In South Africa, there are 4 main credit bureaus that lenders will use to assess your creditworthiness. Of these, global giant Experian is one of the best-known and most commonly used. The first step to taking control of your credit usage and understanding how lenders perceive your credit habits is by accessing your credit report and understanding what has shaped it. As everything in life is just a little sweeter if it’s free, we’re here today to walk you through how to get your free Experian credit score the easy (and safe) way.

Can I See My Experian Score for Free?

Yes, you can see your Experian score for free. In fact, once every 12 months, you have a right (enshrined in the National Credit Act) to request a free full credit report from every one of the 4 main credit bureaus. Experian was one of the first credit bureaus to offer its own online portal to make this even easier than before.

If you don’t want to go online, you can also phone the call center for Experian, or any of the other major bureaus, to request your free copy. You will have to verify your identity for the call center agent, just as online, and then your free report will be on its way to you.

How to Get Your Free Experian Credit Score

So, that’s how you access your annual free Experian credit report- either through an online request or via their call center. What if that once-a-year timeline is a little too long for you? We really should monitor the state of our credit history a lot more frequently than that. If you continue to work directly with Experian, you can get as many more reports as you want, but they will cost a small fee (in the region of R20) for each report until you once again reach your free annual option. Isn’t there another free option?

Why yes, there is! Since South Africans have a notoriously high debt-to-income ratio and some terrible spending habits, financial institutions are keen to help counter this by empowering users to take control of, not be controlled by, their debt. So more and more free credit monitoring options are opening up to us.

Currently, there are three other free options to explore to get your Experian credit score free. Firstly, there are safe and reputable online third-party services that collect data from the credit bureaus and allow you to access it regularly online. Of these, Kudough and ClearScore both draw on Experian data. While they might not be quite as accurate as a report directly from Experian, they are a great way to track overall movement and trends in your credit score. As you can see the individual reporting lenders whose data is used for the report, you can also identify any fraudulent activity or inaccurate accounts listed on your credit report. This lets you report them much quicker than you could by waiting for your annual free report- before any damage can be done!

Secondly, many financial institutions like Standard Bank now offer a neat little widget accessible directly through your banking app. Most are powered by Experian data. This only shows your score, not a full report, but it is still useful to monitor. Lastly, Kudough has partnered with Money Market at Checkers and Shoprite to let you request a free report while in-store.

Does Experian Give You Your Real Credit Score?

Experian is one of the largest and most trusted credit bureaus in the world. Many institutions use their credit reports, either exclusively or in tandem with other bureaus, to make their final decisions about lending to consumers. So yes- your Experian credit score is highly likely to be the credit score used in making decisions about your creditworthiness.

