Many lenders in South Africa like banks and other financial institutions consider the applicant’s credit score to determine if they are eligible for a loan. With a good credit score, you can get any type of loan you want at lower interest rates. Credit scores are calculated by credit bureaus through the compilation of credit information for different people across the country. TransUnion is one of the credit bureaus that operates in South Africa. This article explores the measures you can take to improve your TransUnion credit score if it is below average.

How to Improve My TransUnion Credit Score

When you apply for different financial products like a mortgage, auto loan, credit card, or personal loan, the lender will ask a credit bureau such as TransUnion for your credit score to determine if you deserve to get the money. In South Africa, you should have a credit score of at least 610 to qualify for different loans.

To improve your TransUnion credit score, you should make timely payments for all your revolving credit balances for bills, insurance premiums, and other monthly related payments. Late payments or missed payments will negatively impact your credit score. Paying off your balance helps you earn more points.

Increasing your credit limit is another option to consider to improve your credit score. This will help you avoid maxing your credit balance each month. It is imperative to ensure you do not spend more money than you can afford to repay. Overspending using your credit card can leave you in a debt cycle that can impact your credit score and worsen your financial situation.

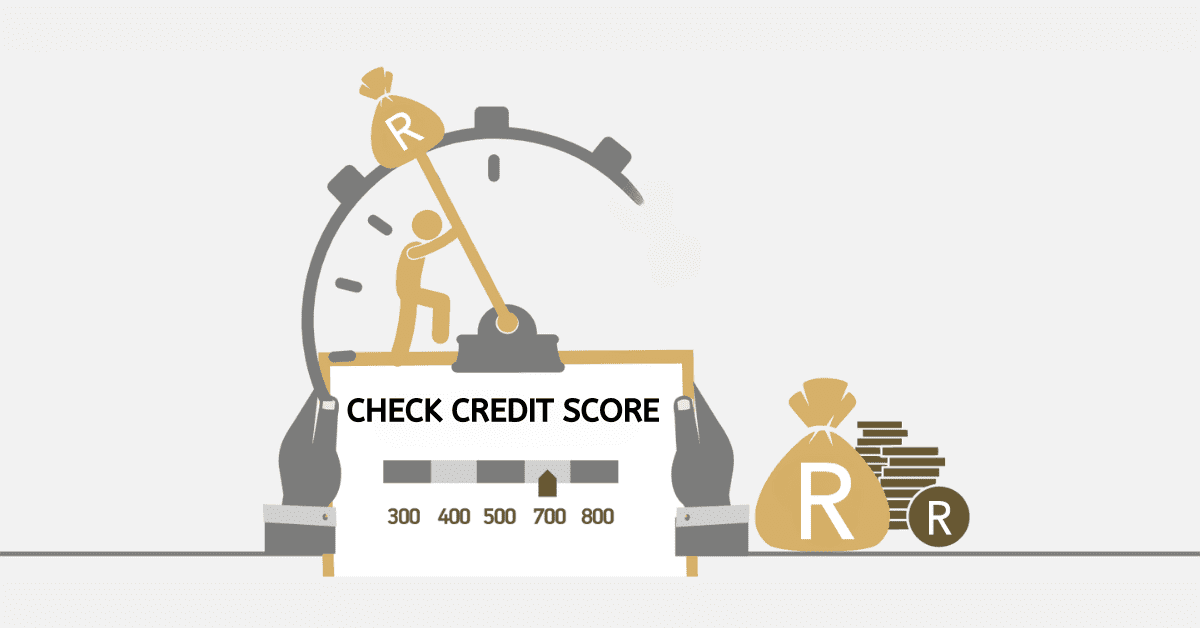

You need to check your credit report for errors that can negatively impact your credit score. If there are mistakes on your report, contact TransUnion and dispute them so they are removed. Some common issues include misreported payments and fraudulent accounts. You can get a free report from TransUnion to help you stay in control of your account. Additionally, you need to ask TransUnion to remove all cleared payments from your report. It is vital to constantly monitor your credit report so you can identify the problem areas early.

What Builds TransUnion Credit Score?

A good TransUnion score is based on your capability to maintain a healthy credit history. All you need to do is to practice good credit habits like making all payments on time. Furthermore, you can also exceed the minimum monthly payment to build a strong credit score. Never exceed your credit limit, and avoid applying for several credits within a short period. This will show the lender that you’re a responsible borrower.

How Do I Get My Transunion Credit Score Accurate?

In order to increase the accuracy of your TransUnion credit score, you need to check your credit report regularly. Check all the details on the report to ensure they are correct. Some people tend to check their credit reports when their loan applications have been rejected.

Identity theft is one common issue that can affect your credit score even when you try to repay all your credits. Someone may fraudulently obtain a loan using your documents without your knowledge and consent. If you check your credit report regularly, you can quickly pick up this anomaly and report it to TransUnion.

