Before you think about how you can improve your credit score quickly, you must first analyse if there is a possibility of improving your credit score quickly.

The “How” and “possibility” are complementary and therefore having an understanding of the possibility could give you the truth about the process.

Many people who find their credit score within a poor range are seeking quick ways to improve it.

Certainly, you can improve your credit score but the notion of doing it quickly can be a fallacy and relative.

In this blog post, we will share some ways to improve your credit score quickly. But remember, the timeline differs and comes with certain conditions.

How to Improve Credit Score Quickly

Having a strong credit history is crucial if you aim to secure more favourable interest rates on mortgages, car loans, and other financial products.

What if your number falls short of your expectations? What are some efficient methods to improve your credit score quickly?

Unfortunately, increasing your credit score is a more challenging task compared to decreasing it. Additionally, understanding the various financial factors that impact your score can be quite difficult.

Depending on the situation, improving your credit score can seem challenging. Fortunately, there are methods to improve your credit score, making you a more attractive candidate for lenders.

Here are some helpful ways that could help you improve your credit score very fast.

- It is important to pay off all of your bills on time and in full. About 35% of your credit score comes from how well you have paid your bills in the past. To improve your credit scores, you need to make sure you pay all of your bills and payments on time and in full. When you can, it is best to pay off any protected credit cards or lines of credit in full. It is possible that making on-time payments can help your credit numbers.

- It is best not to use more than 30% of your credit card limit at a time. It might be tempting to spend as much as your credit limit every month just because your credit card company lets you, but you should resist the urge. If you want to quickly raise your credit score, you should keep your debt-to-credit ratio at 30% or less. This shows how much of your credit limit you have used compared to your total credit limit. When you do this, your credit scores will go up quickly by 200 points or more.

- Make sure you check your credit report for mistakes and fix them if you find any. Your credit scores may be going down because of mistakes on your credit record. One quick way to raise your credit scores is to find and fix these mistakes on your credit record. When you dispute a mistake on your credit record, Equifax or TransUnion may take between 5 and 30 days to look into it. You might see a quick rise in your scores after the mistake is fixed.

- You can ask for a bigger credit limit on your credit card or line of credit if you want to improve your credit score. If you raise your credit limit, your debt-to-credit ratio will go down. This is a big part of figuring out your credit score. Your credit scores may go up after they are changed if the ratio goes down.

- Having bills that are being collected can hurt your credit scores. Getting rid of your debt may help your credit score. If you can not pay back the full amount right away, you might want to ask your creditors to agree to a payment plan and mark the debt as “paid” on your credit report.

What increases credit score fastest?

There are a couple of things that could cause an increase in your credit score when done well. Ultimately, the credit score range deals with formulas of the financial behaviour of an individual.

If you want to increase your credit score faster, the first thing to do is to always pay your debt on time.

Paying your debt on time is one of the factors that contributes to the credit score calculation. Once it is done right and on time, your chances of having your credit score increase faster will be more than expected.

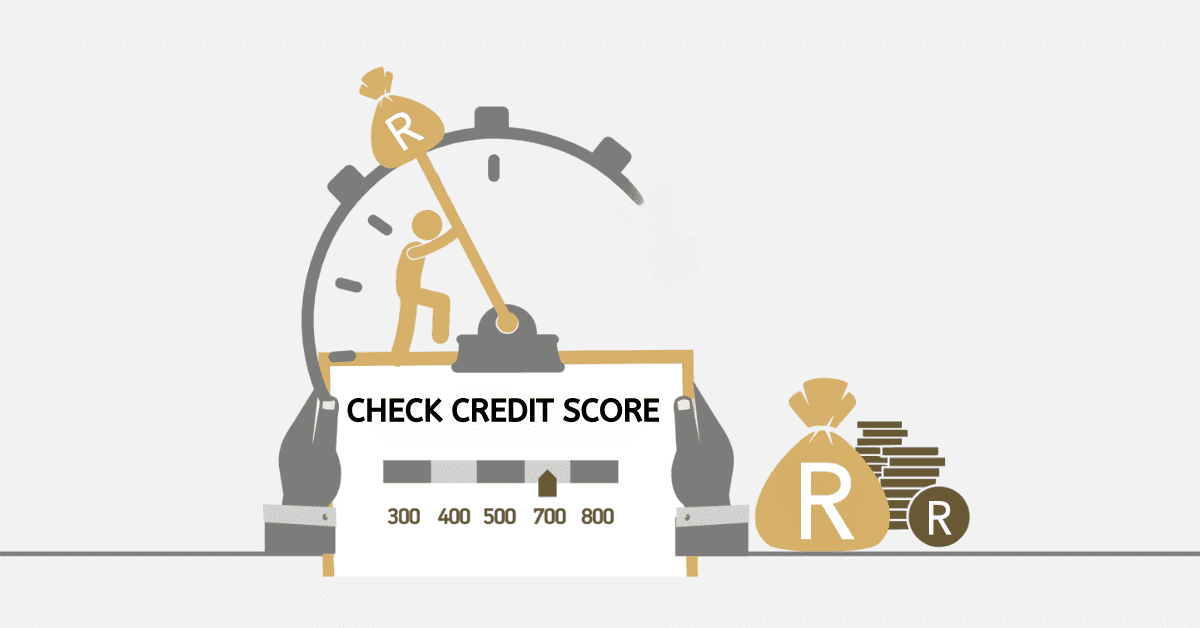

How long does it take for your credit score to go up?

The duration for your credit score to enhance can differ depending on personal circumstances. Positive changes, like making payments on time and decreasing debt, can lead to gradual improvements in just a few months.

However, it may take several years to see significant score increases, especially if there are any past delinquencies or bankruptcy on record. It is essential to maintain consistent and responsible financial behaviour, such as timely bill payments and responsible credit management.

It might require over 6 months for any significant changes to become apparent in your credit score.

Why is my credit score going down if I pay everything on time?

A common question that confuses a lot of credit users. It is possible to have your credit score down although you pay everything on time. Well, here is what you need to know.

When you pay everything on time, it can be considered as high credit utilisation. This is because the payments affect certain factors like credit mix, the length of your credit history or even the debt you have paid.

Once you see the drop, you do not need to panic but rather analyse the expenses on your credit history to know if you are doing the right thing at the right time.

Is it true that after 7 years your credit is clear?

Yes, your credit could clear after 7 years. The system is designed to clear your credit after every 7 years irrespective of who you owe. Clearing credit does not clear the debt but gives you the chance to rebuild your credit score.