South African citizens who earn an income should all apply for a tax number with SARS. If you earn above the tax threshold, and are thus eligible to pay tax, you will be required to register for a tax number as a matter of course. Fortunately, this is a simple and easy process. Here’s what you should know.

How to Get a Tax Number in South Africa

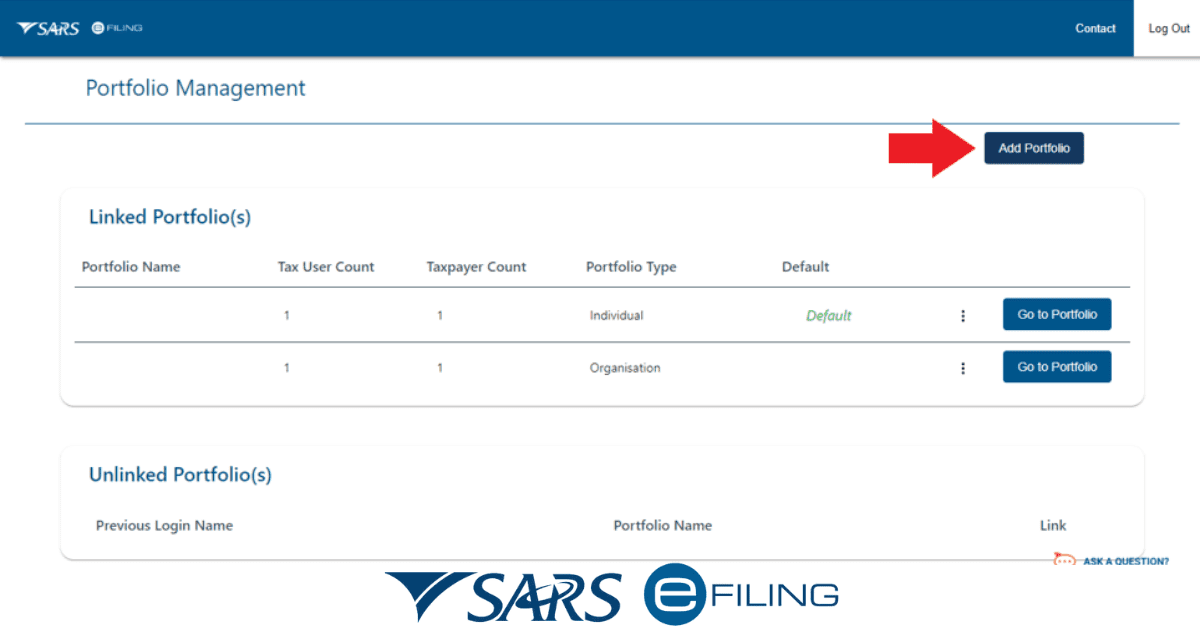

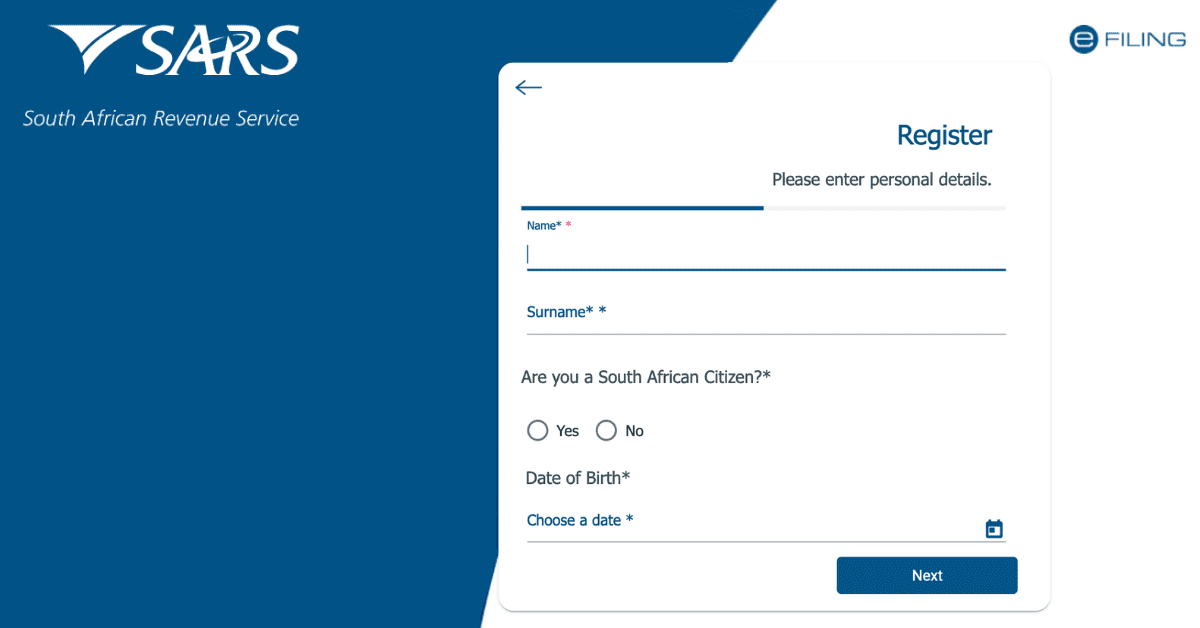

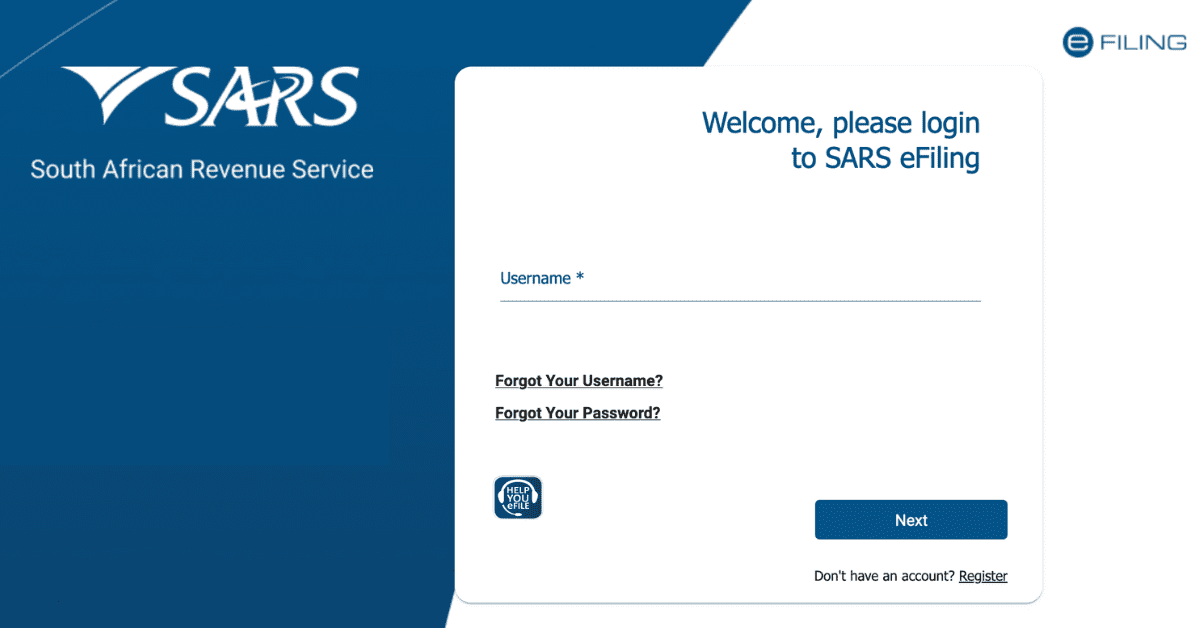

Getting a tax number in South Africa is easiest when done through the eFiling portal. As part of the sign up process, you will be asked if you have a tax number. If you do not, the system will automatically assign you one. However, if this is your first year working, be aware that companies that deduct PAYE from your monthly salary will have already gotten a tax number for you. You can ask your company for this number, or find it on your IRP5 for the year. If you are not sure if you have a tax number, you can use the online search query or phone the SARS call centre.

You can also apply for a tax number at a branch. The same supporting document copies will be needed- your ID, proof of residence, and proof of bank account.

What Documents do I Need to Get a Tax Number at SARS?

When you first register for a tax number, you will need your South African barcoded ID card, three months of bank statements, and proof of residence. Once your tax number is issued, you will use it on most of your dealings with SARS, so keep it somewhere where it is easy to reference. Your tax number will not change, even if you change employers or start to work for yourself.

Who is Eligible for Tax in South Africa?

Everyone who earns an income above the tax threshold is eligible to pay tax. For the 2025 period, this means earning more than R91,250 annually. This threshold is adjusted annually. If you are earning below the threshold, it is still a good idea to apply for a tax number, as you will be visible as an earner in South Africa, but you will not be required to pay income tax until you pass the threshold.

How Do I Get a Tax Number as a Foreigner?

Applying for a tax number as a legal foreigner in South Africa is very similar to applying as a South African citizen. If you are a naturalised foreigner who has taken citizenship, you will likely receive a barcoded ID to use. Asylum seekers can use their asylum seekers permit. If you are a foreigner who is not classed as living in South Africa for tax purposes, you will likely need to declare your South African earned income on the income tax of your country of residence.

