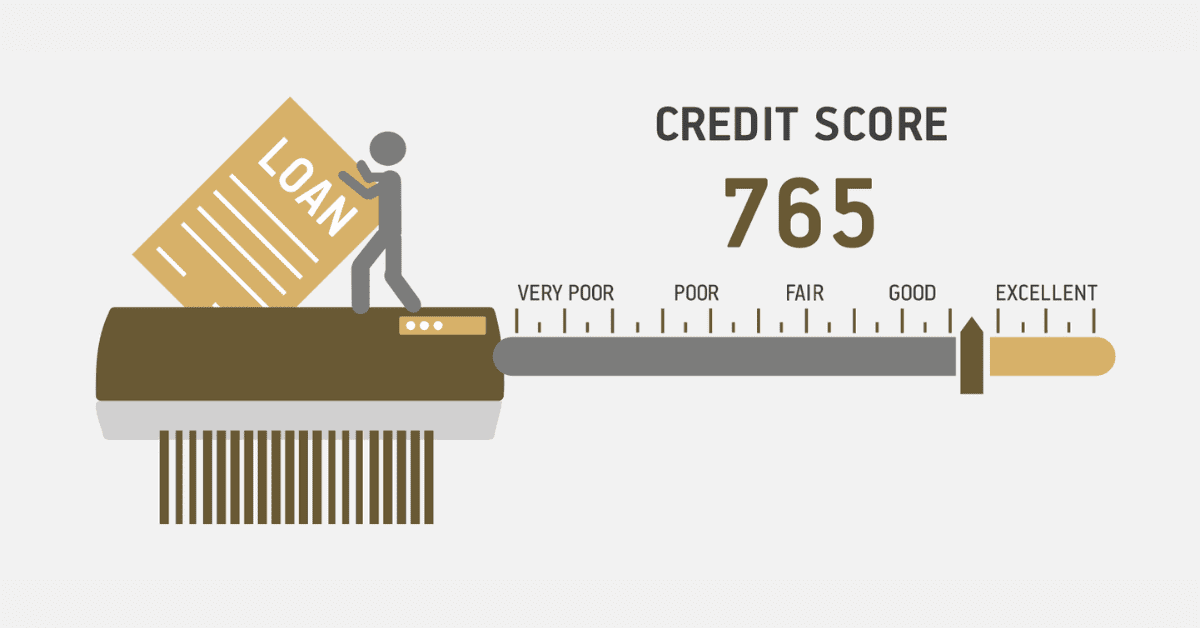

A credit score is a number that shows how likely someone is to pay back money they borrow. It is a way to measure a person’s creditworthiness. In South Africa, credit scores range from 300 to 850. The higher the score, the lower the credit risk. The score is influenced by various factors, including payment history, credit utilisation, length of credit history, types of credit, and new credit. Your credit score plays a significant role in determining the financial opportunities and challenges that you may encounter. Having a good credit score can help you secure better interest rates and increase your chances of getting approved for loans. On the other hand, a low credit score can make it more difficult to access credit. Consistently keeping an eye on your finances and making responsible choices with your money are key factors in maintaining and enhancing your credit score as time goes on.

How to increase credit score

If you are looking for a quick method to boost your credit scores, it is important to understand that there is not a single strategy that can instantly improve your scores. However, there are certain actions you can take that may potentially improve your position within a relatively brief period. It is important to note that the effectiveness of these steps will vary depending on your individual circumstances. We will share with you what has the potential to help you.

Regrettably, there is no magical formula that can instantly improve your credit scores.

However, if you manage your credit effectively, there are several ways you could potentially enhance your credit score gradually.

Building credit takes time because credit is a complex process. Depending on your specific circumstances, there might be strategies to quickly improve your credit scores. For instance, one approach could be to rapidly reduce your debt by paying it off within a stipulated time.

Creating consistent habits is the most impactful action you can take to increase your credit score, regardless of the circumstances.

Here are some quick tips that can help you improve your credit scores gradually.

- Regularly check your credit reports to see your progress

- Sign up to have your credit checked for free.

- Always check your debt.

- You can set up an autopsy, which automatically does your deductions for you on your debt.

- Ensure to pay part of your debt every 30 to 60 days.

- Negotiate to get a lower interest rate.

- Ask for your credit limit to be increased.

- Request for a secured credit card.

What is the fastest way to boost your credit score?

Looking for the fastest way to boost your credit score can raise your hopes and distort your credit score plans. Instead, you need to find the right bank, tips and advice which can help boost your credit score at an increasing rate.

It is extremely important to manage your credit wisely in the South African context in order to maintain a positive credit score. If you ever have the opportunity to pay more than the minimum amount due each month, it is recommended that you take advantage of it. By diligently reducing your circulating debt, you can have a significant impact on your credit score. This is especially true if you keep your credit utilisation rate low.

If you want to improve your credit profile in South Africa, there are two ways you can consider increasing your credit limit. The first option is to request an increase on your current credit card, while the second option is to open a new credit card. Both methods can help you enhance your credit profile. If you make sure not to reach your credit card limit, having a higher overall credit limit can help decrease your credit utilisation rate. Before you decide to request a credit limit increase, it is important to make sure that you will not be tempted to spend beyond your means.

If you want to give your credit score a quick boost, it is a good idea to review your credit report for any inaccuracies that could be lowering your credit. If you find any errors, disputing and removing them may lead to an improvement in your credit score. It is quite common to come across situations where payments are made late or there are still records of past collection accounts, even if they have already been resolved. If there are any discrepancies, please ask for them to be removed. It is important to prioritise settling any outstanding collection accounts. Unpaid collections can negatively impact your credit score in the credit landscape of South Africa.

How do you fix a bad credit score?

If you want to fix your bad credit score without putting your financial stability at risk, a good first step is to get a free credit report. This will help you identify any issues that may be affecting your credit. To address any inaccuracies, it is important to dispute them. Additionally, it is crucial to settle any outstanding debts and engage in negotiations with creditors to explore potential payment plans. It is important to make sure that you prioritise making timely payments on your current accounts.

You may want to think about debt consolidation or consider reaching out to a professional for advice. You can consider opening a secured credit card, using it responsibly, and gradually rebuilding your credit over time.

What are four things that can lower your credit score?

In South Africa’s financial space, just like in many other countries, various factors can cause a person’s credit score to decrease.

Here are four factors that can potentially lower your credit score

- Late payment or missing your payment can have a negative impact on your credit score and can cause it to drop.

- Huge and high levels of debt can lower your credit score. When you have a lot of debt and also a significant amount of money, it affects your credit score.

- If you fail to repay a loan, whether it’s a personal loan, mortgage, or any other type of credit, it can have a major negative impact on your credit score.

- Applying for too many credit accounts can cause your credit score to drop.

Who is the best credit repair company?

When it comes to choosing the best credit repair company in South Africa, it is necessary to factor in a lot of planning and strategising. These include evaluating their success rates, reading customer reviews, and considering their affordability. There are a few companies that stand out for their transparent practices and proven results, such as Credit Matters, Credit Rescue, and Key 2 Debt Freedom. Although these companies may be unique, they may not be highly recommended as the best. We are here to share with you the best credit repair company you can have. Based on the company mission, mission, values customer support, tips and systems SA credit clear and credit-worthy solutions are considered to be the best credit repair company.

SA Credit Clear and Credit-worthy Solutions Limited is considered to be one of the best credit repair companies in South Africa. With their expertise, experience and systems, they can improve your credit score through payment history updates, judgemental removal, default removal and many more.