Ah, the lender’s ideal- the person with a perfect credit score! For those of us struggling with a soft economy and rising cost of living, it seems like an impossible goal. In many ways, it is- people with the highest possible credit score are few and far between if any exist at all. However, you can still have a fantastic credit score that practically guarantees lenders will want to throw money at you without reaching the highest possible score. Today we will show you how.

How to Have a Spotless Credit Score (South Africa)

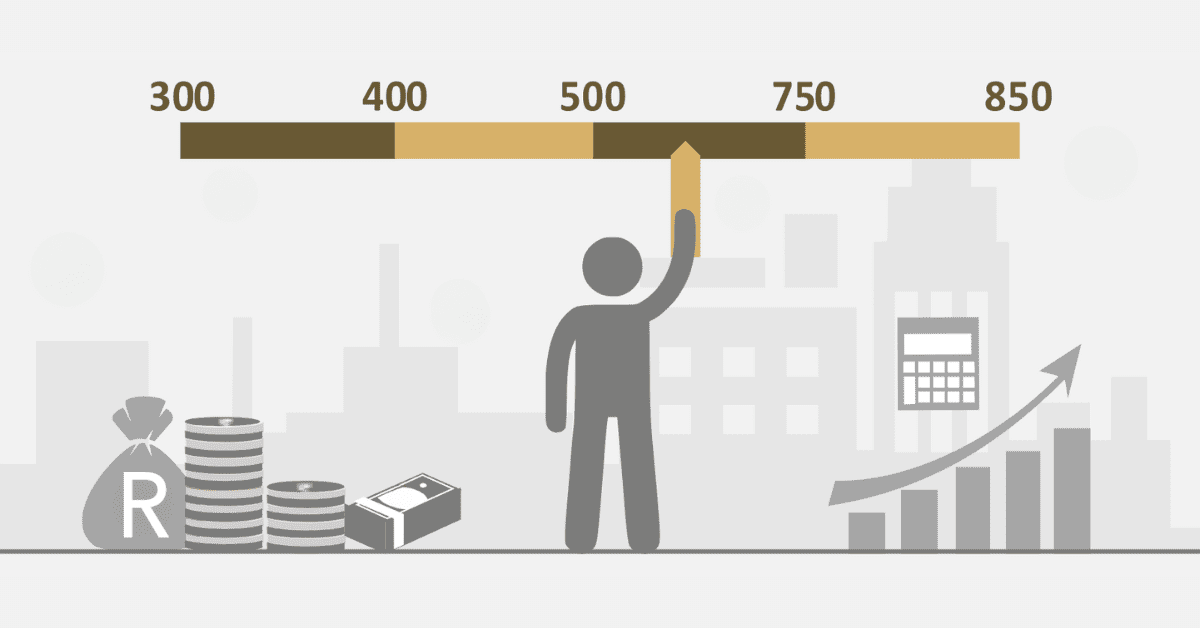

In South Africa, the highest credit score you can have is 850. Aiming to boost your credit score all the way is a worthy goal. In honesty, however, you are unlikely to achieve it- and you don’t have to! Credit scores over 800 are considered excellent, and represent the best of the best lending behavior over a long time. If this is you, give yourself a gold star! The credit world is your oyster. Anything over 700 is counted as ‘very good’, and will mean you can get favorable interest rates and access to almost all the credit you could want.

So how do you get to these spotless credit scores? It boils down to excellent credit behavior. It isn’t a quick or one-time process, either. It will have to be maintained over a very long timeline. Ideally 5 years. That means keeping a variety of different types of credit, both long- and short-term, open. Long-term debt well managed is a major score booster, like your mortgage.

Credit should be used (no 0 balances), but not too much. Ensure you never make a late payment, go over your limit, or default on a loan. Then there is the thing that few people realize- you also have to be actively using that credit while meeting all those benchmarks! If you pay off all your lines of credit and never use them again, your credit score will also drop. Paying off the balances in full within 30 days (typical, and prudent, financial advice) also won’t count. The credit bureaus see that as ‘cash’ spending behavior, not real credit usage. Plus, higher credit scores go to those who have some credit, not no credit.

As you can see, a spotless credit score doesn’t entirely overlap with having excellent financial ‘hygiene’ or being debt-free. You could have millions in the bank and no credit score at all because you have bought everything in cash! It’s also near impossible to keep, and maintain, that sweet spot over long periods. However, keep those benchmarks in mind and do your best to meet them. You will soon see a positive impact on your credit score.

How to Clear Your Credit Score if You Want to Buy a House

Then there’s the matter of bad credit. How do you improve your credit score if you want to buy a house, or make another major credit purchase?

It will start by looking at your credit report with each bureau in depth. Carefully note every entry. Is something wrong, has a mistake been made, and is there any fraudulent activity that isn’t you? These matters can be disputed, and should then be removed from your report. Now, work on clearing your outstanding debts, resolving any legitimate defaults or judgments, and otherwise tidy up your report.

Next, how well are you using credit? Ensure you are paying your installments like clockwork every month. Don’t go over your credit limits, or let an account default. Take steps to bring your credit utilization (how much of your balance you have used) under 50%, and above 30%. If you aren’t already using a variety of types of credit, you may need to open and scrupulously maintain a few more. 2 credit cards, for example, will have less of a positive impact on your score than a credit card and a car loan. Even if you use them meticulously.

With time and patience, this will gradually improve your credit score. Typically, you need a credit score of at least 640 to be granted a mortgage. Ideally, try to get it to 700 or higher to unlock better rates and boost your chances of approval.

How Long Does it Take to Fix Bad Credit in South Africa?

How long it takes to fix bad credit in South Africa depends on how bad it is. If you have sunk into the 300 range on your credit score, and have no obvious defaults or errors, it’s going to take a long time to rehabilitate. If you are at the national average of 560, raising it will be quicker.

In general, it takes about 3 months for improved credit behavior to have a positive impact on your credit score. It will keep rising further with time if you keep up the good work.

How Long Does Bad Credit Stay on Your Record in South Africa?

How long any item on your credit report- good or bad- has an impact on your credit score depends on what that item is. These times are dictated by the National Credit Act in South Africa, and are called ‘retention periods’. Serious items like court judgments will remain on your record for 5 years. Even if it is resolved or paid, the impact will remain for the full retention period. Defaults, which are less severe, will remain on your report for 1 to 2 years, as will rescinded judgments. Payment history is updated every 30 days, with 12 months of data shown. Credit utilization is also updated every 30 days, and the previous month’s data falls away immediately. As a rule of thumb, the worse the behavior, the longer it will impact your report. A missed payment will have a small impact, whereas a judgment has a massive one.

Trying to get the highest credit score possible is a solid financial goal, and it all starts with managing your credit smartly. We hope these tips will help.