The general population prefers Investing in government bonds, as they would be happy to have regular and secure returns. Government bonds from South Africa give a secured income, and the National Treasury guarantees them. Not only do they promote economic development in the country, but they also yield periodic returns through the payment of interest.

How Do I Invest in South African Government Bonds

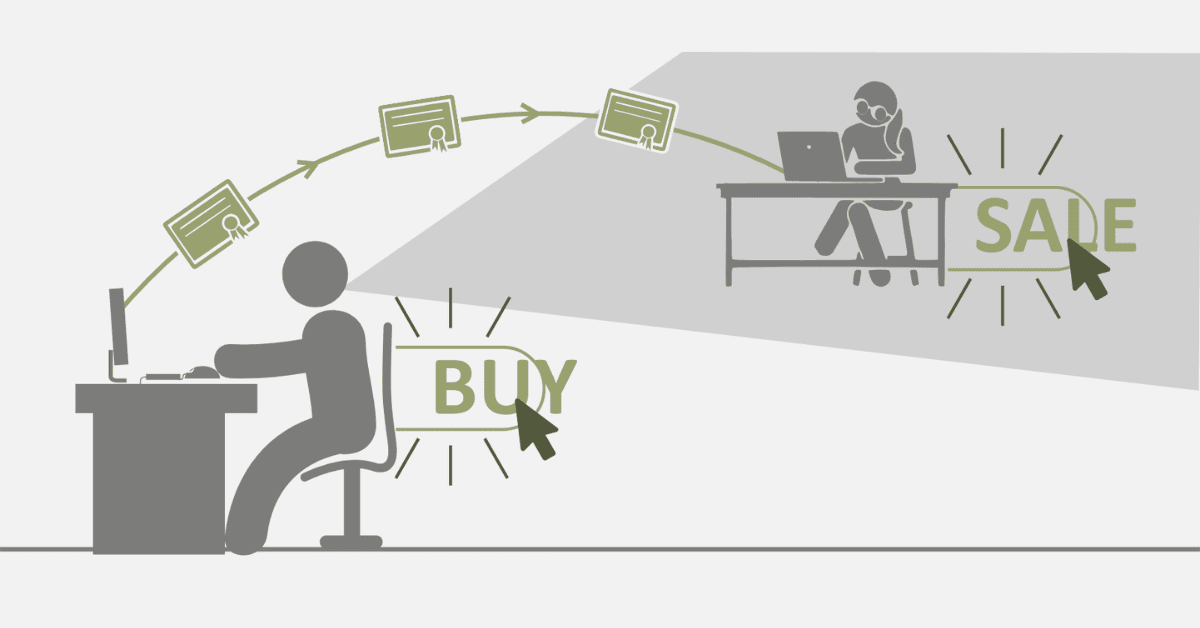

Investment in South Africa’s government can be undertaken through different channels, each suited for different investor objectives and levels of funds. One of the most straightforward channels available is the RSA Retail Savings Bonds, intending to give the general population a chance. The bonds are purchased from the National Treasury, either directly online or from authorised money providers. The investor can choose between the fixed rate and the inflation-indexed bond, the amount of investment (at least R1,000), and fill in the necessary documents. The investor is issued certificates to confirm the holding and periodic interest payments regarding the bond.

Alternatively, capitalists may buy government bonds on the Johannesburg Stock Exchange. This involves acquiring the bonds on the secondary market from authorized stockbrokers. The JSE facilitates the trading of government bonds. Besides, the capitalist can buy and sell the bonds before the respective maturity dates. Using a stockbroker, the investor can select among various government bonds whose return terms and terms of maturity are different, and the investor can customize the portfolios based on his risk tolerance and goals.

Bond-based exchange-traded funds (ETFs) are also suitable for diversified exposure. The ETFs track a basket of government bonds. Thus, they give investors a diversified basket in one investment. Bond ETFs are traded on the JSE, and capitalists can sell or buy stakes through stockbrokers. That is similar to equity transactions.

Are South African Government Bonds Worth Investing In?

The bonds issued by the government in South Africa are conservative holdings, ideally suited for investors who want to hold onto capital and the recurrent flow of money. The government bonds are collateralized with the good faith and credibility of the South African government and are riskless over other investment means. The routine payment of interests, or coupon, earns one a recurrent inflow of cash that would best suit one under volatile market situations.

The attraction of government bonds also comes from the diversification advantage. Including the bond in the investor’s portfolio eliminates overall risk since the bond is less correlated with equities. That means that the government bond would not change in value during market volatility in the equities. It might increase instead, providing a cushion against damaging losses in the portfolio.

However, the prospective buyers should also be aware of a few concerns. Changes in interest rates are sure to impact the market value of outstanding issues in the bond market, i.e., an increase in the rate will reduce the value of the bond. Second, government issues are secure, but the yield will be lower than in other, riskier investments, e.g., equities.

Where Can I Buy South African Government Bonds?

Purchasing South African government bonds is facilitated through different channels and new and existing investors are attracted to them. The RSA Retail Savings Bonds can be purchased directly from the National Treasury. Potential buyers are invited to the website of the RSA Retail Savings Bonds to access applications and detailed information on the issues available of the bond. The applications can also be accessed in hard copy at the branches listed by the South African Post Office and at the banks appointed by the National Treasury.

Government securities can be found in the Johannesburg Stock Exchange (JSE) market for investors to use the secondary market. The investor must open an account with a registered stockbroker who will provide instructions on buying and selling on the investor’s behalf. The JSE offers a regulated and open market, and the transactions are conducted smoothly and securely.

Moreover, bond-based exchange-traded funds (ETFs) provide another means of investment in government bonds. The bond-based ETFs are also traded on the public market via the JSE and bought via the same brokers selling individual bonds.

Are South African Government Bonds Tax-Free?

The tax treatment of the interest earned from the South African government bond is critical for the investor. The bond interest income, in theory, is taxable along with the income. However, the taxpayer is exempted from interest. It lowers the taxation of the interest income. Under the current taxation rules, the exemption is R23,800 for a taxpayer younger than 65 years and R34,500 for a taxpayer 65 years or older. It is also worth mentioning that the thresholds, as discussed above, are charged on the aggregate interest income accrued from all sources in a taxation year and not on the government bond alone.

What Happens to Bonds After 5 Years?

The government bond term will specify the maturity date when the invested principle is repaid to the bondholder. With a 5-year bond, the investor receives the originally invested principle plus the interest over time accrued during the bond term at the end of the bond’s life. It also needs to be pointed out that the repayment of the principle is the end of the investment, and the bond runs out of the hands of the investor.

Before the bond’s maturity, the investor can sell the bond in the secondary market, like the JSE. The market value in disposing of it at the time may vary from the buying price depending on the prevailing market rate and demand. From the above, disposing of the bond before the bond’s maturity may enable the investor to make a profit or sustain a loss.

For the RSA Retail Savings Bond investors, premature bond redemption is typically subject to a restriction. However, under some circumstances, such as adversity and other qualifying situations, premature withdrawal is under the terms and conditions of the National Treasury.

Final Thoughts

Investing in the SA government bond market offers a secure and guaranteed vehicle through which individuals interested in investing in capital and earning regular interest income can achieve this. The investor selects the means best suited to their objective and risk tolerance using different investment media, including the acquisition from the National Treasury, secondary market trading on the JSE, and bond-specific exchange-traded funds. It’s essential to consider the taxation aspect of bond investments and to be cognizant of prevailing taxation to comply and achieve maximum returns after taxation.