Experian, a global organisation leading the way in various business areas, utilises state-of-the-art technologies and creative solutions.

Although there are a lot of services with Experian, they are more focused on the credit scoring system. Experian is considered to be one of the largest credit bureaus in the world offering amazing services to its customers, stakeholders and others.

This organisation uses statistics, historical data and financial spending to determine the credibility of individuals. And this credibility is translated into credit scoring systems.

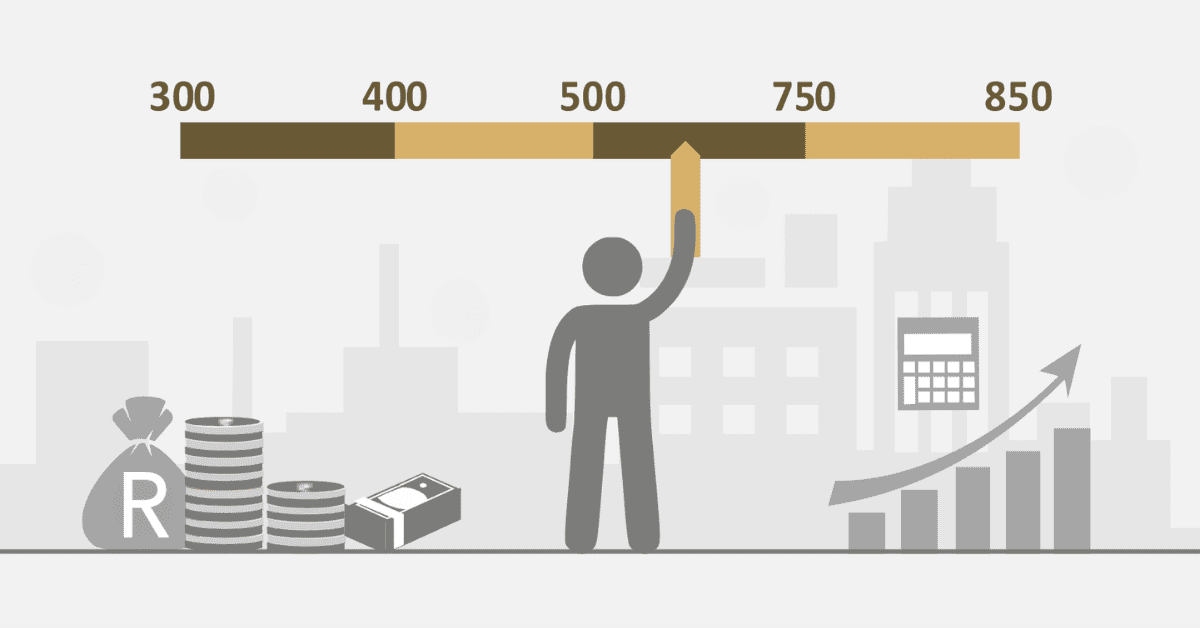

The Experian Credit Score is a numerical representation of an individual’s creditworthiness, provided by Experian, a global information services company. The score, which ranges from 300 to 850, provides lenders with valuable insights into a person’s credit history and financial behaviour, helping them evaluate the level of risk involved in granting credit.

Various factors impact the score, such as payment history, credit utilisation, length of credit history, types of credit used, and new credit accounts.

Can I see my Experian score for free?

Your credit report is a comprehensive record of all your credit and debt accounts. This information includes details about your debt amount, payment history, and credit account management duration. It also contains personally identifiable information such as your name, Social Security number, and address.

Experian offers a convenient way to access your credit score at no cost. Simply log in to your online portal and provide a valid ID to check your score for free.

With Experian you can see your credit score for free, All you need is access to your online portal; with a valid ID, you can check your score for free.

How do I get my Experian credit score for free

Experian is one of the largest credit reference agencies in the world. Given its frequent use by lenders, it tends to be quite comprehensive. You can access your Experian credit report at no cost by following these steps:

- Use this URL to the Experian credit check portal – www.mycreditcheck.co.za.

- Login into the platform.

- Navigate to your credit profile.

- View your credit score at zero cost.

Does Experian give you your real credit score?

