A good credit score is vital to accessing any type of credit product. While the best financial habit would be to never use credit at all, that’s not realistic for most of us. When it comes to big-ticket purchases like homes or cars, buying in cash would be a difficult goal. Lenders won’t offer big loan amounts like that without some assurance you are a good risk, however. So it pays to start building your credit score before

How to Improve Credit Score (Clearscore)

Improving any credit score, including ClearScore, needs three things:

- You must have active credit lines.

- You must show responsible management of that credit.

- Those good habits must continue over time.

Everyone’s credit history is deeply personal. So there is no ‘one trick’ to fix it. If you have very few lines of credit (or none), try to open a few more so they can build a better profile of you. Don’t do this all at once, however, as that itself will reduce your credit score. Open a couple over a year or so.

If you have bad credit behavior, you need to fix that. Your score will improve over time as you do. Pay on time, don’t go over the limit, and try to stay under 50% credit utilization. Deal with things like defaulted loans and court judgments. Once this is done, stay on track.

The last point, time, can’t be cheated. You are going to have to allow your credit score to improve gradually- it won’t happen overnight. If you are practicing good credit use, however, it will improve. Hang in there!

Is ClearScore Credit Rating Accurate?

The quick answer? ClearScore is as accurate as any other credit report score you will get. In the wider world of credit ratings, however, there’s no such thing as a truly accurate credit score.

There are 4 major credit bureaus in South Africa- Experian, TransUnion, Compuscan, and XDS. While they all (roughly) track the same factors, each has its own formula for assessing risk. Additionally, different bureaus update their scores at different times. Also, some lenders will take longer to update specific bureaus than they do others. So a change that reflects on one bureau’s ratings already may not have reached another. A lapsed account may still show on one bureau’s report but have been fixed on another. You get the idea.

This means that while they will all agree on a ‘rough average’ based on your general lending behavior, the exact score they assign you will differ. To further complicate the matter, many lenders use different bureaus or prioritize specific bureau scores over others. It’s nearly impossible to know exactly which they are using. They may even use in-house ‘scorecards’ to evaluate you too, which many mobile companies do in South Africa.

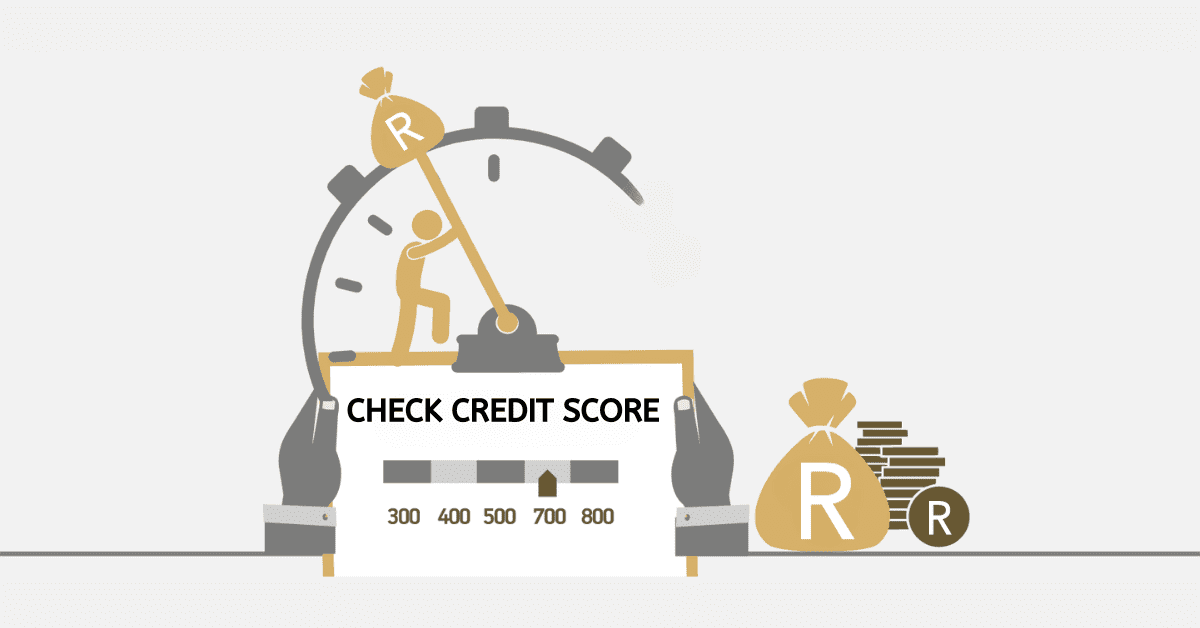

However, don’t sweat about the precise score you have. Despite these differences, all reputable bureaus will show more or less the same details- a broader pattern of your credit behavior. For example, if you have a credit score of 700 with Experian, you may have 680 with TransUnion and 710 with Compuscan. This won’t make a big difference in your access to credit. You won’t find that one bureau shows you as a great risk and you have terrible credit on another. The only time there’s a possibility of that happening is if there is a major error on one report, of course, in which case you should seek to rectify it with the bureau.

