If you receive foreign income from employment, dividends, rental income, interest, or royalties, you should know that it is taxable in South Africa. If you are not eligible for foreign tax exemptions available, you should pay tax on the foreign dividends you receive and declare them when you submit your South African tax return. There are different things you should know about foreign income declaration to SARS. Read on to learn how you declare foreign income from the SARS tax return

How Do I Declare Foreign Income on SARS Tax Return?

All foreign income is taxable, and you should file a tax return if you are a tax resident in South Africa. The tax system in South Africa is residence-based, so SARS is entitled to tax you if you receive taxable income regardless of its source. All tax residents who earn a foreign income of more than R1.25 million per year are eligible to pay tax.

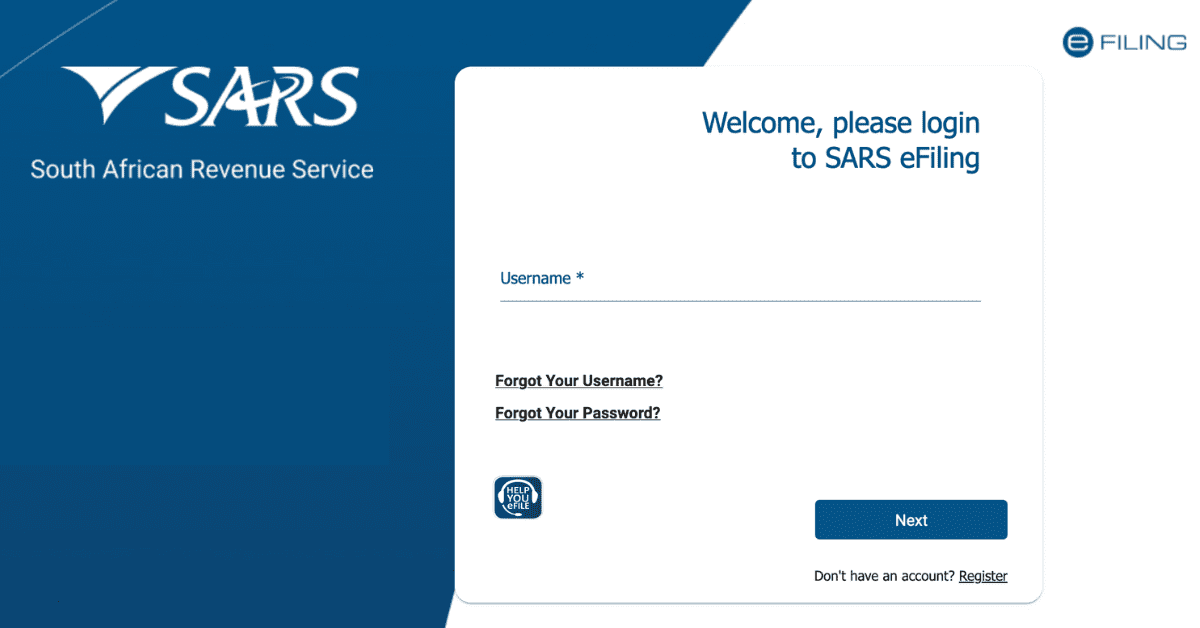

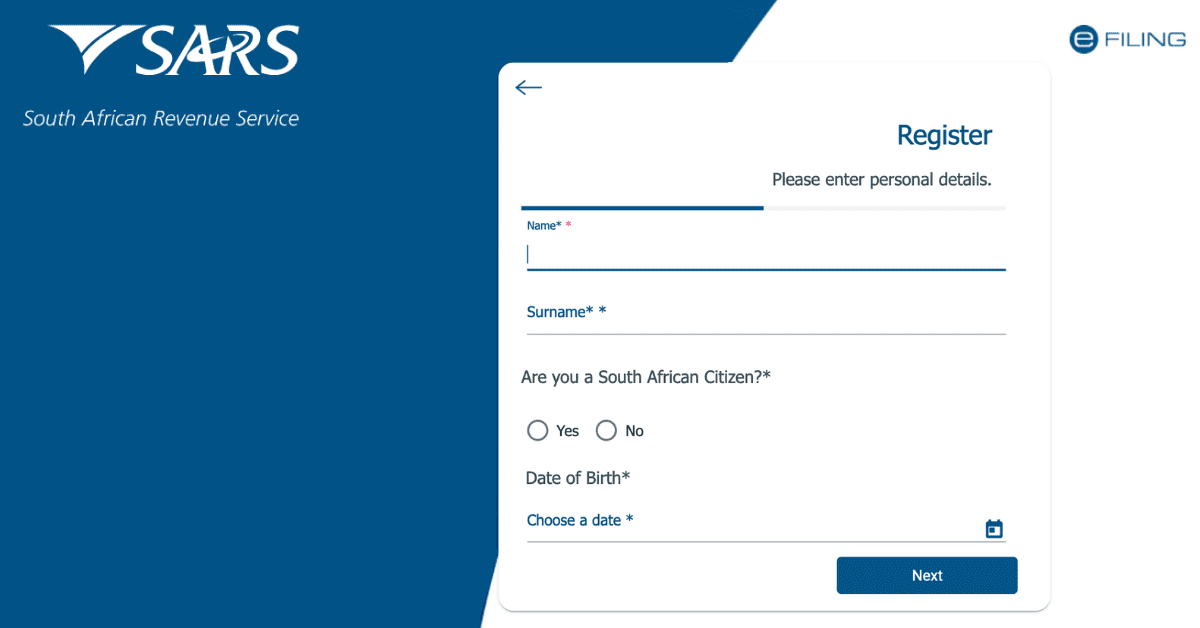

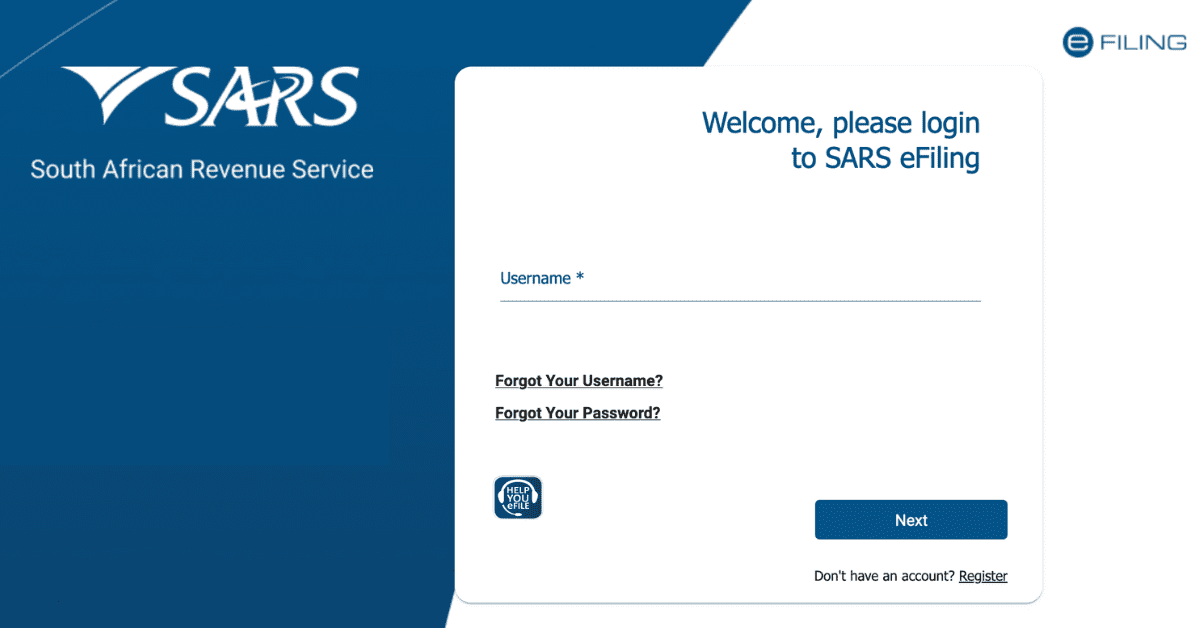

For each year of assessment, the normal tax tables will be applied. Therefore, you must register as a taxpayer with SARS first to be able to declare your foreign income for the SARS tax return. You can register as a taxpayer via the eFiling platform or visit your nearest SARS branch.

