Debt can be crippling, washing people over with a sense of great depression, especially when it seems as if a financial hole has been placed in life and there is no way out. Many South Africans live daily with debt, encouraged by the high cost of living, loans, and credit card debt. It does take good planning and a disciplined approach to climb out of debt. Whether from credit card debt, personal loans

How to Get Out of a South African Debt

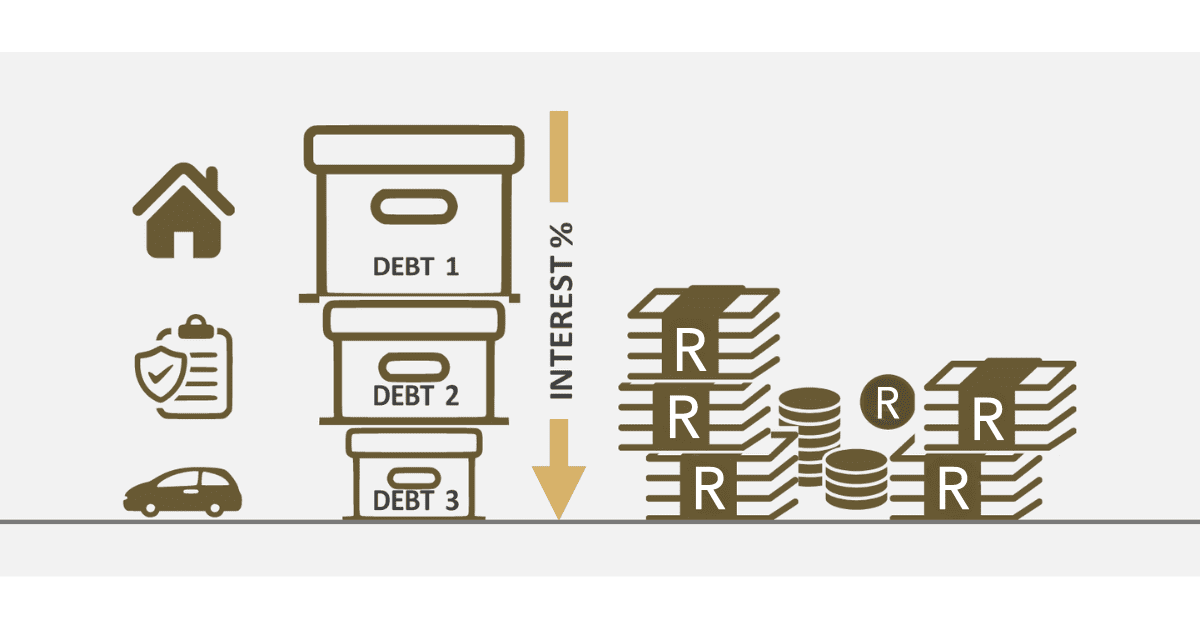

- Understand Your Arrears Situation: The first step toward getting out of that situation of credits would be understanding the entire scope of what you owe. You must gather all your arrears and write them down, including your credit card balances, personal overdrafts, store accounts, and any other cash you owe. More importantly, jot down the interest percentages, minimum settlements, and due dates associated with each advance. This will give you a better idea of which ones cost you the most and which ones must be prioritized.

- Set a working budget: This is one of the essential tools to manage one’s finances. Begin with noting all sources of income and necessary monthly costs. Carve out some portion to settle your debt from your income and reduce unnecessary expenses. Religious following of your budget ensures there’s enough money left in the month to pay your debts.

- Prioritize High-Interest Debt: Most have high interest on South African credit cards and some personal loans. You should, therefore, direct most of your efforts into eliminating these high-interest debts first. This is what some financial experts call the “avalanche method.” First, cleaning up the most expensive debts will minimize how much of your money is leaving your pockets in interest and go toward other uses over time.

- Loan consolidation: You should take that one step further and combine all your debt into a loan with lower interest and possibly a lower balance. Loan consolidation could make your payments and the debt simple. But ensure that the consolidation loan’s interest rate is less than your present debts.

- Negotiate with Creditors: If you cannot make payments, it would also help to speak with your creditors about any adjustments in payment terms with better negotiating terms. Most lenders in South Africa want to restructure plans/repayment plans or even offer temporary relief in times of breathlessness. Negotiating lower interest rates or extended payment terms can give you some breathing space.

- Debt counseling: This comes into play when you are classified under poor debt categories. According to the National Credit Act, counseling enables over-indebted South Africans to reorganize themselves with principles listed out for reducing debt and structured repayments. A debt counselor does the exercise. They reorganize your arrears so that you forward reduced monthly settlements with lower interest percentages.

What Happens if I Can’t Clear My Debt?

- Legal action: Once you default on the payments, the creditors drag you to court, which, after hearing the case, would give a judgment against you. The most extreme thing that can happen to you is wage garnishment, where your salaries are deducted by the courts of law to repay the debt. In extreme cases, asset repossession can occur to reconcile the debt.

- Blacklisting: In South Africa, failure to pay off your debt already gets you on the blacklist of credit bureaus. Your credit score goes down; afterward, it will increase your chances of not being given credit for a brighter future. Being listed, all the loan opportunities, including renting properties or opening some bank accounts, are affected as a consequence.

- Debt review: You can apply for an arrears review if you can’t settle your advances. This is a legal process in which a debt counselor evaluates your monetary situation and creates a realistic settlement plan. This is always in conjunction with the income and expenses of the debtor. You will be protected against any legal action by your creditors if you stick to your repayment plan.

- Sequestration: This signifies the legal process where the estate is declared insolvent, and the assets are used to pay off the liabilities. Against such liability, the exercise may offer relief, but in the long term, there are significant financial implications, such as the inability to get credit quickly.

What Debt Cannot Be Erased?

- Court-ordered debt: Debt due to be paid to the court, like alimony and child maintenance, are debts with an obligation that remains enforceable and would not be written off by the process of debt review or debt sequestration. This kind of debt is insistent and must be repaid; otherwise, it can lead to serious legal repercussions.

- Tax Debt: Owning the South African Revenue Service some cash is another kind of advance that cannot be erased just like that. SARS has wide-ranging powers to recover uncleared taxes. These include the garnishing of wages, the freezing of bank accounts, and the seizing of assets.

- Student Loans: Many times, a troubled student advance burden cannot be discharged under review or when declared insolvent. This is typically because such student loans are granted by government institutions, or at the very least, financial institutions have government guarantees.

- Secured Debt: In the event of secured debt concerning a home loan or vehicle finance, the same won’t get wiped out unless there is recovery through repossession and sale of such an asset to realize the outstanding amount. You might still owe the balance if the asset’s sale does not fully discharge the loan amount.

Is It True That After 7 Years, Your Credit Is Clear?

Most of us believe that if you can survive seven years, all information regarding debt goes off your credit report. Well, in South Africa, this is only half true. This is how it works: The National Credit Act (NCA) provides that such adverse information, a good example being missed payments or defaults, may form part of the credit record for the maximum period of not exceeding five years.

If not paid, judgments lapse from a credit report only after 30 years when a court issued them concerning ‘bad debt.’ If you settle a judgment or finish debt counseling, you can request that the blacklisting be removed from your credit record. However, the seven-year rule does not apply to all kinds of debt, especially court judgments, which remain enforceable for much longer.