Understanding credit scores is an important part of being in finance. It is a number that shows your creditworthiness and can largely determine your ability to get a loan or credit. Hard searches are also called hard inquiries and are part of calculating your credit score. In this post, we explain how to check for hard searches on your credit score, how to know who did a hard inquiry on your credit, how many are OK, and whether someone can run it without you noticing.

How To Check Hard Searches On Your Credit Score

In South Africa, hard searches do affect your credit report. This is when a lender or institution needs to decide based on lending to you. Hard searches on your credit report can be checked via platforms like ClearScore. After logging in, look for your report’s ‘Enquiries’ section. It’s where all the recent hard search details can be found.

Note that each hard search leaves a print on your report, visible to potential lenders. These marks stay on your report for 12 months, though a debt collection is visible for 2 years. If your credit report is subject to frequent hard searches in a short period, it can negatively impact your credit score, as it could indicate you’re desperate for credit or struggling with current debt.

How To Find Out Who Did A Hard Inquiry On My Credit?

As mentioned, you can determine who did that search type on your overdraft if you obtain your loan report from any of the four bureaus in South Africa. You can trace the name and date of the lender or the company who made that hard search in your credit report, the type of credit you applied for, and the amount for that reason.

If you recognize the hard search, you have permitted the lender or the firm to check your credit report and score. If you don’t recognize the hard search, this could indicate identity theft or fraud. In that case, you should immediately contact the bureau and the lender or company and dispute the inquiry. Also, take action to secure your identity and credit, such as changing your password, informing your bank, and monitoring your loan record and rating regularly.

How Many Hard Inquiries Is OK?

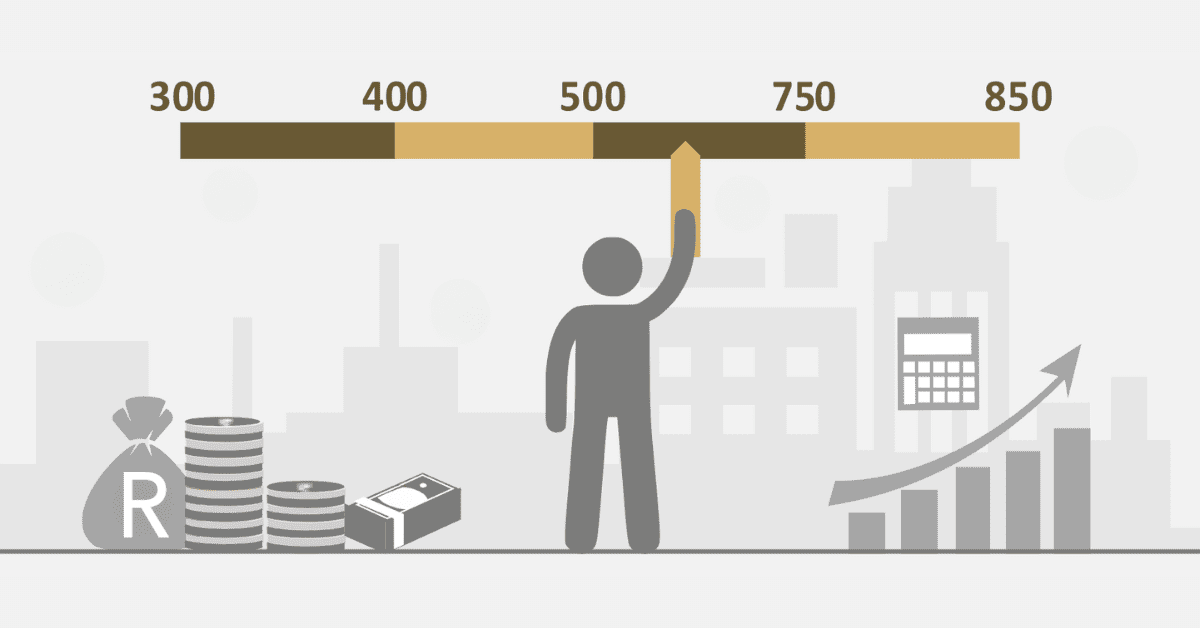

There’s no definitive number of these searches that’s okay because different lenders and companies can have different qualifications or thresholds for determining your creditworthiness. A good general rule is that these searches should not exceed two or three showing on your overdraft report within a year. This will help you avoid pulling down your loan rating and looking like a risky borrower. Of course, there may be instances where one needs to process more overdrafts, for example, when purchasing a house, buying a car, or consolidating your arrears. Then, space out your applications and shop for the best deal quickly. This will reduce the effect of multiple hard inquiries on your credit score, especially because some credit scoring models consider various inquiries for the same type of credit as a single inquiry, provided they are done within a specified period, often 14 to 45 days.

