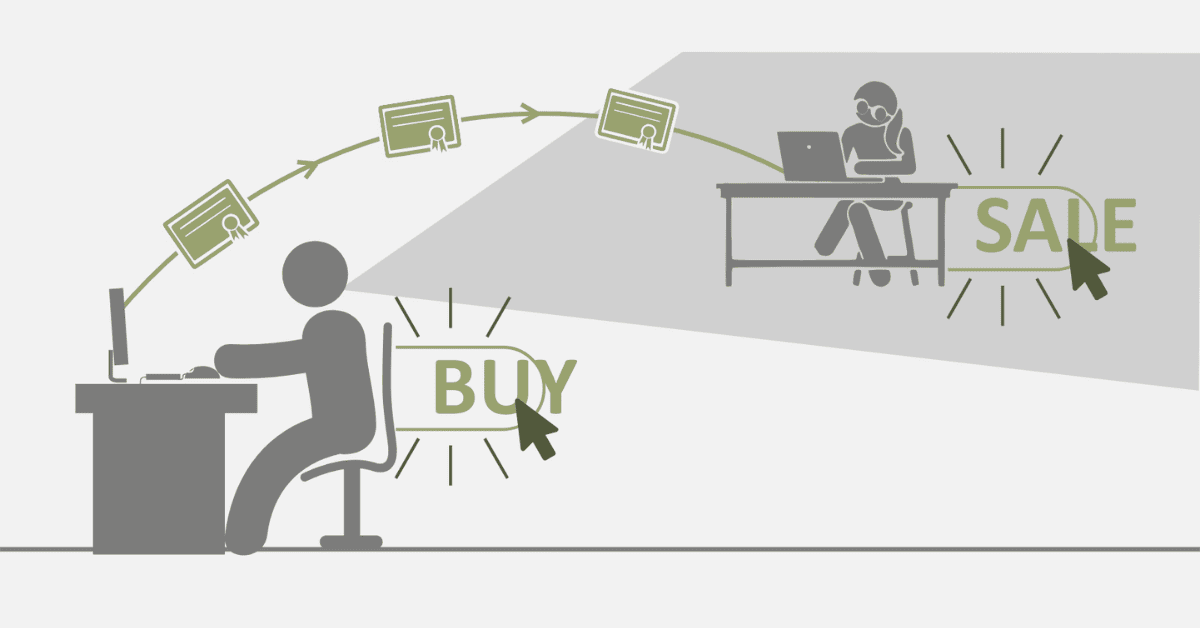

- Stokvels: These are traditional savings groups where members all contribute a fixed amount and get the lump sum at a specified time. Stokvels are a pretty popular mode of investment in South Africa, and, by the way, one can invest a small amount of money. Again, they are also accompanied by the benefits of community support and accountability.

- Investment Apps: Some of them are designed in a manner that you can invest for as little as R5, meaning that investment is able to reach anybody despite their financial stance. They offer many investment avenues and can be an excellent tool for beginners to start with.

- Stock Exchange: Company shares can be bought from listings at the Johannesburg Stock Exchange. Whereas it looks pretty intimidating at first, there are numerous resources available to help novices understand the stock market and finally make informed decisions.

- Unit Trusts: Investment products in which monies from numerous investors are taken and then, with that pooled money, put into stocks and bonds. Unit trusts offer diversification and professional management, which could very well be an excellent way to make your first small investment.

- Retirement Annuity Funds: These are the units expressly set up to take care of retirement savings and are available to all members, regardless of their working status. They enjoy tax advantages, which can be a good deal in starting to amass a fortune for the future.

- Tax-Free Savings Accounts: These allow your wealth to grow bit by bit because you will not lose any of your returns to tariffs.

Should You Invest If You Do Not Have a Lot of Money?

Yes, one should. Investing is not only for the rich. Actually, by beginning early with what one has, it can grow into significant wealth over time. Even small amounts, if invested wisely, can grow exponentially due to the power of compound interest. In addition, investing can provide financial security and income diversification. Do remember, with investing, every rand counts. It is always good to invest in something, even if it is pretty tiny. Over time, the small investments will add up to significant wealth.

What is the Safest Investment?

Below are ten features of a safe venture:

- Government-Backed: Governmentally backed investments, like those in treasury bills, are also relatively safe. This is to say that the money you have invested will always be repaid because, in any case, the government guarantees repayment with this type of investment.

- Price stability: Generally, safer investments do not show much price volatility. This will mean that prices do not change so much in short periods; therefore, they are far less risky than investments with high volatility.- ADVERTISEMENT -

- Liquidity: They can easily be converted to cash. This implies that when you need to have your money back within no time, you can quickly withdraw it without incurring losses.

- Diversification: Safe investments are most probably part of a diversified investment. This, therefore, means that an individual makes many investments using various investment tools to lower the risk and thereby gain more chances of making money through investment.

- Steady Returns: They offer very steady, although not dramatic, returns. It means that though it does not give a chance to make a fortune overnight, in the same manner, it is pretty assured that one cannot lose all their money here either.

- Inflation Protection: Some ventures, such as TIPS, provide a few degrees of protection from inflation. This means that the value of one’s venture rises with inflation, thereby maintaining the power of purchase.

- Low Default Risk: This feature is standard with safe businesses. It means that the probability of the entity you invested in failing to repay the money is tiny.

- Fixed Interest Rates: Most safe investments have fixed interest rates. What this means is that you are pretty sure of what you will be receiving from your investment, making planning for the future a breeze.

- Long-term Orientation: Safe investments are usually designed for long-term growth. In other words, they are best for those who really can leave their money invested for a long time. Regulation: Generally, highly regulated safe investments are for the protection of an investor. It implies that there are stringent rules that assure that these investments are safe and just.

How do you Build Wealth?

Building wealth is not an event but a long-term process that involves thoughtful planning, budgeting, and investments. Here are ten ways to build wealth:

- Early Start: The earlier you begin venturing, the more time your money has to grow.

- Budget: Be aware of your earnings and spending, as then you could try to locate those areas in which you can save. Saving regularly is always a perfect habit. Even small amounts can accumulate with time.

- Invest wisely: diversify investments and make them dynamic to suit different needs.

- Create More Than One Source of Income: Never rely on one single income. Look for means to earn money on the side.

- Limit Debts: Debts with a high-interest rate can devastate your money-making potential. Eliminate your debts as soon as you can.

- Retirement Plan: Maximize the available employer matching contribution in retirement accounts.

- Educate Yourself: Master skills related to personal finance/investment.

- Shun Get-Rich-Quick Schemes: Wealth is earned over time. Avoid people who promise you riches quickly and easily. Stay Persistent: Wealth creation is a marathon, not a sprint. You have to be consistent in your goals.