An ITA34 is one of the most common correspondence types you will receive from SARS as it pertains to the assessed amount due on your income tax return. Receiving any official notice from SARS can seem scary, but this particular type of assessment isn’t one to worry unduly about. Today we walk you through everything to do with your ITA34 and what you need to know.

What Does SARS ITA34 mean?

While the ITA34 is sometimes called an IT34, it’s just an error. They mean the same thing. ITA34 is an abbreviation for “Income Tax Assessment” and is a form used by the South African Revenue Service to assess your tax liability. The ITA34 form is used to calculate the amount of tax that is owed by the taxpayer in income tax and to determine the amount of any tax refund that may be due.

The ITA34 form is based on information that is provided by the taxpayer, such as their income, expenses, and deductions and is generated after you submit your income tax return. SARS may also use information from third-party sources, such as employers, medical aids, pension funds, or banks, to verify the information provided on the form.

If you receive an ITA34 form from SARS, it is important to review the information on the form carefully and to make any necessary corrections or updates. If you believe that the information on your ITA34 form is incorrect, you can contact SARS directly for assistance or lodge a dispute on eFiling.

How to Get SARS ITA34

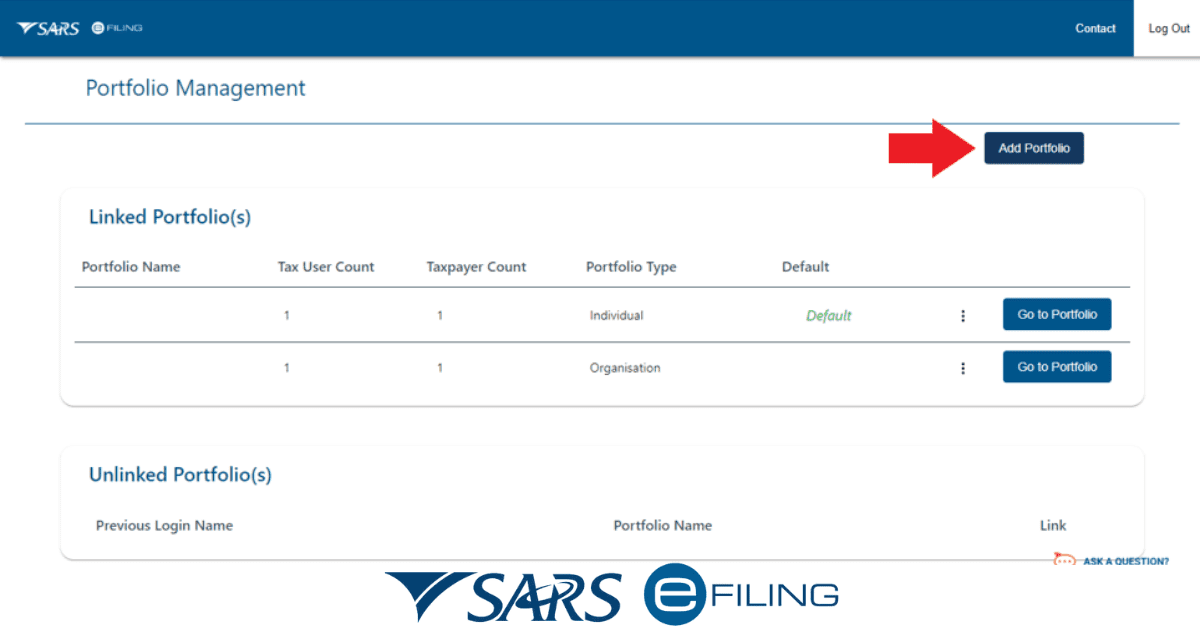

You will likely be informed via your preferred contact method (email or sms) when your ITA34 is issued after you submit an income tax return. To access your SARS ITA34 in full via eFiling, you should do the following:

- Log in to your SARS eFiling account.

- Navigate to SARS Correspondence to see the full notice.

- Alternatively, go to your income tax return under the Returns heading and click on the correspondence note at the top of the page.

- This will take you to the ITA34 page, where you can view your ITA34 form and any related information.

If you do not have a SARS eFiling account, you can register for one on the SARS eFiling website. Once you have registered, you can log in to your account to access your ITA34 form and any other tax-related information.

How Do I Know if SARS Owes Me a Refund?

If you personally submit your income tax return or liaise with your accountant/bookkeeper as they submit on your behalf, you likely already know whether there is a refund due to you or if you will have to top up amounts paid through the year towards income tax.

However, you can also determine if SARS owes you a refund by reviewing your Income Tax Assessment (ITA34) form. The ITA34 form is used by SARS to calculate your tax liability and determine the amount of any tax refund that may be due, so all details are shown here.

If you believe that the information on your ITA34 form is incorrect, you can lodge a dispute to remedy the issue.

What Happens After Receiving my ITA34 from SARS?

For many people, there will be no need to take action once they receive your ITA34 from SARS. After receiving your Income Tax Assessment, you should, however, review the information on the form carefully to ensure that it is accurate. If you find any errors or discrepancies, you should contact SARS directly to request that they be corrected or lodge a dispute.

If you agree with the information on your ITA34 form, you do not need to take any further action. SARS will use the information on the form to calculate your tax liability and determine the amount of any tax or tax refund that may be due.

If you owe taxes, the ITA34 form will show the amount that is owed and the due date for payment. You can make the payment to SARS using one of the methods listed on the form. Make sure to pay careful attention to the account to pay (typically SARS-IT on most banking apps) and the reference to use. This ensures your payment will be correctly allocated. Remember, different tax types use different accounts.

If you are owed a tax refund, the amount will be listed on your ITA34 form. SARS will usually process the refund within a few weeks of receiving your tax return. It is important to keep a copy of your ITA34 form for your records going forward.

The ITA34 acts as a summary of the information provided by third parties and yourself on your income tax return and acts as the final notice on what is owed, or owed to you, to finalize the tax year under review. So it is an important document to understand. Hopefully, you now have all that information at your fingertips!