A credit score is a figure commonly used by lenders to measure your creditworthiness and determine the amount you can borrow and interest charged. If you want to borrow money from financial institutions like banks and other related credit providers, you need to have a good credit score to prove that you are responsible for managing credit and capable of repaying the money. When you miss a payment or apply for a loan, credit bureaus record and maintain this information. A credit report is used by banks to determine your eligibility for credit.

Fortunately, there are different measures you can take to improve your credit score to get the loan you want. This article explores the measures you can take to improve your credit score on FNB.

How to Improve My Credit Score on FNB

When you have a bad credit score, you may not qualify to get a loan from a reputable financial institution like FNB. To improve your credit score, you need to ensure that you pay all your monthly bills like electricity, water, and others on time. If you miss a payment or make a late payment, credit bureaus in South Africa will collect the information. And it will appear on your credit report.

It is imperative to create a realistic budget so that you will be able to meet your expenses. With a budget, you can stay in your lane to avoid spending money you don’t have. Reduce spending on luxurious items such as cosmetics, entertainment, or eating out to build your savings in your FNB account. Be sure you have enough cash to cover essential items on your budget like insurance premiums. However, if you have more than two funeral policies, you need to relook and check if it is necessary.

The FNB app is another good option that can help you save money to improve your credit score. Log into your FNB App, go to Navigate Life, and then go to Navigate Money. Check available funds on nav» Money to see if it is enough to cover your debit orders. Saving money in your account is another option that can help you cover your installments or debit orders to avoid credit build-up, which can negatively affect your credit score.

Avoid getting new credit when you have outstanding debts or loans. Whenever you apply for a new loan, the lender can make a hard inquiry on your credit report to check if you are capable of repaying your debt. If you have several outstanding debts, it is a good idea to consider debt consolidation. With this method, you can consolidate small unsecured loans like store cards into a single manageable loan with lower account fees and interest rates. Once you lower your interest rates, you will be able to reduce your monthly premiums, and you can use the money to cover other immediate needs.

When dealing with debt, you need to be careful to avoid worsening your credit score. It is crucial to know your credit score so you can improve it. You can use the FNB App to check your credit score by following these steps: log in to your FNB App -> nav» Money -> My Credit Status. Once you know your score, ensure you clear your credit card debt and spend less than 30% of the credit limit provided. Spending above your credit limit will lead to the build-up of unnecessary debt that can choke in the long term when you fail to clear it.

If your credit report has errors, this can negatively impact your credit score. Therefore, you need to check your report to ensure that it is error-free. If you identify any errors, be sure to dispute them to improve your credit score. It usually takes up to six months to improve your score, depending on your credit status.

How do you check your credit score on FNB Mobile Banking?

The first step is to log in to your FNB App -> nav» Money -> My Credit Status. When you get your status, you will also get tips that can help you improve your credit score. Alternatively, you can also visit My Credit Status inside the nav» Money. If you have FNB credit products, you can use this facility to make payment arrangements.

How do you manage your credit on the FNB App?

Log into your FNB app, choose Navigate Life, and then click Credit Status. You will get details about your credit status. If you need to improve your score, get tips from the app and pay your arrears. Additionally, you can also get personalized credit offers to help you manage your debt.

What Credit Score Does FNB Use?

A credit score is a figure used to determine one’s capability of managing their debts and repaying them. A bank like FNB checks your credit history and credit score to determine the level of risk you pose if they lend you money. Your credit score also plays a pivotal role in helping lenders decide the amount you can borrow and the interest charged.

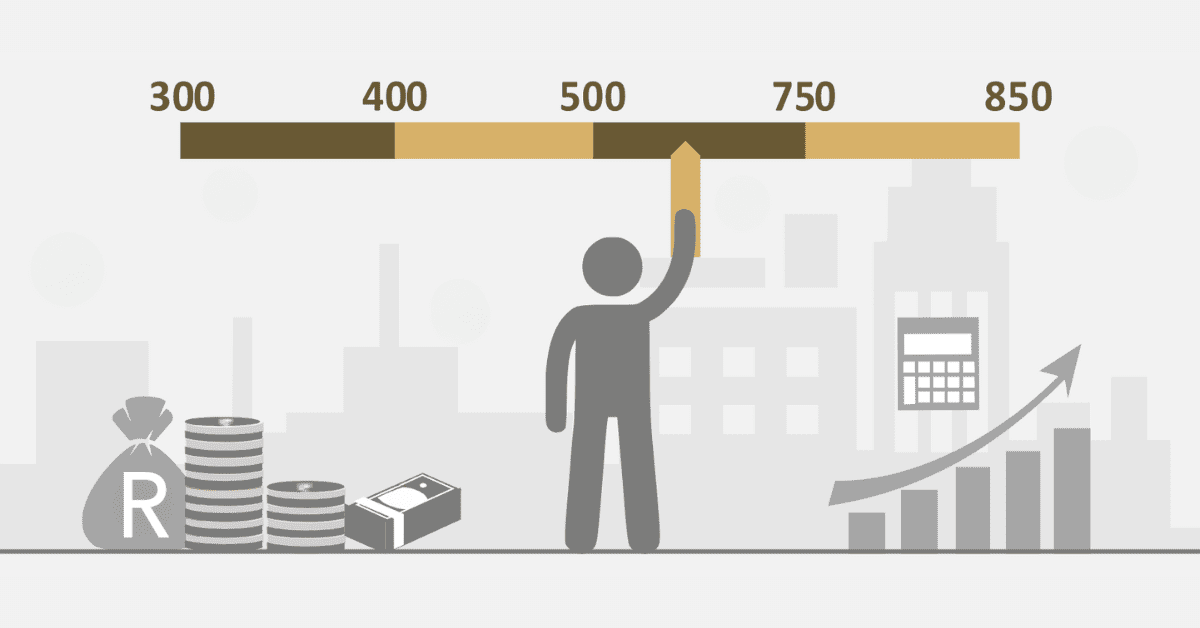

FNB uses the FICO credit model, which involves any three-digit number that ranges from 0 to 999. For a bank like FNB to consider your eligibility for a home loan, you must have a credit score of around 610. Any score above this figure is considered good, and it comes with several benefits like competitive interest rates and access to different loans. The following are the credit scores commonly considered by lenders in South Africa.

- 781- 850 Excellent

- 661-780 Good

- 610 – 660 Fair

- 500 – 610 Poor

- 300 – 499 Very poor

If your credit score is below 610, you need to improve it before applying for a loan at FNB.

Can I Get a Credit Report From FNB?

FNB is a lender, so it does not provide credit reports to clients. When you submit your loan application to FNB, the bank will obtain your credit report from any of the four main credit bureaus in South Africa, including Equifax, Experian, TransUnion, and XDS. Consumers are eligible to get a free report from any of the credit bureaus at least once every 12 months. FNB app only provides a credit score.

A good credit score allows you to get loans from banks like FNB at favorable interest rates. With a poor score, your credit application may be rejected. The good news is that you can improve your score by following these tips.