Many lenders rely on the credit report compiled by credit unions to determine if the loan applicant deserves to get the money. They also use credit scores to charge interest rates based on the applicant’s credit history. Therefore, you need to check that the information on your credit profile is correct. You can obtain a free report from TransUnion, to ensure the accuracy of your credit score.

Why Is My Transunion Score So Low?

Several factors can negatively impact your TransUnion score. For instance, late payments or missed payments are the major issues that negatively impact the credit score. To avoid this, you should make timely payments. If you cannot pay your bills on time, it is crucial to engage the creditor so you can arrange a payment plan to maintain a good credit score.

Bankruptcy can also be another reason for your TransUnion credit score going down. Once you file for bankruptcy, your credit score will lose close to 200 points. This will severely affect your credit score.

Several new credit applications within a short period will negatively impact your credit score. For each loan application submitted, the lender will make a hard inquiry on your credit history, which affects your score. Therefore, you need to do some research first before applying for a loan. This will help you choose the lender with the best deal to avoid hard inquiries on your report.

There could be errors on your credit report, which can impact your score. It is crucial to monitor your credit report so you can dispute any mistakes to TransUnion on time. Be sure to obtain a free credit report before it’s too late.

How Is Transunion Calculated?

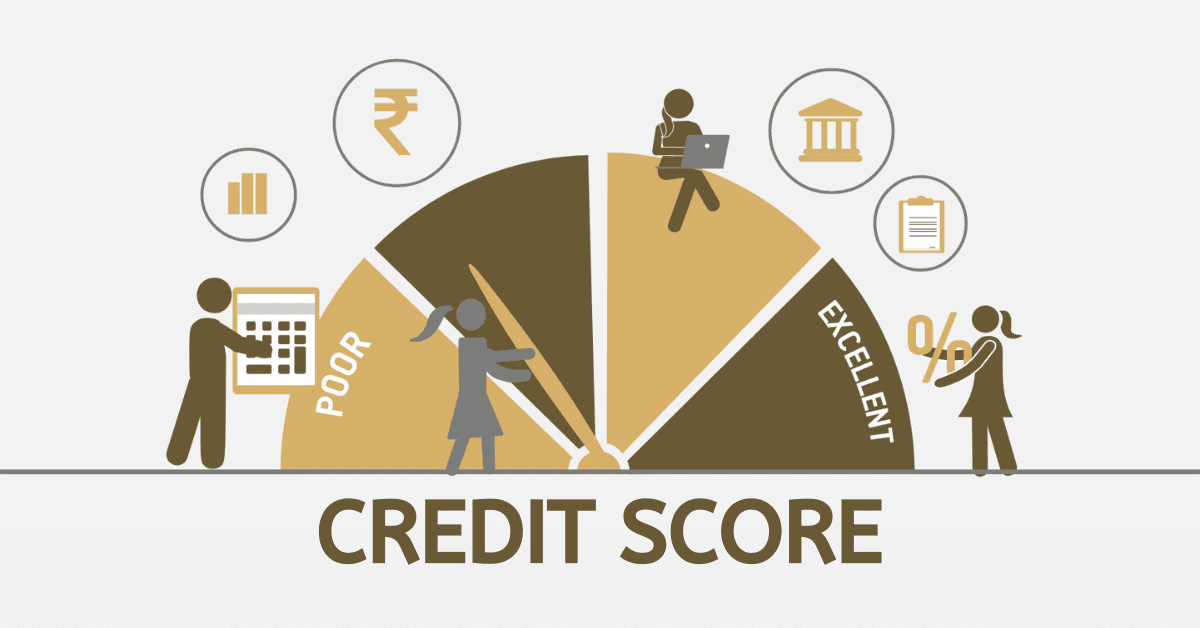

A credit score is a crucial financial indicator obtained from details in your credit report. TransUnion compiles financial data about each individual and this information is used to calculate the credit score. TransUnion uses specific scoring models and algorithms to calculate credit scores. For instance, the scoring models are used to evaluate different elements of your credit history including credit utilization, payment history, and duration of credit.