Now, back to ClearScore. ClearScore is not a credit bureau. It’s a third-party service that aggregates data from Experian and a smaller bureau, illion. So it will be a little different from your exact Experian data. It is a reliable tool to track your credit score and monitor changes, however, and that is invaluable.

Why is my ClearScore Credit Score So Low?

If your ClearScore credit score is low, it could mean several things. The most likely is that you have bad credit habits such as late payments, going over your credit limits, or defaulting on debt. People who have no credit lines at all may see a 0 or sub-300 score, too. In this case, it means they have no record of you yet, not that you have done something wrong.

In some cases, your ClearScore credit score could be low due to errors or fraud on your report. Perhaps a defaulted line of credit you have now paid off is still showing active on the report. Or someone has opened credit lines in your name fraudulently. For this reason, carefully scrutinize the data on the report and make sure you agree with all of it. This is why products like ClearScore, which lets you monitor your credit report regularly and effortlessly, are invaluable.

Let’s be honest, though. A bad credit score 9 times out of 10 means you have messed up. You likely know it too. Luckily, you can turn that around with better financial behavior!

What is a Good ClearScore Score?

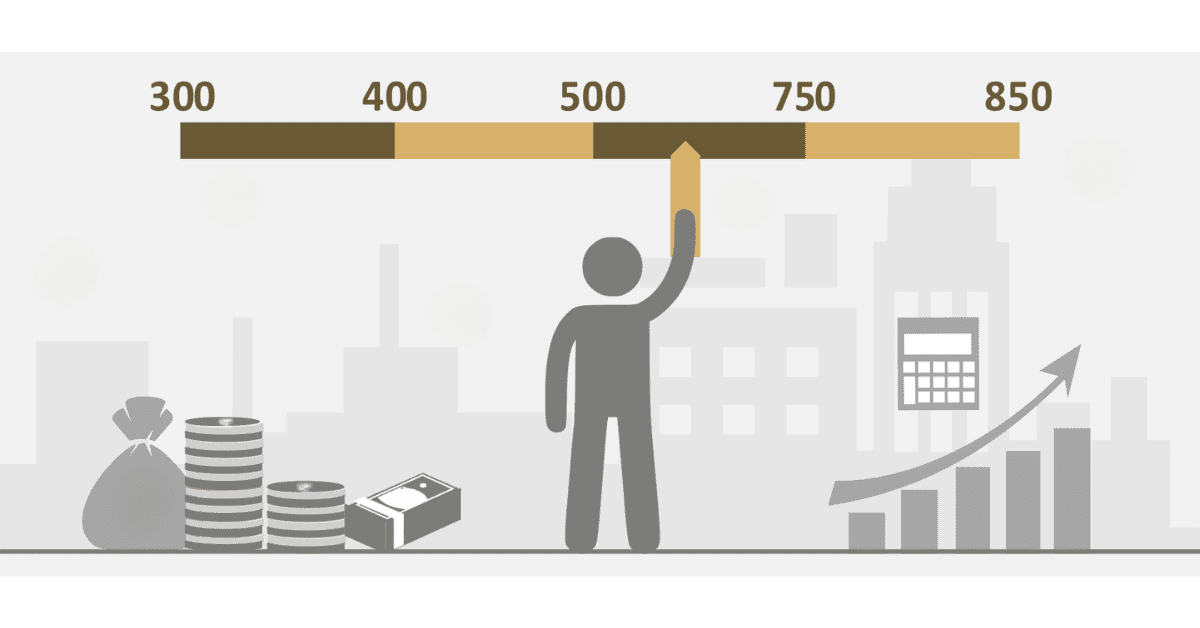

In South Africa, a credit rating of over 670 is considered good. Ironically, most of South Africa does not fall in that bracket. The South African average credit score is around 560-580 (poor to fair), a telling sign of our terrible credit habits! Obviously, if lenders only lend to those in that ‘good’ bracket, they wouldn’t do much business at all. As long as you are at or above the national average, you are doing OK and will be able to access most types of credit.

As ClearScore offers you a neighborhood average, too, try to beat that. The ideal credit score is as high as you can get (850 in SA), but you don’t have to be perfect to have credit access. Stay in at least the fair range, and do your best to improve it as much as you can.

ClearScore is a nifty free service that lets you monitor your credit score more easily. It can be a great partner to a better credit future, so don’t be scared to try it out!