The moment you enter the market for financing, your credit score will become critically important. We talk a lot about the impacts and struggles of bad credit. People with no credit scores at all often get missed from the conversation. Not today! We are here to help you better understand what financial options are open to you if you have no credit score at all. Let’s get started!

How to Get Financing Without a Credit Score

If you have no credit score, rather than a bad one, you will look like a slightly better risk to lenders. You are an unknown risk, whereas Mr Bad Credit is a proven poor risk. You haven’t done anything ‘wrong’ with credit, you’ve done nothing at all. However, you will face many of the same struggles to get financing, as that still makes you a riskier prospect than someone with a good credit score.

So how do you get financing without a credit score? Alternative lenders will be your best first choice. Online lenders are a good place to start. Peer-to-peer lending platforms are rare in South Africa, but there may be one in your area. Lastly, microfinance institutions may consider factors beyond just your credit history, such as your income, employment status, and financial behavior. Research reputable alternative lenders in South Africa and inquire about their eligibility requirements for financing without a credit score.

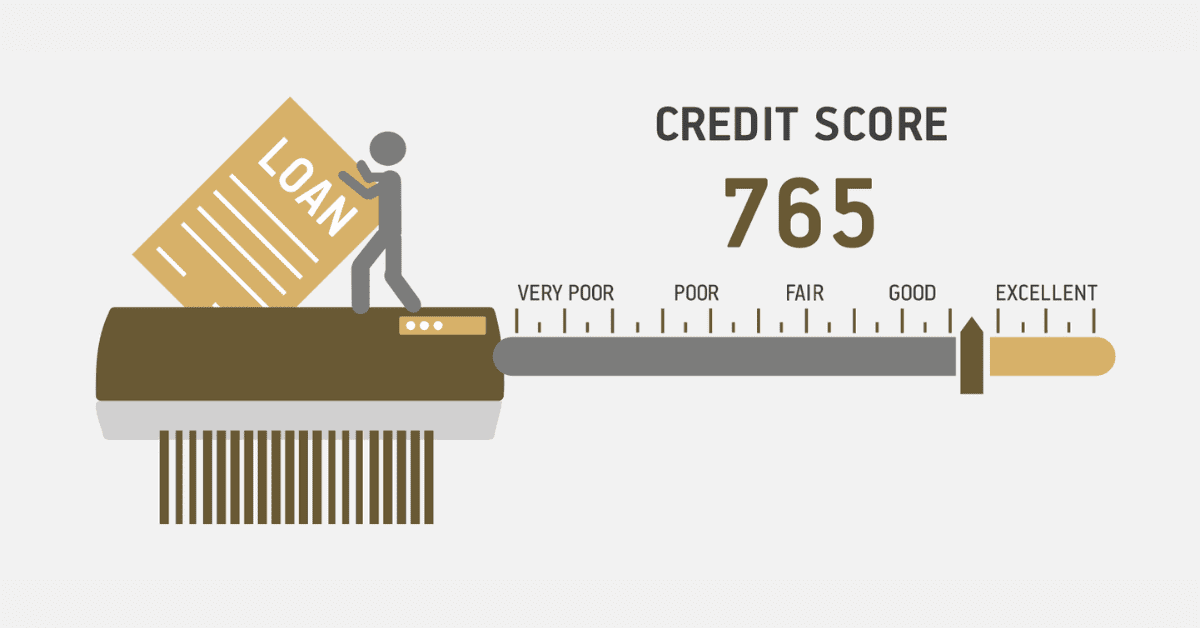

In the long term, however, you want to work on building your credit score. It is the best (and safest) way to get fair access to a variety of financing options. Start by taking out a small line of official credit from a lender- even a store account or cellular contract helps- and build on that with careful management and good use. Over time, your credit score will grow, and with it your options.

Which Loan Company is Easiest to Get?

