The unemployment insurance fund deduction is one of the best policies that has ever been implemented. The systems put in place to ensure the implementation has been user-friendly and supportive.

After its implementation, there has been much improvement in the systems, which has aided many individuals in terms of financial support.

The UIF is built in a way; such that evading it will cost you more and also put your life at risk. Being part of UIF costs only 2% of your monthly gross salary, and you can enjoy great benefits when making claims.

As the population of South Africa grows, the government creates these policies to internally and externally support individuals across the working force, especially those within the private sector. All one can do to be part of is to be a full-time worker or work more than 24 hours in a month, be registered, and ensure contribution goes into UIF every month.

How to Deduct UIF From Salary

New employees or individuals yet to join the working force in the private sector may want to know how the deduction of UIF is done.

According to the labour act law, all employers must register their employees upon confirmation of employment. Individuals who are put on salaries are obliged to pay UIF every single month.

The deduction of UIF from salary applies every month, which is 2% of your total gross salary.

You do not need to be paid before you make the necessary deductions from your account. The department of labour has indicated to all employers to deduct the right percentage from their employee’s salaries. In such instances, your employer pays your UIF even before you receive your salary.

So, for example, if you are earning R8000 as your gross salary, at least 2% of that salary must go into UIF; where 1% comes from your employer and the other 1% comes from the salary of the employee.

A mathematical example is as follows

1% of R8000 is R80. This R80 represents 1% of your UIF deduction. And then, your employer must also pay an equal amount of 1%, which is R80.

At the end of the day, R80 is deducted from your gross salary, and then your employer pays the other R80 from the company’s account.

Is UIF calculated on basic salary?

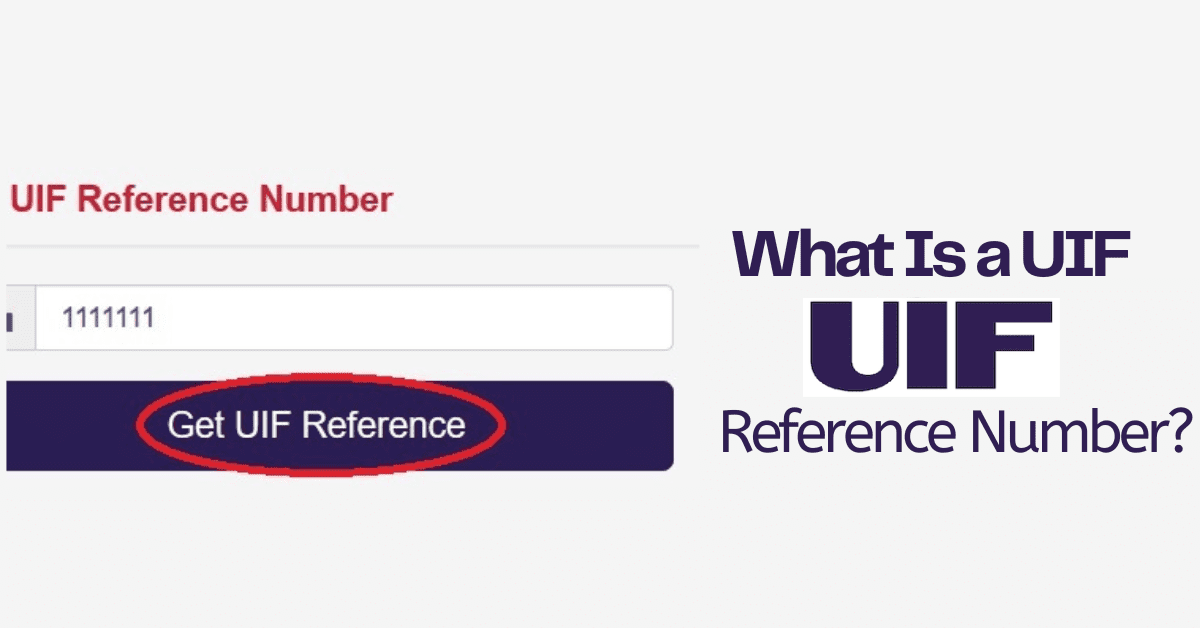

The unemployment insurance fund calculation is always done every single month. According to labour law, every employee must ensure the right contributions comes from their salary into UIF. This is the more reason why when employers register employees for UIF; they are given UIF reference numbers. The Reference number represents the data of the employees.

The calculation of UIF can be complicated when it comes to what is the expected amount and how it is done. To make it simple, the department of labour expects that at least 2% of your salary must go into UIF on behalf of the employee.

To further say, the deduction done for UIF is calculated from the basic salary. All employees have a basic salary stated in their contract, and therefore UIF is calculated on the basic salary.

For those who may be confused about the basic salary, this is the amount an employee earns before any deductions or additions is done.

How is UIF calculated for gross salary?

The UIF calculation on gross salary is done every single month. Once an employee works within the month, the amount expected to earn is the gross salary. This gross salary is the expected wage for the employee before any deductions are done.

The unemployment insurance fund states that 2% of the gross salary must be contributed to the UIF. And as such, 1% must come directly from your employer, pegging it based on the gross salary, and the other 1% is deducted from the gross salary of the employee.

Is UIF calculated on taxable income?

Before we look at the calculation done on the taxable income, let us look at what the taxable income actually means.

Taxable income is the amount that is subjected to tax before payment. In another context, taxable income is the amount one earns for a job or service done, which is used to calculate the amount of tax owed.

In layman’s terms, any job or service done by an individual that requires payment in the form of an income must be taxed.

So then, the question comes; is my gross salary a taxable income? Yes, your gross salary is a taxable income, as explained in a different context.

In this case, UIF is calculated on that amount before any deduction is done.

Any income that comes from your employer as taxable income may include personal salary, bonuses, commissions, capital gains, etc. Not to confuse you, the requirements for the UIF calculations on taxable income also factor into consideration the work duration. Once you earn a basic salary and work more than 24 hours in a month, UIF will be calculated on your taxable income. Also, Individuals who are put on a commission basis income are not obliged to contribute to UIF.

How is monthly UIF calculated

The monthly contribution for UIF is compulsory, and this must not be evaded. The unemployment insurance fund is designed to support employees who may be unemployed for being sick, on maternity, retrenched, or for a reason that is confirmed by UIF to qualify you for the claims.

The monthly UIF calculation is done on the gross salary of every employee. The employer must ensure the UIF calculation is correct and matches up to that 2% of the employee’s salary.

For instance, if you are paying a worker for a job done at a gross salary of R1000, 1%, which is R10, must be set aside from that gross salary. The employer will also add an additional R10 to the first deduction to sum up to R20. Together making, R20 is paid to UIF on behalf of the employer.