The world of credit scores can be very confusing. Yet understanding your creditworthiness is essential for you to make informed financial decisions. If you have encountered the term ‘FICO score’ before, and are curious what it means, we are here to help. Today we will unveil everything you need to know about FICO, and how to make it work for you.

What Is a FICO Score?

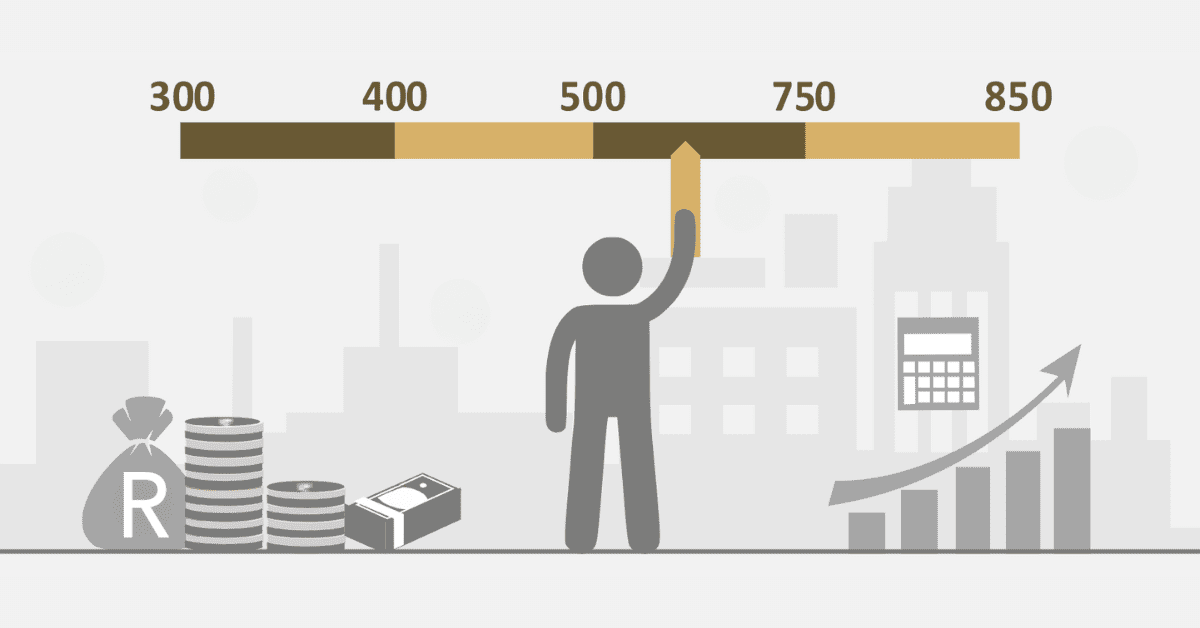

Technically speaking, a FICO score is just another way to say your credit score. It was first developed by the Fair Isaac Corporation, hence the acronym. Your credit score plays a key role in determining whether lenders see you as a good or bad credit risk- your creditworthiness. In South Africa, the FICO score scale runs from 300 to 850. The higher the number, the better your score.

How to Get Your FICO Credit Score

So, your FICO score isn’t a new thing to worry about. It’s just the same old credit score under its official name. Luckily, accessing your FICO credit score is pretty straightforward. It is also well worth doing, as it will show you how lenders perceive your credit behavior.

There are many credit bureaus worldwide, some specializing in very niche areas. For us ‘normal people’ in South Africa, there are 4 major credit bureaus to know. These are Experian, XDS, Compuscan, and TransUnion. They carefully track and compile your credit information as reported by lenders, and calculate the FICO score from there.

To get your FICO score, you can request a copy of your credit report. Ideally, approach each of the Big 4 bureaus separately, as their data can vary slightly. You can do this online, or call their call center for assistance.

How are FICO Scores Calculated?

FICO scores are created through some complex actuarial science (the fancy term for financial risk calculation). A range of factors are used, including:

- Your track record of making timely payments on credit accounts.

- The amount of credit you’re currently using compared to your total available limits.

- The length of time you’ve had credit accounts open and in good standing.

- The number of recently opened credit accounts and hard credit inquiries.

- The diversity of credit accounts you have, such as credit cards, loans, and mortgages.

Together, this data is used to assess your creditworthiness, and a FICO score is assigned to you accordingly.