Can Another Person Run Your Credit Without You Noticing About It?

No, they can’t run your rating without your permission since they need your way forward to run the report and get the reading. According to the National Credit Act, you have a right to privacy and confidentiality of your loan information, and no one else, unless necessary and/or legally required, may access your overdraft statement and readings without your consent.

So, where you are to apply for credit or any other service where a credit check is run, ensure that you have gone through the terms and conditions and understood the same before agreeing. You should also check your credit report and score periodically and watch out for hard searches you do not recognize. If there is any unauthorized or fraudulent hard searching on your credit report, inform the credit bureau, lender, or company and dispute immediately.

Conclusion

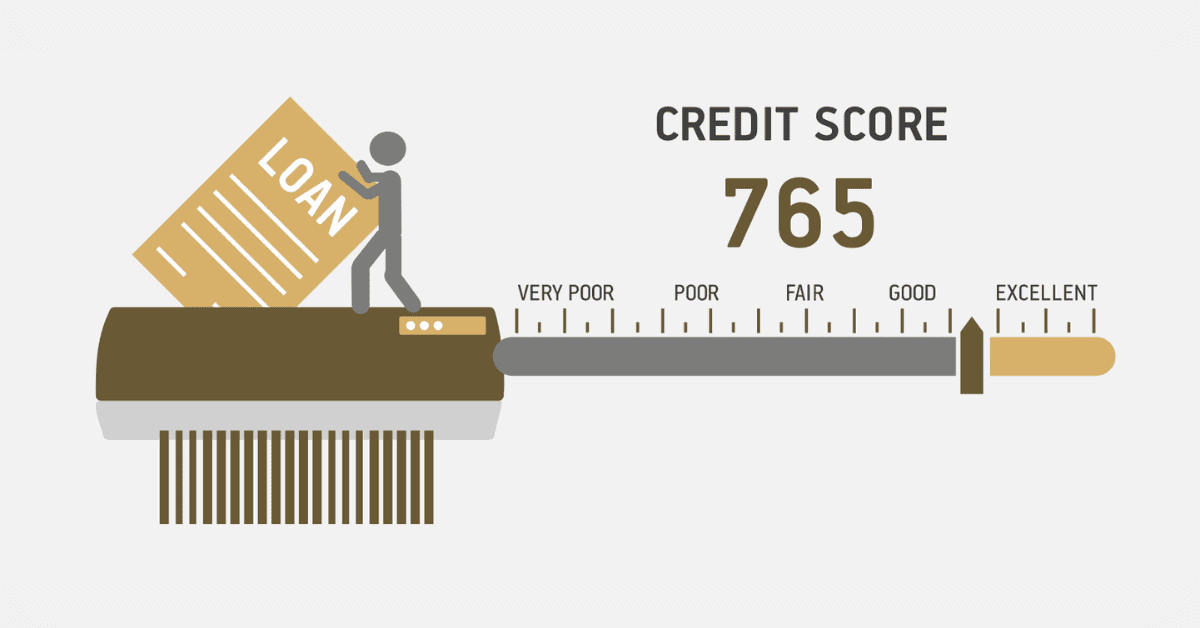

With the help of a reliable and secure platform, it becomes easy to keep an eye on hard searches on one’s credit score. Such a platform offers accurate and free access to credit reports and scores. Regular checks put you in control of your credit activity – you get to identify errors and notice fraud at its first stage. This way, you can act immediately while raising your credit score. A good credit score opens up paths of financial opportunity, which may show up in various ways of lending, credit cards, or good terms on mortgages. So, get into the habit of looking out for the hard searches on your credit score and reward yourself with a healthy credit profile.