Can I be Taxed Without a Tax Number?

SARS issues a tax number to everyone who pays tax in South Africa. However, you may not be aware that your company has applied for a tax number for you when they begin deducting PAYE from your salary. In this case, you need to determine what the tax number issued to you was. Of course, if you meet the minimum threshold for paying tax in South Africa

What is the Minimum Salary to Pay Tax in South Africa?

The minimum annual salary to pay tax in South Africa in 2022/23 is R91,250 for workers below 65 years of age. It is slightly higher (i.e you pay less tax) for people older than this. This is referred to as the tax threshold. It is updated regularly- typically annually or every two years, so it pays to keep an ear out for those announcements.

Is PAYE and Tax Number the Same?

No, PAYE numbers and tax numbers are not the same. Many people get confused by this. For salaried employees, PAYE is the amount withheld from your salary by your employer to pay directly to SARS on your behalf to cover your tax obligations. Your company will have a PAYE number that they use as a catch-all to identify them as an employer on their system, but this has nothing to do with your tax number. If you are an employer, be aware that your personal tax number, your company’s tax number, the tax number of your various employees, and the company’s overall PAYE number, are all different things you will need to track.

Is a SARS Tax Number the Same as the VAT number?

No, the SARS tax number is not the same as a VAT number. Most individuals do not pay VAT and will not have a VAT number. Companies will have a tax number to pay their annual income tax, and, if they are VAT-registered, will have an additional VAT number to pay that specific form of tax on. Do not confuse the two, or your payments will be assigned to the wrong tax type and could affect your compliance status.

Once you receive a tax number on the SARS system, your tax number will stay the same with SARS for life, except under some unusual conditions. It will not be affected by things like changing employers, or even opening your own business if you run as a partnership or sole proprietorship. The only time you will receive ‘another’ tax number to track is if you establish a PTY LTD company or similar tax entity, which will receive its own tax number in addition to your personal one- and you will still need your personal tax number, too. Luckily, the process of getting a tax number in South Africa is a pretty easy and streamlined one.