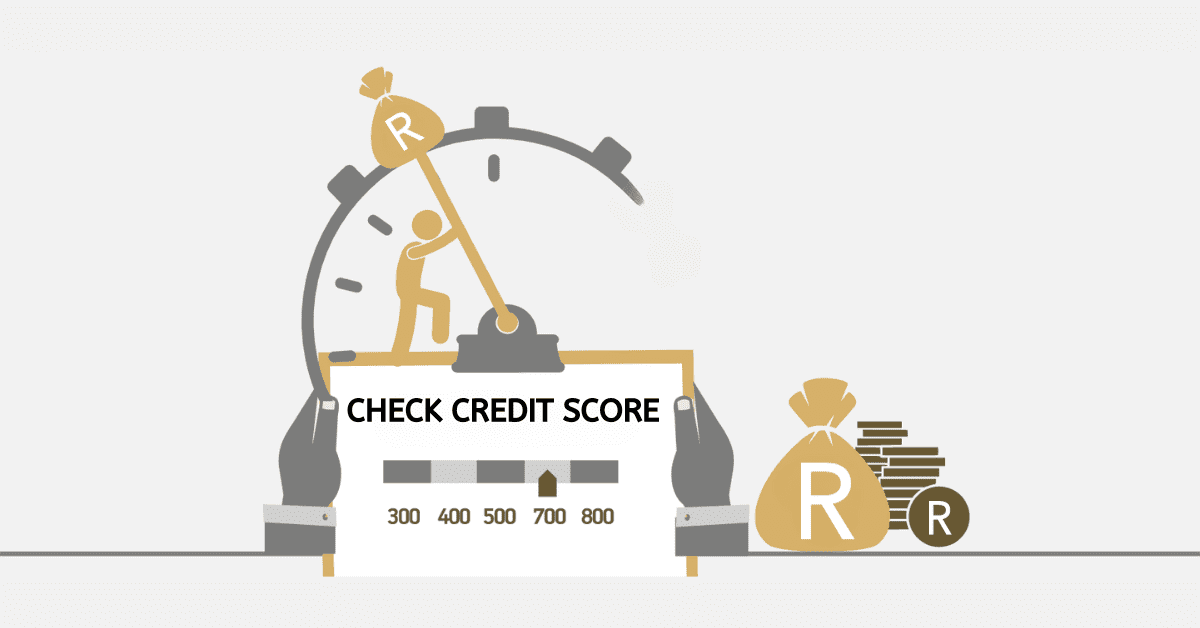

Is There a Way to Check My FICO Score for Free?

In South Africa, you are entitled to one free credit report from each bureau every 12 months. You can also get a new report at any time after that for a very negligible fee- typically about R20 per report. You can even sign up for a regular service or alerts directly with the bureau for a similar small monthly fee.

Today, several third-party services aggregate data from specific bureaus and let you access it monthly for free. They will even email you a reminder! ClearScore and Kudough are two well-known and trusted options. While this data may differ slightly from your exact credit report, it is a very smart way to track changes and get alerts conveniently.

Can I Check my FICO Score Through My Bank?

In addition to these third-party services, many banks and financial institutions have introduced app widgets and online ‘quick scores’ that will also give you a brief insight into your FICO score. While these are not comprehensive reports, they are also useful for tracking your credit score over time.

As with third-party services, they may not be 100% accurate to the last digit. That doesn’t matter. What does matter is that you have a solid idea of where you stand with the credit bureaus, how good your credit score is, and if it is rising or falling. This lets you take action quickly if something seems wrong. You can also better prepare yourself before you make a credit application.

Why is my FICO Score Different from Bank to Bank?

FICO scores will differ a little between banks and financial institutions. Remember how we mentioned there were 4 main credit bureaus in South Africa? They all track the same general trends but use the data a little differently. Here are some things to note:

- While FICO scores are widely used, there are multiple versions of the FICO scoring model. Each is tailored to specific industries or types of credit.

- Some banks and lenders directly report only to specific bureaus or prioritize one bureau above others. This means other bureaus may be slower to reflect the same changes. Credit scores can fluctuate daily based on changes to your credit report, such as new account openings or late payments. If you check your score at different times, you may see variations.

- Lastly, mistakes happen. Inaccuracies or inconsistencies in the information reported to credit bureaus by lenders can lead to variations in your credit score across different platforms.

Don’t get too hung up on your exact FICO score to the last digit. You will notice that, even with small discrepancies, every bureau’s score will be in a similar range. Where you fall in that broader range is much more important than whether you have a 692 or a 699 score.

If you do notice one bureau is significantly different from the others, however, it is worth asking for a credit report. This is a good indicator that there may be a mistake, error, or even fraud that a specific bureau has picked up. Better safe than sorry!

What’s the Difference Between My FICO Score and Credit Score?

There is no difference between your FICO score and credit score. They are two different ways of talking about the same thing. FICO score is the official name, but credit score is used more. The FICO scoring model is not the only one used in the world, but it is by far the most common.

There you have it! FICO is the most common scoring model used to create a credit score globally. Knowing your credit score is the first step to taking control of your financial future. When you know where you stand, you can take proactive steps to improve your creditworthiness and achieve your financial goals.