Experian, a prominent credit bureau, collects and manages credit information for individuals. They offer credit reports and credit scores to individuals, but it’s worth mentioning that there isn’t a universally accepted “real” credit score.

Experian, along with other credit bureaus, provides various types of credit scores depending on the scoring model utilised. There are two widely used types of credit scores: FICO scores and Vantage scores.

Experian usually provides either the FICO Score or VantageScore when you request your credit score, depending on the product or service you use. It is crucial to grasp the scoring model being utilised and acknowledge that various lenders may employ different scoring models when making lending decisions.

How do I check my Experian credit score without hurting it?

Checking your Experian credit score does not affect your credit score. When there is a hard inquiry on your credit score; which is mostly done by lenders, that part of it affects your credit score.

When you check your credit score, it is classified as a soft inquiry and does not affect your credit score. There are multiple ways to access your Experian credit score without any impact on your credit.

Keep in mind that only soft inquiries will not affect your credit score. When a lender checks your credit as part of a loan application, it is considered to be a hard inquiry, and this can affect your credit score.

You can check your Experian credit score at any time and for free without having to worry about what could hurt your credit score.

What is a good Experian credit score?

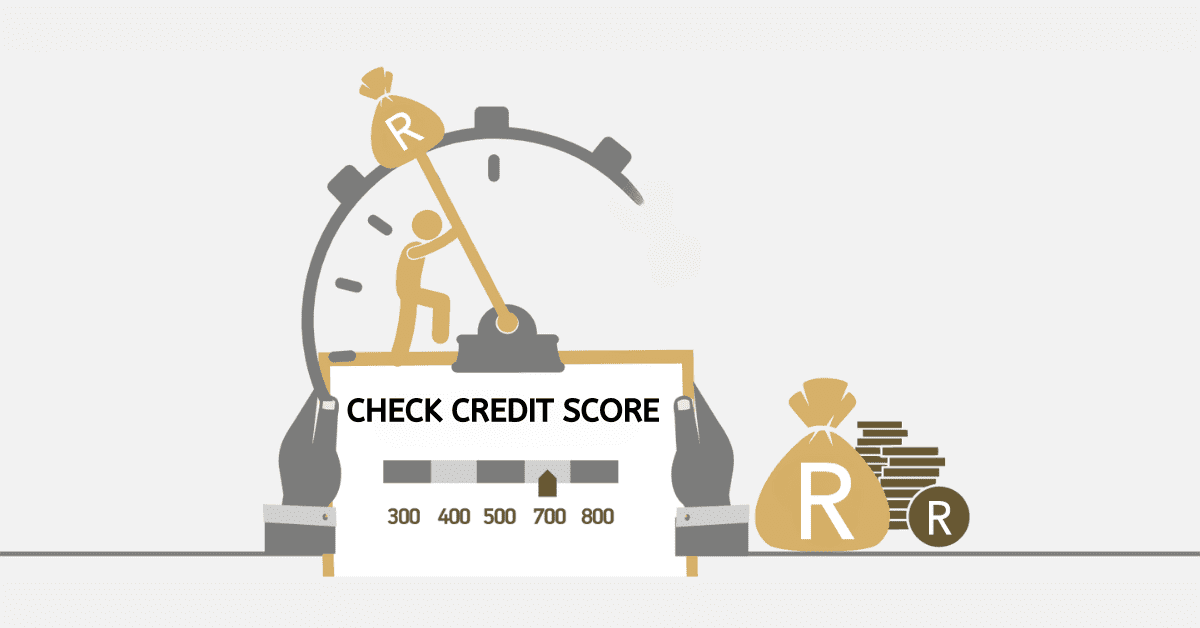

Your credit score is a three-digit number that is determined by a mathematical algorithm using the data from one of your three credit reports.

These reports are typically updated every month.

Your credit scores reflect your creditworthiness and play a crucial role in helping lenders assess the probability of you repaying debt as agreed upon.

Your credit scores can have an impact on the premiums you pay for car insurance, loans, and credit cards.

With a range between 300 and 850, a credit score of 700 or above is typically regarded as Good. An outstanding score in the same range is 800 or above.

However, considering the majority of credit score ranges, there is always a consideration to indicate a score above 650 to be a good credit score.