This offshore investment strategy has helped South African investors achieve benefits such as diversification, the potential to make a higher return, and hedging against local economic uncertainties. This essentially means South Africans spread their investments in foreign markets across a variety of economies and a series of sectors, thereby reducing the associated risk of losing investments in case of the poor performance of these economies and sectors. This article attempts to give the South African reader the lowdown on offshore investing: what’s in it for him or her, what’s the degree of risk versus reward, and what amount of money can leave the country.

How to Invest Offshore

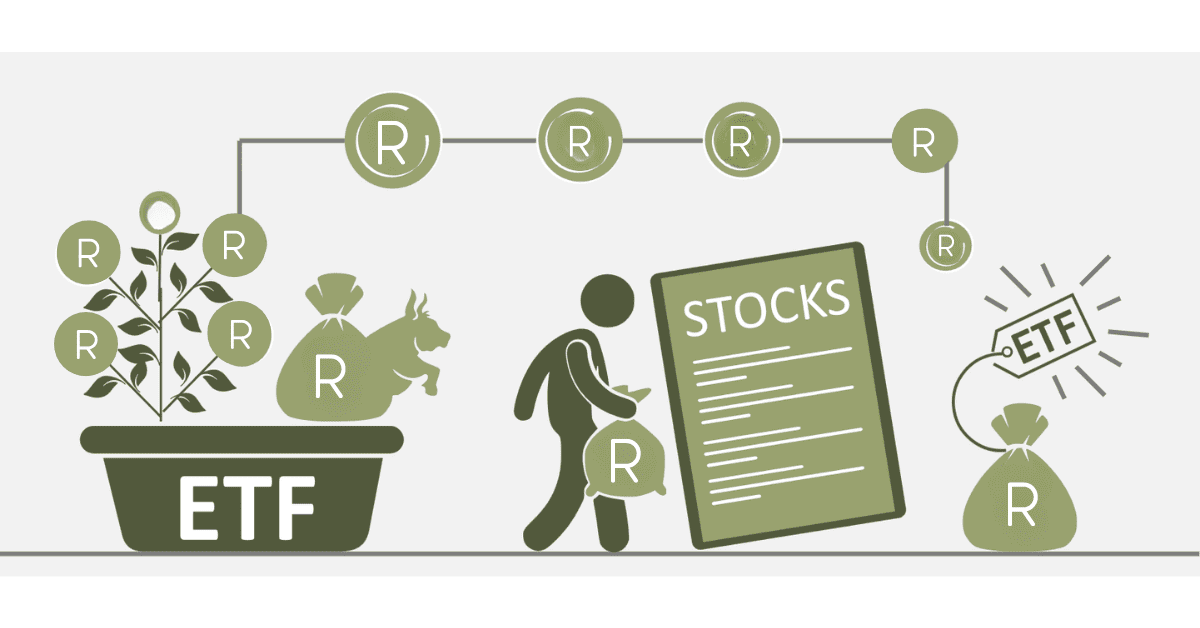

There are two options. They can use their Single Discretionary Allowance of up to R1m a year to send their money offshore without the need for a tax clearance certificate. This facility is granted by the South African Reserve Bank and would allow one to invest in markets abroad without the hassle of a tax clearance certificate. This can make the process of investing offshore much quicker and easier. For amounts above R1 million, there is an FIA that covers up to R10 million per calendar year, though it does require a tax clearance certificate. This allowance is also one supplied by the South African Reserve Bank. However, since the amount is bigger in this instance, a tax clearance certificate is required.

Is it Good to Invest Offshore?

Yes, because it comes with several benefits. These include tax incentives, protection of assets, privacy, and the opportunity to venture in countries where investment is a great possibility. It also protects against political instability and economic misfortunes in the home country. The disadvantages, however, are the enormous costs and increasing regulatory attention that come with offshore jurisdictions and accounts.

Why Should South Africans Invest Offshore?

Of course, there are many reasons for this :

- Diversification: Offshore investment can spread your risk across different economies, sectors, and currencies. This contrasts with the fact that a poorly performing economy, sector, or currency will not thus much affect the total portfolio. That will, to a degree, stabilize your returns and cut the general risk of the portfolio.

- Global Markets: South Africa’s financial markets will be less than 1% of the world. So invest offshore, where the remaining 99% is. It helps you to have access to a much more extensive range of investment opportunities, which may increase your potential returns.

- Hedge Against Rand Volatility: The rand is a very volatile currency, and while one invests offshore, it offers one an excellent hedge. In layman’s language, this means that if the value of the rand drops, the value of your investments offshore may rise, thus offsetting the loss.

- Possibility of Higher Return: There may be offshoring markets where the potential return is high compared to the South African market. This can specifically be correct in emerging markets where the growth can be high.

- Political and Economic Stability: Investing in developed economies can provide growth that is more stable than in emerging markets like South Africa. This could bring an element of security to your investments since developed economies mostly have a more stable political and economic system.

- International Liabilities Funding: If you are already planning future events, such as emigration, travel, or your child going to an international university, then investing offshore might be an excellent way to facilitate funding for those liabilities in the future. As your investments will already be in that country’s currency where you are planning to emigrate or travel or where your child is planning to study, this will not be a problem.

- Protection against local risks: Offshore investments cushion you from the volatility in the local market as well as from changes in the exchange rates. This means that if the South African market decreases, or if the rand has devalued, it doesn’t necessarily mean a negative move for your offshore investments, or these might even pick up in value.

- Provides exposure to global growth: That is as the rest of the world grows economically, offshore investments stand a good chance of going up in value.

