Dividends Tax is charged on dividends forwarded by South African businesses to their shareholders. This tariff is withheld by the business that clears the dividend and forwarded over to the South African Revenue Service (SARS). The dividend tax rate is 20% unless a reduced rate or exemption applies.

To declare and pay dividend tax, a company must submit two forms to SARS: the DTR01 and the DTR02. The DTR01 is a declaration of the dividend and the beneficial owners of the dividend, while the DTR02 is a pre-populated return that shows the tax payable and any adjustments. The DTR01 and DTR02 must be submitted within 21 days after the dividend is paid.

This article will explain how to complete the DTR02 form using the eFiling system. We will further offer some background info on the DTR01 record and the difference between the DTR01 and the DTR02.

How to complete DTR02?

The DTR02 is a form containing all the information submitted via the DTR01. The DTR02 must be requested, reviewed, and filed by the company that paid the dividend. The DTR02 also shows the tax payable, any adjustments, and the payment details.

To complete the DTR02, follow these steps:

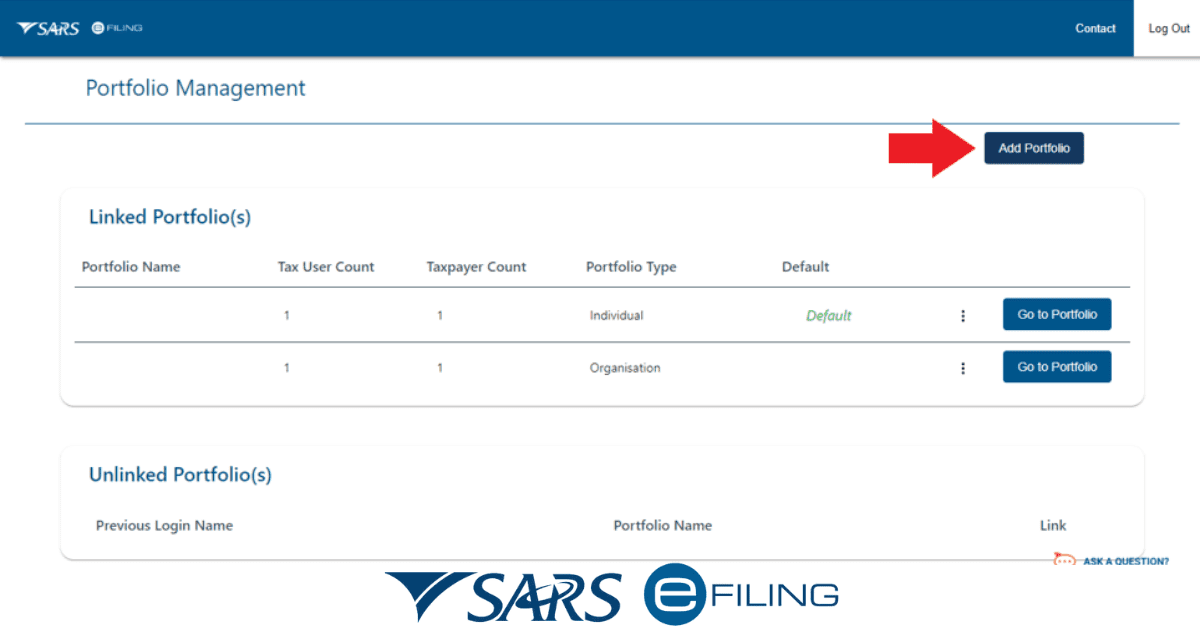

- Log in to the eFiling system and select the ‘Dividends Tax’ option under ‘Returns’.

- Click ‘Submit New Return’ and select the tax period from the drop-down list.

- The DTR02 will be created and pre-filled with the info from the DTR01. Make sure that all the info is precise and complete.

- Check the input section, showing the dividends declared and received. Verify the dividend amount, the dividend type, the beneficial owner type, and the tax rate or exemption code for each dividend.

- Check the output section, where the cash dividends distributed are shown. Verify the dividend amount, type, and the tax withheld for each dividend.

- Check the tax payable section, where the total tax withheld for the tax period is shown. This is the amount that must be paid to SARS.

- Check the adjustments section – it shows any refunds or corrections from previous tax periods. These figures will be cut from or added to the tariff payable.

- Complete the proclamation and notes page, where you certify that the info is real and precise. You can also add any comments or explanations for the return.

- Press on ‘File’ to forward the tariff return to SARS. You will receive a confirmation message and a reference number for the return.

- Click on ‘Payment’ to view the payment advice and the payment reference number. You can clear the tariff online using the eFiling software or utilize the payment reference digits at your bank. The payment must be cleared within 21 days after the dividend is discharged.

What is a DTR02 form?

A DTR02 form is for declaring and paying Dividends Tax to SARS. The form has the information from the DTR01 form, which tells the dividend and the owners of the dividend.

It has these sections:

- Input: The dividends declared and received, with amount, type, owner, and tax or exemption for each.

- Output: The cash dividends paid, with amount, type, and tax for each.

- Tax payable: The total tax for the tariff period to be paid to SARS.

- Adjustments: Any refunds or changes from previous periods to change the tax payable.

- Declaration and notes: The company says the information is true and can add comments.

- Payment: The payment advice and number to pay the tax to SARS.

The company that paid the dividend must get, check, and send the DTR02 form to SARS in 21 days. Remember, the DTR02 form can be done online with eFiling.

What is DTR01 and DTR02?

DTR01 and DTR02 are forms for Dividends Tax to SARS. Dividends Tax is on dividends from South African companies to shareholders. In addition, the company that pays the dividend keeps the tax and pays SARS.

The DTR01 tells the dividend and the owners of the dividend. The company that pays the dividend fills and sends the DTR01 before the dividend. This DTR01 needs:

- The company details, like name, tax number, and contacts.

- The dividend details, like amount, type, payment date, and declaration date.

- Owner details include name, tax number, owner type, and tax or exemption. The owner is who owns, controls, or benefits from the dividend.

The DTR02 is for declaring and paying Dividends Tax to SARS. It has the information from the DTR01. A company that pays dividends receives, evaluates, and sends the DTR02 in 21 days. This DTR02 shows the tax, adjustments, and payment.

Note that the DTR01 and DTR02 can be done and sent online with eFiling. Or, the forms can be done and sent to a SARS branch.

How do I submit a DTR01?

To send a DTR01, do these:

- Log in to eFiling and choose ‘Dividends Tax’ under ‘Returns’.

- Click ‘Submit New Declaration’ and pick the tax period.

- Fill in the company details, like name, tax number, and contacts.

- Fill in the dividend details, like amount, type, payment date, and declaration date.

- Fill in the owner details, like name, tax number, owner type, and tax or exemption. Click ‘Add Beneficial Owner’ for more owners.

- Click ‘Save’ to save the declaration. You can change or delete it before sending it.

- Click ‘Submit’ to send the declaration to SARS. You will receive a confirmation and reference digits.

You can also send a DTR01 at a SARS branch by filling the DTR01 and giving it to a SARS official. You will need your identity and the documents for the dividend and the owners.