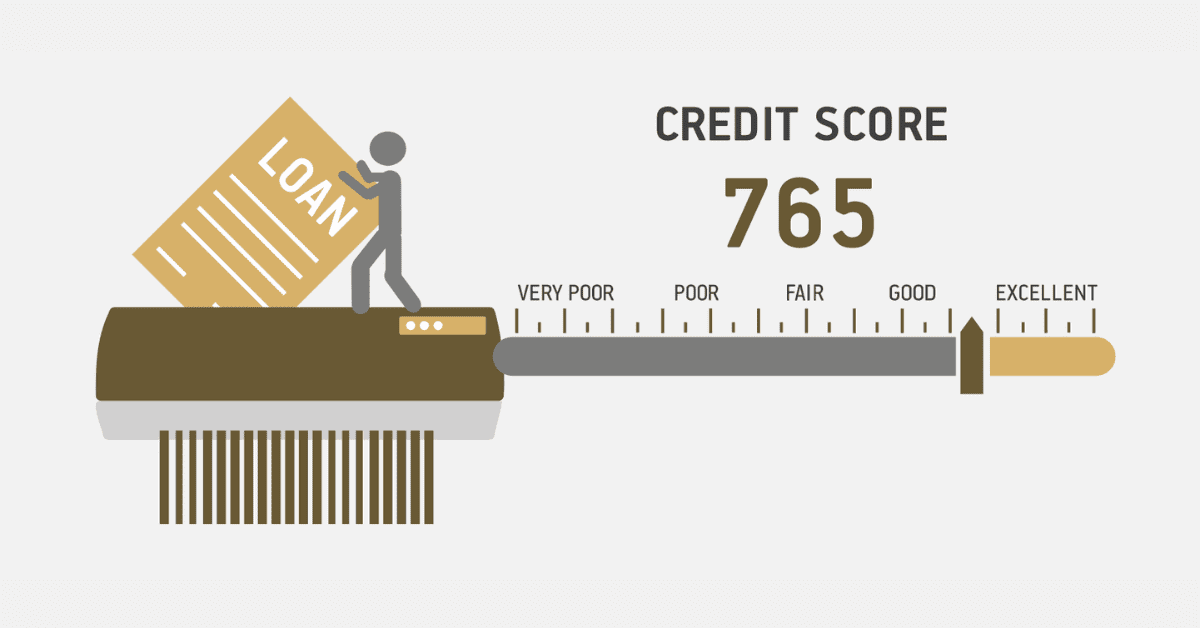

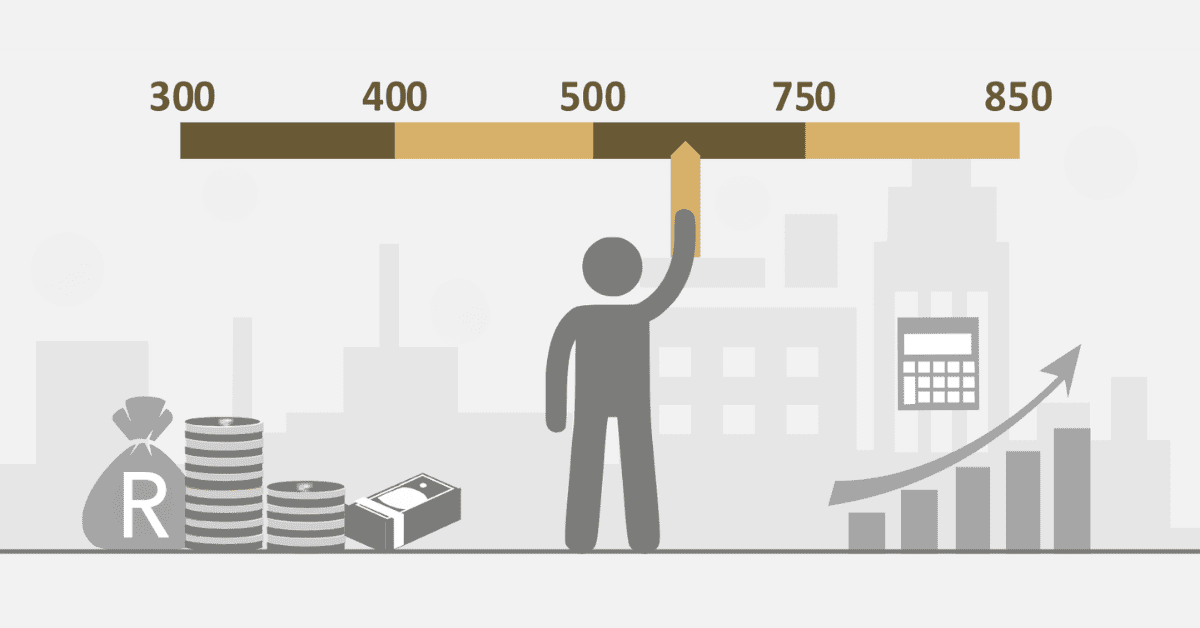

It is important to stress, however, that there is no such thing as one ‘real’ credit score. Creating credit reports is a matter of actuarial science. The fancy way of saying ‘financial experts who are skilled in assessing risk’! There is no wrong or right final answer, and there are some different models, algorithms, and predictions used between bureaus. Usually because they focus on a specific type of credit, or a specific industry, and have tailored their risk assessment to that market. That doesn’t make one ‘right’ and one ‘wrong’.

In fact, we strongly advise that you don’t start obsessing about tiny things like a few points difference between bureaus at all. Even if there are small variations, the overall picture from each bureau will be roughly the same and that’s what matters the most. Except in the exceptional circumstances where one bureau has received incorrect data, like fraudulent activity in your name or an error. If you notice a very large discrepancy between two bureau’s scores, it is worth inquiring about for that reason.

Is Experian Different from ClearScore?

Experian is different from ClearScore. Experian is an actual credit bureau- the big guys who collect credit data and create your credit report in the first place. ClearScore is a third-party service that lets you see your credit report whenever you want to, but it has no hand in gathering any of the data- it pulls it from the bureaus themselves.

That said, ClearScore’s credit report will be very similar to the data from Experian. It aggregates its data from two agencies- Experian and illion, which is a much smaller and rarely used agency. So Experian’s data is heavily weighted in ClearScore’s reports and dominates the scores it shows.

Remember, you can’t fix what you don’t know about! Regularly monitoring your credit report is vital in your journey to great creditworthiness, so take advantage of Experian’s free credit score options as much as you can to empower yourself.