You can use eFiling or go to any SARS branch to declare your foreign income for the SARS tax return. You should declare all foreign dividends with source code 4216 in the Investment Income section of the tax return. The declaration of foreign dividends goes along with foreign tax credit with source code 4112. Any foreign dividend exemption is calculated automatically.

When declaring foreign income on your tax return, you need to follow the same steps used when submitting tax returns for other taxes. You can do this online or visit your nearest SARS branch.

How Do You Enter Foreign Income on Tax Return?

The South African Revenue Service (SARS) is responsible for collecting income tax in South Africa. To enter your foreign income on your tax return, you must be a registered taxpayer with a tax reference number.

You can complete your SARS tax return online or on paper when you have an income tax number. You need to register for eFiling to be able to complete your tax return online via eFiling or SARS MobiApp. Once you are registered for eFiling, you should log into your account to complete the process. Go to “Tax Returns” and follow the prompts that appear on the screen.

When entering your foreign income on your tax return online, be sure to complete all mandatory fields. Ensure you enter the correct details in the fields to avoid delays in processing your tax return.

You can also manually enter the foreign income on the tax return at your local SARS branch. Remember to book an appointment before visiting your branch, where you will be given a form to complete. Use a pen to fill out the form and avoid mistakes. Be sure you enter the correct information and keep your documents secure for about five years.

The good thing about completing your foreign income on your tax return at your branch is that you can ask for assistance to ensure you do the right thing first. If you make errors or alterations to the form, your tax return will be delayed.

How Do I Fill Out a Foreign Tax Credit?

Foreign tax credit comes in the form of rebates and is allowed on taxes paid on foreign income. Rebate refers to a deduction made from the amount to be paid. In South Africa, a rebate is a mechanism used to reduce double taxation. The aggregate tax credit allowed should not be more than the total tax payable.

All the foreign tax payable should be converted to the South African Rand using the average rate of the tax year on the last day of the tax year. The prevailing forex exchange rate determines the tax you should pay.

To fill out your foreign tax credit, you must be registered for SARS and have a tax reference number. You should declare your foreign tax credit in the Investment Income section of your tax return under source code 4122.

You need to complete the return for foreign tax credit accurately, and you can do it online or visit your nearest SARS branch. When manually filling out the foreign tax credit form, use a blue or black pen. Maintain your writing within the spaces provided, and do not make any marks in the boxes that are not applicable.

When you make a mistake, never use correcting fluid or erase something. Complete all mandatory fields to avoid delays in the processing of your return. These fields include your name, surname, address, tax reference number, year of assessment, and signature. If your form is incomplete, it will be sent back to you, which can lead to late submission. Late submissions can attract penalties.

Where Is Foreign Source Income Reported?

The South African Revenue Service (SARS) is responsible for administering a wide range of taxes. If you earn taxable foreign income, you should report the source of income to SARS for tax purposes. For instance, you should report the Rand equivalent of your foreign income to SARS.

When you declare foreign interest to SARS, you should use source code 4218 under the Investment Income section of the tax return. You can report your foreign income online via eFiling. Alternatively, you can visit your local SARS branch for more information.

If you earn foreign income which exceeds R1.2 million per year, you should know that it is taxable. To comply with the South African tax law, you should be registered for SARS via eFiling to declare your foreign income for the SARS return. When completing your foreign tax credit return, ensure you provide accurate details and avoid mistakes.