Let’s go grocery shopping. Maybe you need some dish soap, a few veggies- and oh yes, your credit score too! Strange as it may sound, the Shoprite Group, which owns Checkers stores, has an initiative to help more low-income South Africans better manage their credit scores. Tough as it is to say, South Africans have some of the poorest financial habits in the world, and many of us are in a bad credit

Can I Get my Credit Report at Checkers?

You can get a credit report at Checkers. If you are a regular at the store, you will already know that they offer a range of finance-related services at their Money Market counters. That’s where you will go to request your credit report, too. It can also be done at Shoprite stores.

It is important to remember that the Checkers credit report is a ‘4-in-one’ product. This means it aggregates data from all 4 of the major credit bureaus in South Africa- Experian, TransUnion, XDS, and Compuscan. So there may be small differences between the Checkers report and your score with each bureau. However, it will give you an excellent idea of where you stand with your credit score, and what you need to dispute or improve. Plus it is super convenient!

How to Download Your Credit Score via Checkers

The Checkers credit report is not a downloadable service. While Checkers is a registered financial service provider, as any institution handling finance matters in South Africa must be, it is not in a position to run the stringent verifications that would be needed through its online services. Your credit report is a private financial matter. In-store, your ID can be checked and compared. Online or via an app, this would be difficult and very open to fraud. You can be anyone on the internet, after all! They have no control over who is logging in under your profile, so don’t offer the service as it could be abused.

There is some good news, however! The Checkers in-store credit report is powered by Kudough. And Kudough does allow you to monitor your credit report online if you sign up for their (completely free) service. You will be mailed monthly reminders to log in and check your report, too. So you can still access the same data conveniently online.

Will my Bank Give Me a Copy of my Credit Report?

While South African banks are some of the biggest lenders in the country, they don’t control or generate credit reports. They just use them to make their lending decisions!

However, there is a rising trend for banks and financial institutions worldwide to partner up with bureaus and third-party credit report services to offer you regular insight into your credit score. This is often done through a widget on your banking app. Many South African banks (like Standard Bank and African Bank) are now offering a similar service. It may not be a comprehensive credit report- it is often just the overall score- but it will give you a great idea of where you stand.

What App Can I Download to Check My Credit Score for Free?

Kudough is not the only online credit report tracker there is. Mycreditscore.co.za and ClearScore are two popular alternatives. If you would prefer to access your credit score via an app (and for free), ClearScore now has a convenient app you can use. It is available on both Google Play and the Apple iStore. ClearScore has a long track record of offering this service and is a reliable and safe choice. If you currently use a different online credit score portal, check if it has its own app, too. Most services are now offering mobile alternatives.

How Do You Check if You Are Blacklisted for Credit?

There is a misconception in South Africa that there is a separate ‘blacklist’ you are put on if you have very bad credit. This is a little bit of a misunderstanding. ‘Blacklisting’ is just the financial services term for someone with a very bad credit history that no reputable lender wants to deal with. It isn’t an official status you have.

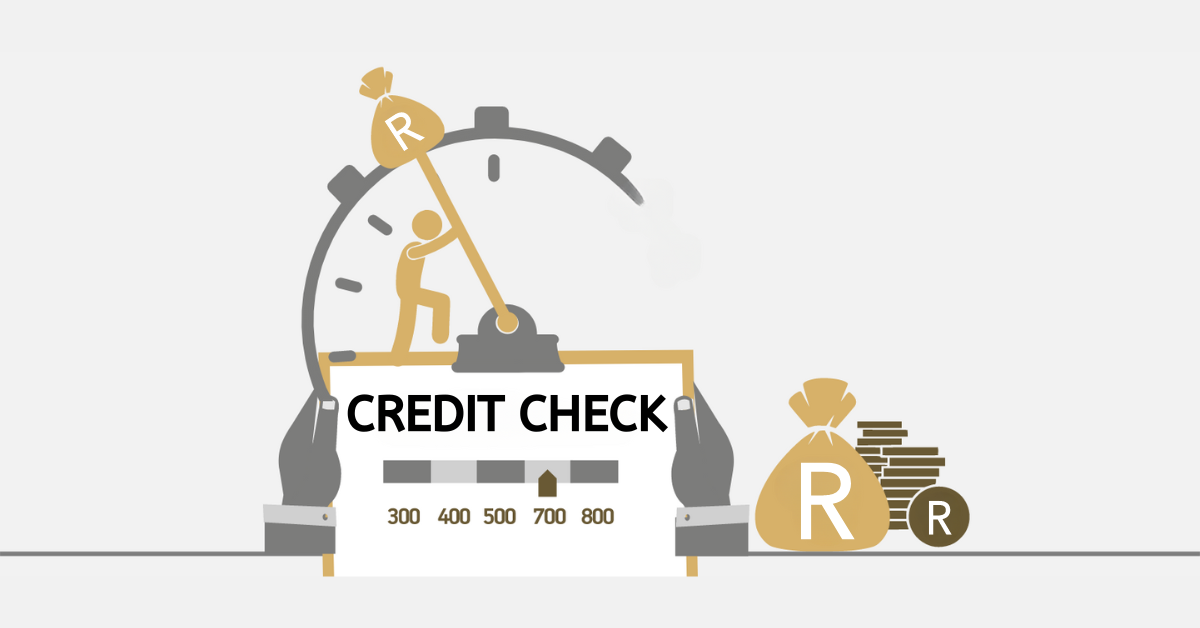

If you want to know if you have a bad credit score, the best place to start is by requesting a copy of your credit report from each of the 4 major credit bureaus. Remember, each bureau calculates its score a little differently. They sometimes have different information, too, or receive it later/earlier than other bureaus. If you think your credit is so bad as to be blacklisted, it pays to check them all. You are entitled to 1 free, full credit report per bureau for free once every 12 months, so take advantage of that.

If your credit score is below 560 points, you have bad credit and will struggle to get approved. If it is under, or close to, 300, it is particularly bad, and 300-400 or less is your ‘blacklisting’ territory (almost no reputable lender will consider you). Check the report for errors you can dispute or items that should have been removed. If all the data is true, you will need to correct the poor credit behavior, resolve your judgments, disputes, or outstanding balances, and wait patiently for your score to improve as your credit use does.

Credit scores often scare people, but they shouldn’t. With these new services, you can confidently take control of your credit history, and make a real difference in your financial life. Why not get started today?