The unemployment insurance fund (UIF) is a government-sanctioned insurance policy for all employed persons who are residents of South Africa.

The UIF gives employees short-term relief if they become unemployed or cannot work because of maternity, adoption, parental leave, or illness.

The insurance fund is governed by two sets of criteria that are set out within the legislature of the country.

These include the Unemployment Insurance Act, 2001 (the UI Act), and the Unemployment Insurance Contributions Act, 2002 (the UIC Act).

These Acts provide for the benefits to which contributors are allowed and the imposition and collection of contributions to the UIF.

Both acts came into effect on the 1st of April 2002, and cover the entirety of South Africa’s workforce with the exception of high-level government officials such as the President or members of a municipal council, amongst others.

Today’s article shall guide readers on how to claim with the UIF online in a step-by-step guide.

How to claim UIF online step by step

Claiming with the UIF online is a relatively easy process, one that was accelerated by the COVID-19 pandemic and the move to digital platforms it spurred in both the public and private sectors.

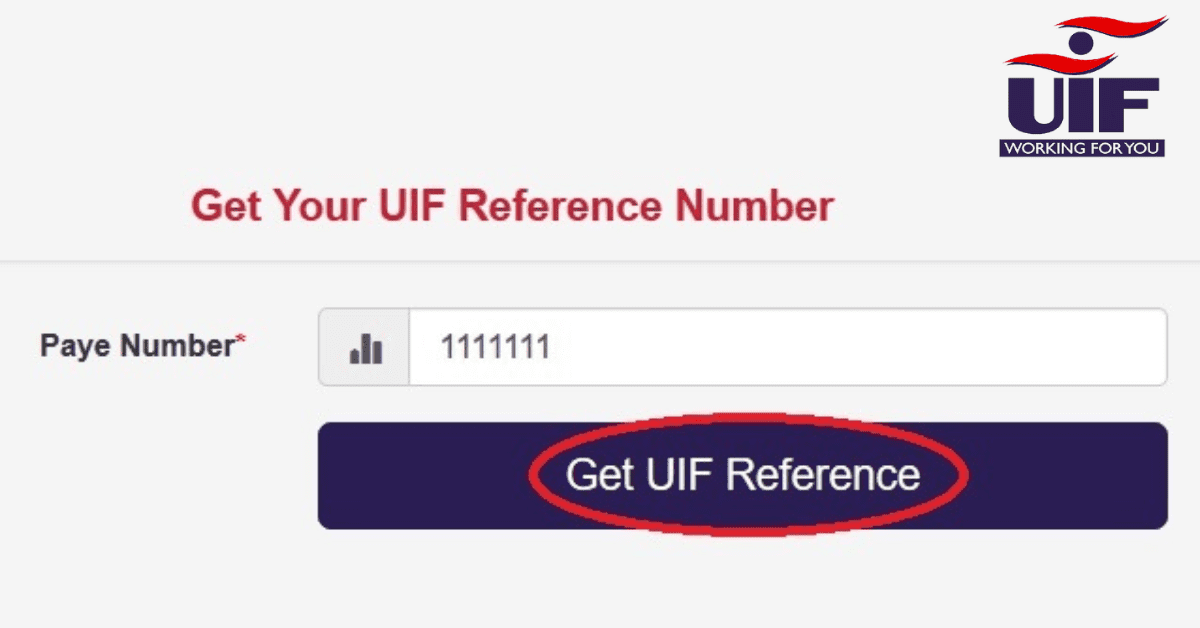

To successfully lodge a claim with the UIF and claim your benefits, you must first be registered on the UIF’s online portal.

Log in and register at the following website in order to be eligible to use the UIFs uFilling services online: www.ufiling.co.za.

Once you have accessed the website, be sure to click on the “Register” option in the top right corner in order to review the online portal’s terms and conditions.

Proceed to complete all the required steps, which will initiate the UIFs verification process.