In South Africa, most regulated and registered lenders use similar credit criteria. However, some are a little more willing to use other factors or have slightly less stringent criteria than others. In the short-term cash loan market, Konga, Hoopla, and Wonga are the best known. Payday loans can be a problematic type of loan, however, due to super-high interest rates and the short repayment cycle.

If you can approach a traditional lender, Absa, Nedbank, and African Bank are slightly less demanding than others.

Which Type of Loan Does Not Require a Credit Check?

Almost no safe, legitimate loans are offered without a credit check. It’s frustrating, but part of the South African regulatory landscape. Some payday loan companies will not check credit. The same goes for some finance institutions that focus on so-called ‘blacklisted’ or ‘bad credit’ lending. Make certain, however, that these are trusted organizations and not fly-by-night scammers.

Also, remember that no credit check doesn’t mean free money for anyone! The lender will simply consider criteria beyond just your credit history. Like your employment status, income, or prior financial activity on their platform. So there will still be checks and balances. The results don’t hinge only on your credit score, however.

How Long Does Bad Credit Stay On Your Name in South Africa?

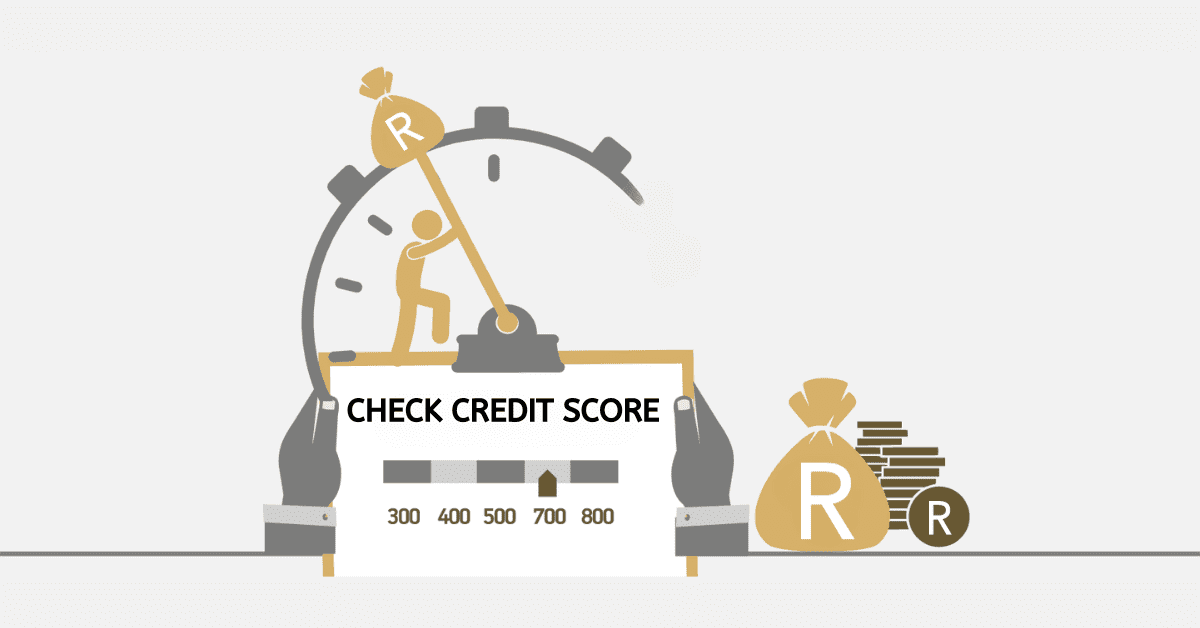

Different credit factors have stronger or weaker effects on your credit score. Judgments, bankruptcies, and court orders keep hurting your credit score for up to 5 years. Payment history rotates regularly every 30 days but shows a 12-month average. Credit utilization levels only stay for 30 days. Hard inquiries and opening new credit lines will have a short-term effect. Most other aspects will be on your report for 1 year.

