All employees or individuals who earn taxable income must pay tax to the South African Revenue Service. Taxes must be paid at certain periods, and all taxpayers must honour their obligations to avoid penalties and interests. This article explains everything you need to know about how to fill in pay periods on SARS eFiling.

What Is Pay Periods on SARS Efiling?

A pay period is when you have been employed by your employer during a particular year. A tax period has a maximum of one full year which can show in terms of days which must be 365. Pay periods also have a maximum of 52 weeks or 12 months.

The pay periods in your year of assessment can also show as a partial year reflecting the days, weeks, months, or the fraction of a year you have worked for a specific employer. In other words, the number of periods shows the number of days, weeks, months, or a fraction of the year you have worked.

If you have worked for the same employer for more than one year, your pay periods must be equal to or less than the previous periods in your assessment. No pay period must exceed one year. You should note that the tax year in South Africa starts on 1 March, not 1 January.

How to Fill In Pay Periods on SARS Efiling

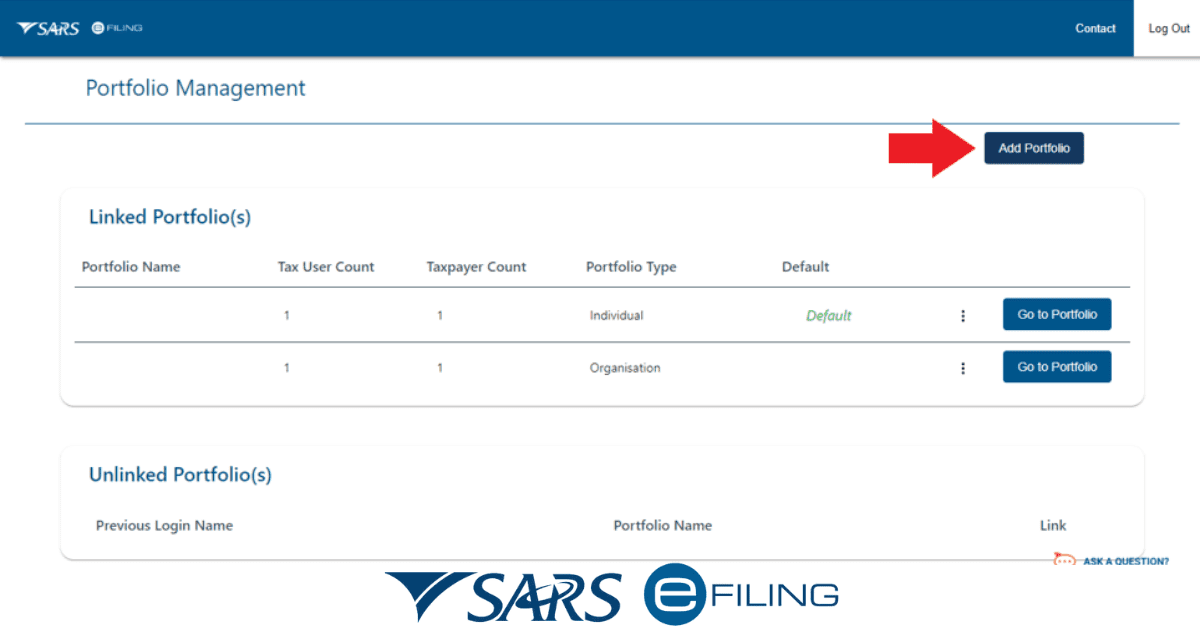

You can easily fill in pay periods for your employees on SARS eFiling. You need to first register for eFiling on its website. Once you register, you should complete the online form that allows you to create your return. On the first page, complete all the questions regarding the type of your tax affairs.

eFiling automatically tailors the tax return to suit your tax requirements. All employers must submit reconciliations that show details of each employee’s tax which include Pay-As-You-Earn (PAYE), Unemployment Insurance Fund (UIF), Skills Development Levy (SDL), or Employment Tax Incentive (ETI).

The employer deducts tax and pays it to SARS monthly. The employer must complete the EMP201, a payment declaration used to declare the total payment with other allocations. On the EMP201, a unique payment reference number (PRN) is pre-populated to help link the payment declaration with the actual payment made by the employer.

If you are an employer, you can use eFiling to submit your reconciliation and make sure you do so on the published date. If applicable, you should submit an accurate Employer Reconciliation Declaration EMP501 and tax certificate for the interim period. This period covers the first six months of the tax year from 1 March to 31 August. You also need to submit your EMP501 for the annual period, which is a full year from 1 March to 28 or 29 February.

If there are some mistakes on your EMP501, you can make corrections. However, you cannot amend the EMP201 when SARS performs the agreed estimate or an audit is in progress. Misrepresentation, false information, or non-submission of your declaration can lead to prosecution and penalties.

When you fill out your declaration, complete all the mandatory fields and ensure the information you provide is accurate. For instance, mandatory information is shown in red bolder. Once you complete the form with the taxpayer’s details, you can send it to SARS via eFiling

What Are Periods in Year of Assessment?

The periods in the year of the assessment indicate a full year (in days, weeks, or months) or show a partial year in terms of days, weeks, months, or a fraction of that tax year. Your pay periods only show the time you have worked with an employer. For example, if you worked for part of a particular tax year with the same employer, your periods will reflect a partial year below 365 days, less than 52 weeks, under 12 months, and less than one year.

The number of periods worked for the same employer for more than one year will be equal to or less than the previous figure in the year of assessment. There are no way periods in one year of assessment can exceed 365 days or one full year. A tax year starts on 1 March and ends on 28 or 29 February of the following year.

How Do You Do PAYE on Efiling?

You can follow the steps below if you want to do your PAYE on eFiling:

- Log in to eFiling

- Identify the SARS registered details feature

- Select a home to locate the SARS registered functionality on individual portfolio

- For organisations or tax practitioners, the SARS registered details functionality falls under the organisations’ tab

- Select “SARS Registered Details”, then click “Maintain SARS Registered Details.”

- The “Maintain SARS Registered Details” screen appears, and select “I Agree” so you confirm that you are authorised to use the details of the individual or company.

- Under the “My Tax Products” tab, select “Payrolls Taxes” and then “Revenue” on the left menu.

- Choose “Add New Product Registration” to register PAYE. The demographic information that will be used for PAYE will be pre-populated.

- The RAV01 form opens with the Payroll Taxes Registration container

- PAYE status

- SDL status

- UIF status

- Select a business code applicable to your business

- Select “Okay” to continue when you make your selections.

- Deactivate the tick box.

What Is a Period in Tax?

A governmental authority prescribes a tax period which refers to the period when a tax return should be filed, or the tax must be paid. SARS determines the tax year, which runs from 1 March to 28 or 29 February of the following year.

If you have taxable income and are supposed to pay tax, you must follow the tax calendar for a particular year offered by SARS. Bear in mind that a calendar year is different from a tax year. You can make your life easier by registering for eFiling since it was designed to handle all tax issues. The platform provides all the details you may want relating to your tax issues.