You will then receive an activation message via a chosen contact method.

Then you can click on the link provided in the message to activate your account.

Use the username and temporary password provided in the email or SMS to access your new Ufilling account.

The UIF online portal will then proceed to prompt you to change your password.

This will initiate the online systems vetting process, which involves confirming your demographic information about yourself, which will then be compared to the UIFs already in the existing database.

Once you have passed the vetting process, you will be directed to a page where you can update your personal information before proceeding to the uFilling website.

Once you have completed the necessary steps to register an account on the UIFs online portal, click on “Benefit Application and Payments” and then proceed to click on “Apply for Benefits.”

Accept the terms and conditions to proceed, then click on the “Next” option.

Verify your banking details and click on “Next” to proceed. It is important to note that banking details may only be captured once on the uFilling system.

Should the need to update your banking details arise, you can download a U12.8 form from the Department of Labour website at www.labour.gov.za.

Confirm or update your personal details, including physical and postal addresses and click on next.

Go on to complete the information related to your occupation and qualification and click on next.

Update your work seeker information and click on the submit button when you are done to send your application to the UIF.

You will then receive a confirmation message informing you that your application was successful.

What documents do I need to claim UIF?

To successfully apply for your UIF in the event that you lose your job within the eligibility criteria of the scheme, you will need the following documents:

A copy of your South African 13-digit bar-coded identity document, accompanied by a UI-2.8 for banking details.

A UI-19 form serves as proof of the fact that you are no longer working for your employer and proof of registration as a work seeker.

How do I submit my UI-19 form online?

The UI-19 form serves as one of the most important forms of documentation in an employee’s journey to remuneration if your job is lost.

The UI-19 form serves as proof that you were registered as a work seeker and that you no longer work for your employer.

You can upload your UI-19 form alongside the other important documents to the online uFilling portal.

You can also deliver it in-person to the nearest Labour Centre, fax them to 021 337 1636, or email them to domestics@uif.gov.za.

How do I know how much I will get from UIF?

Although a number of factors, such as employment type, can cause claim payouts to vary from person to person, the government does offer a standardized metric from which the amount of renumeration can be claimed.

Unemployment benefits are calculated from the last 6 months’ salary prior to termination, with the salary capped at a ceiling amount of R17 712 per month.

Average salary x 12÷365= daily income (Year 1)

Y1 value is used in the Income Replacement Rate (IRR) formula and the calculation of the daily benefit amount.

IRR= 29.2 + (7173.92/ (232.92+Y1)

=29.2 + (7173.92/ (232.92+582.31)

=29.2+ (7173.92/ (815.23)

=29.2+ (8.8)

=38%

Daily benefit amount (DBA) =Y1x 38%

=R582.31 x 38%

=R221.28 per day

Total benefit amount = daily benefit amount x available credit days.

How long does an online UIF claim take?

If an online claim is approved and its subsequent request for payment is complete, an assessment will be conducted upon the claims finalization, and the applicant will be advised of the outcome via SMS or email.

Should all go well in this initial period, the claimant should receive their money within eight weeks of registering a claim online.

Does UIF pay lump sum?

The UIF does give claimants the opportunity to claim their benefits as a once-off lump sum payment upon request.

In 2020, at the height of the COVID pandemic, the Minister of Employment and Labour announced via social media that the UIF had paid claimants R 15 billion in lump sum payments within a 5-week period.

Does UIF money expire?

There are no indications in the UIFs laws and bylaws that indicate successful payouts have an expiration date, as they are disbursed directly into a claimant’s bank account after one’s application was approved.

However, you must apply for UIF benefits as soon as you become unemployed or within 6 months of your employment being terminated.

Failure to do so will make any application for claims invalid after a 6 month period.

You are also obliged by law to report to the UIF in the event that you gain employment again while still being a recipient of a payout, as the contrary is deemed as fraud and leaves one subject to the applicable punishments.