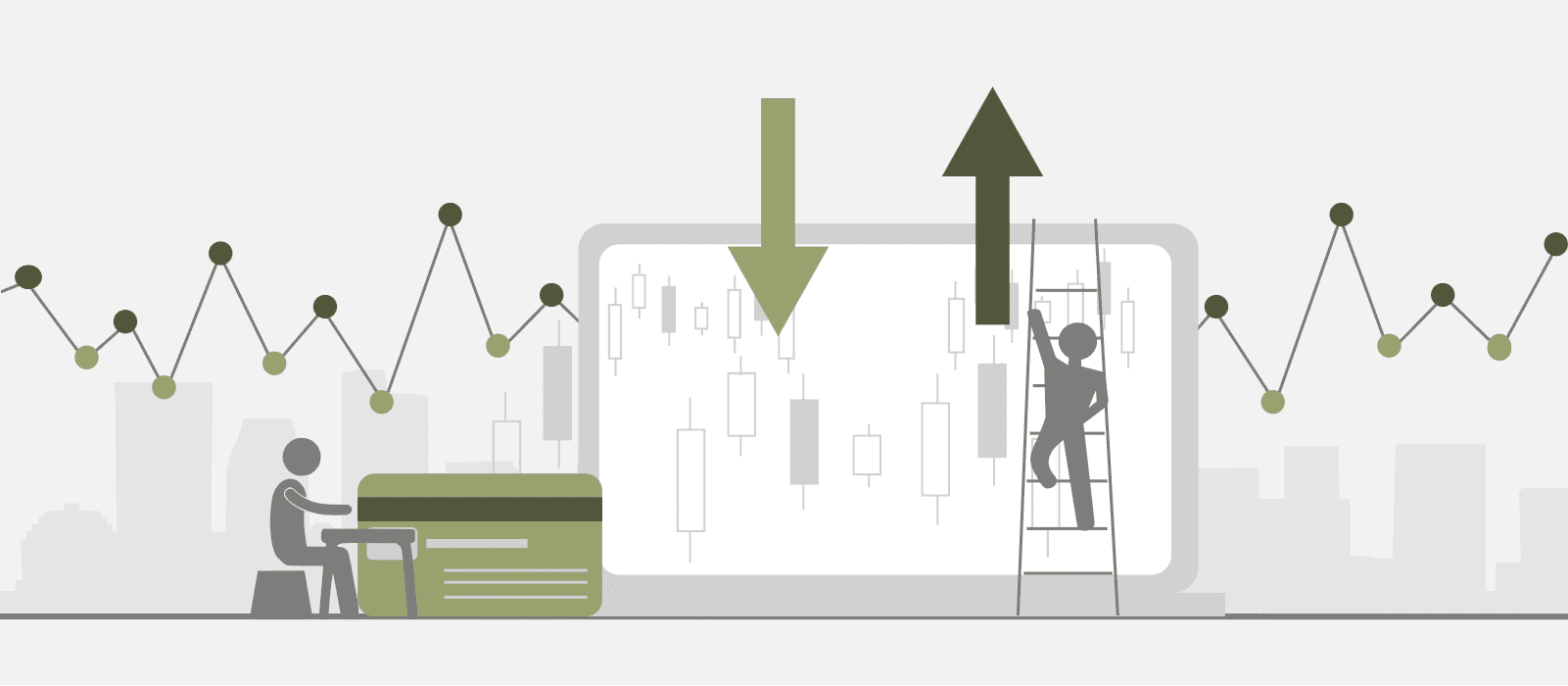

What are the Risks of Offshore Investments?

They include:

- Market Risk: The value of investments may fluctuate with the market. In simple terms, any poor performance that is recorded in the market where your offshore investments lie will most likely impact the value of those investments.

- Currency Risk: Such exchange rate fluctuations work in either direction—working to the value of one’s offshore investments. For example, this could imply that if the rand strengthens in relation to the currency of your offshore investments, then your assets would be valued less when converted back to rands.

- Political risk: This refers to the political instability of the home country in which one is investing; such changes can bring a negative bearing on your investments. In fact, it can even result from a change in government, civil strife, or a change in laws or regulations, which will reduce the value of the investments.

- Regulatory Risk: The risk to profitability or legality of investments because of changes in laws or regulations. Regulatory risk is subject to changes in laws relating to taxation and other laws regulating finance, as well as to any other rules that affect the mode of operation of businesses and so, consequently, investments.

- Economic Risk: There might be a financial change that affects the return rate, such as inflation or recession. This only means that strictly speaking, your offshore investments will actually reduce in value if they are placed in an economy with inflation or recession.

- Liquidity Risk: Some of the investments may be complex to liquidate when one intends to sell. That means one may not sell off his or her investment when they need to, or they may need to sell off at a much lower price in relation to what they would prefer.

- Costs: On the other hand, offshore investing involves vast costs. This can come in the form of set-up and maintenance fees for the offshore account, transaction charges, or taxes on the return from the investment. All these may eat into your investment returns.

How Much Money Can I Take Offshore?

South Africans are allowed up to R1 million offshore annually without a tax clearance certificate. The process is termed the Single Discretionary Allowance (SDA). The South African Reserve Bank provides SDA, which gives South Africans a chance to invest in foreign markets without a hustle for a tax clearance certificate. This can make the offshore investment process quicker and easier. Besides, all South African residents have an annual Foreign Investment Allowance (FIA) of R10 million that can be taken outside the country. However, a tax clearance certificate is required to externalize funds through your FIA.