While an overall bad credit score is daunting, you might feel better knowing it isn’t one cohesive thing. Your credit score is built from the sum of everything you do with credit- both good and bad. This makes it easier than you may think to move the needle of your credit score tank out of the red and into the black! That missed payment from last January will drop off your report and give you a little boost when you reach February. Even if the default from last April is still influencing your report. Start replacing the bad credit factors with good ones, no matter how slowly, and you will gradually rehabilitate your credit score.

How Do I Know If I Am Blacklisted in South Africa?

Here’s a fun fact: We know you aren’t blacklisted. Nope, no matter how poor your credit score is! We don’t have a crystal ball, either. Blacklisting doesn’t exist. ‘Blacklisting’ is an out-of-date term that refers to the days when credit bureaus only tracked negative credit data. Today, they track both negative and positive data. So take a deep breath! There is no secret behind-the-scenes list preventing you from ever getting financing again. The term is still used colloquially for super-bad credit, but it isn’t an actual thing to worry about. Just a handy description.

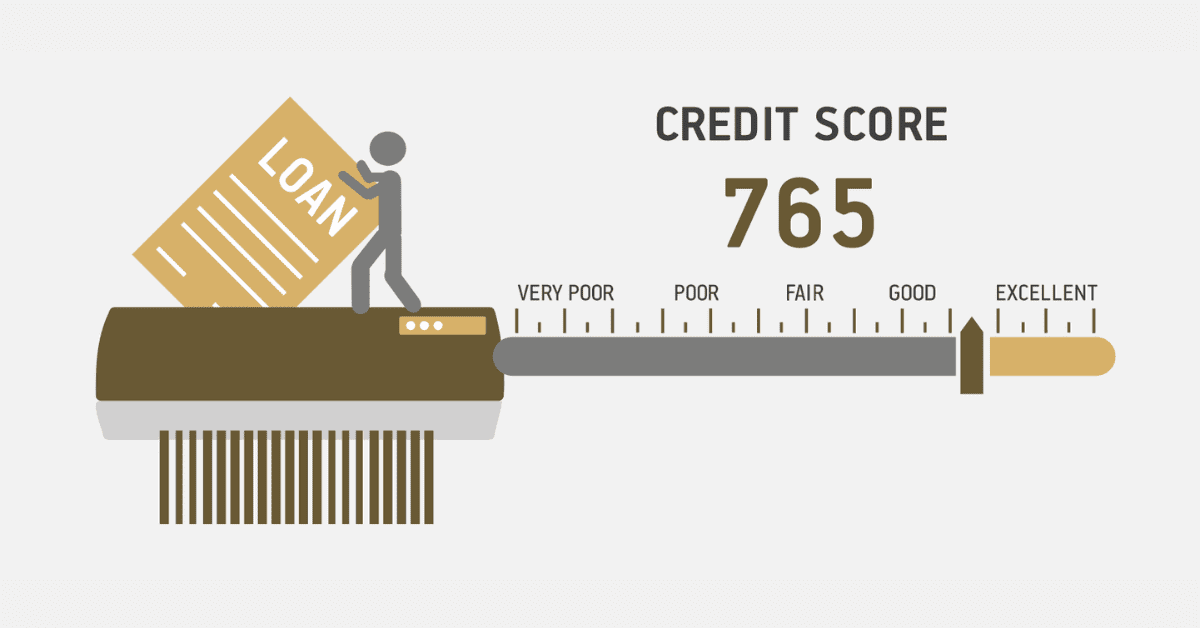

If you have a really bad credit score, though, it will still greatly impact your ability to access credit. If it is bad enough, no legitimate lender will offer you credit. However, credit scores are not permanent, and you can rehabilitate yours by addressing outstanding debt, paying it off or making a payment plan, and then practicing good credit habits. Pay on time, keep debt utilization under half of the available balance, and generally use credit smartly. With time, you can recover your credit score and get a fresh start.

Accessing financing with no credit score isn’t a walk in the park. You have some options open to you, however, and you should now feel more empowered to explore them.