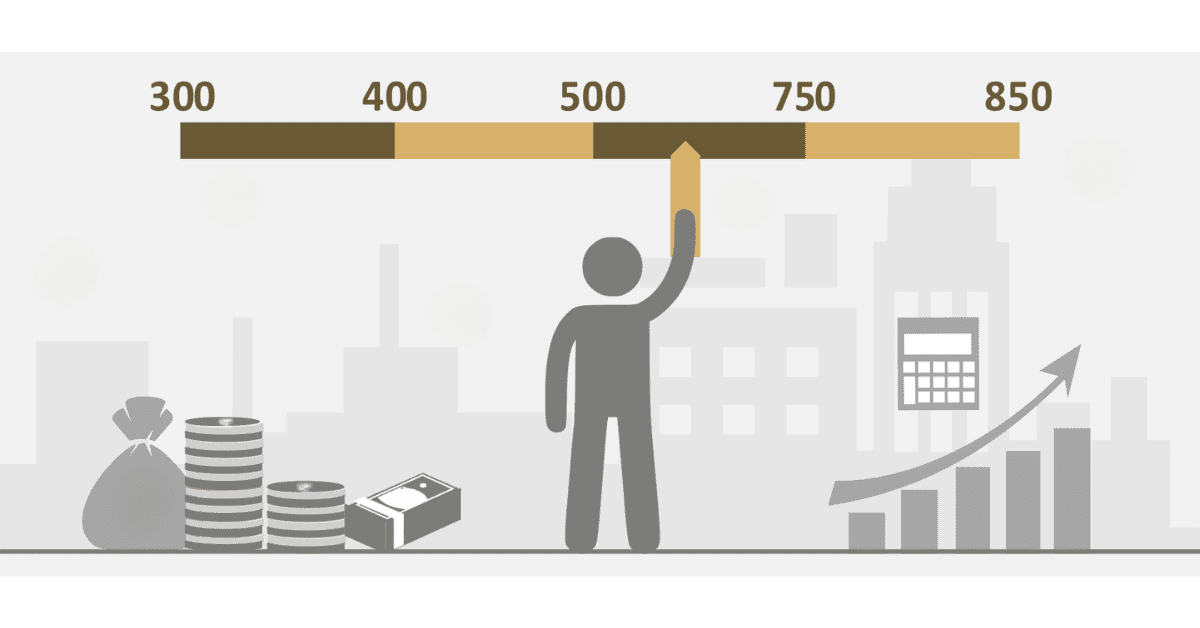

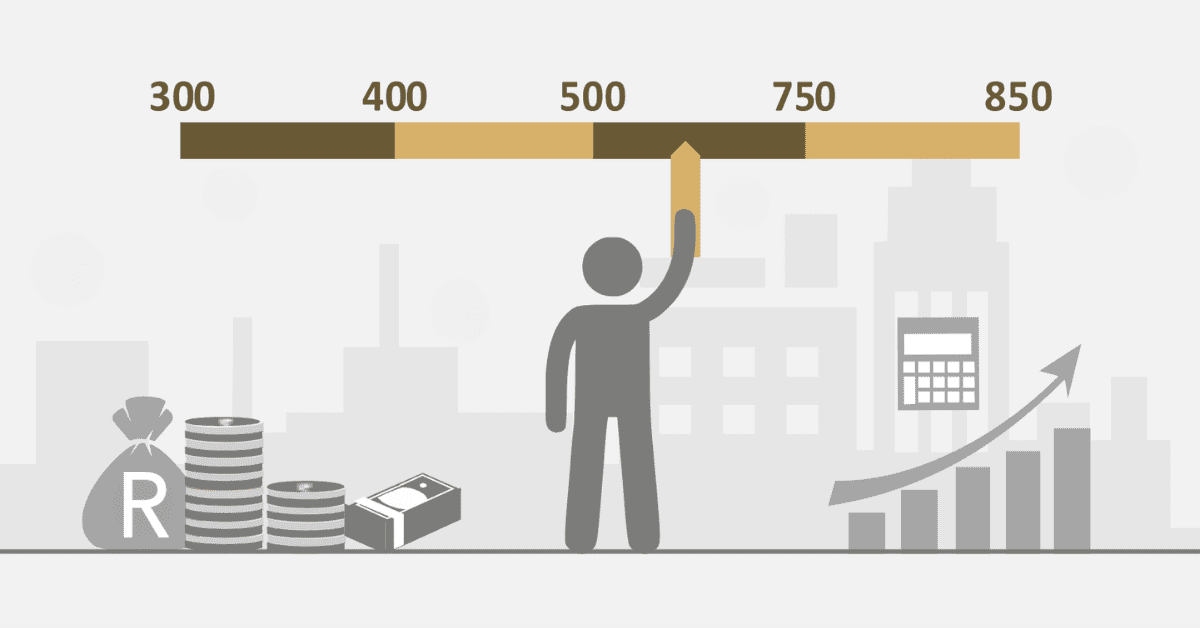

TransUnion utilizes the VantageScore 3.0 scoring model to calculate credit scores for different individuals. According to this scoring model, a score range between 721 and 780 is considered good for TransUnion. Anything less than 600 is considered poor, while any credit score above 781 is considered excellent. However, other lenders may have lower or higher standards, and this can affect your credit score.

Your credit score determines your eligibility to get a loan and the interest rate that will be charged. To improve your score, you need to consider a multifaceted approach depending on your financial status. These tips can go a long way in helping you improve your TransUnion credit score.