A credit score is a representation of how creditworthy one is when it comes to issues of remitting debts. It could affect the kind of loan or credit card one is eligible to apply for, among other financial products. In South Africa, checking one’s credit score is easy and convenient in various ways, but one of the easiest and most handy ways is using the FNB app. FNB is among the leading banks in the country, and in that regard, the site provides a credit status tool that one can use to view their credit score, what credit products they qualify for, and even tips on improving their credit

How To Check Credit Scores Via FNB App

Below are the steps to follow:

- Log in to the FNB app on that smartphone or tablet

- On the top left of your screen, tap on the hamburger menu icon

- Scroll down and tap on “nav>>igate life”

- Tap on the “Money” tab

- Tap on the “Credit status” tab

- In case it’s your first time, you might need to accept the terms and conditions to go on.

- Now, you will see your credit status, credit score, products you can get on credit, and how to improve your credit health.

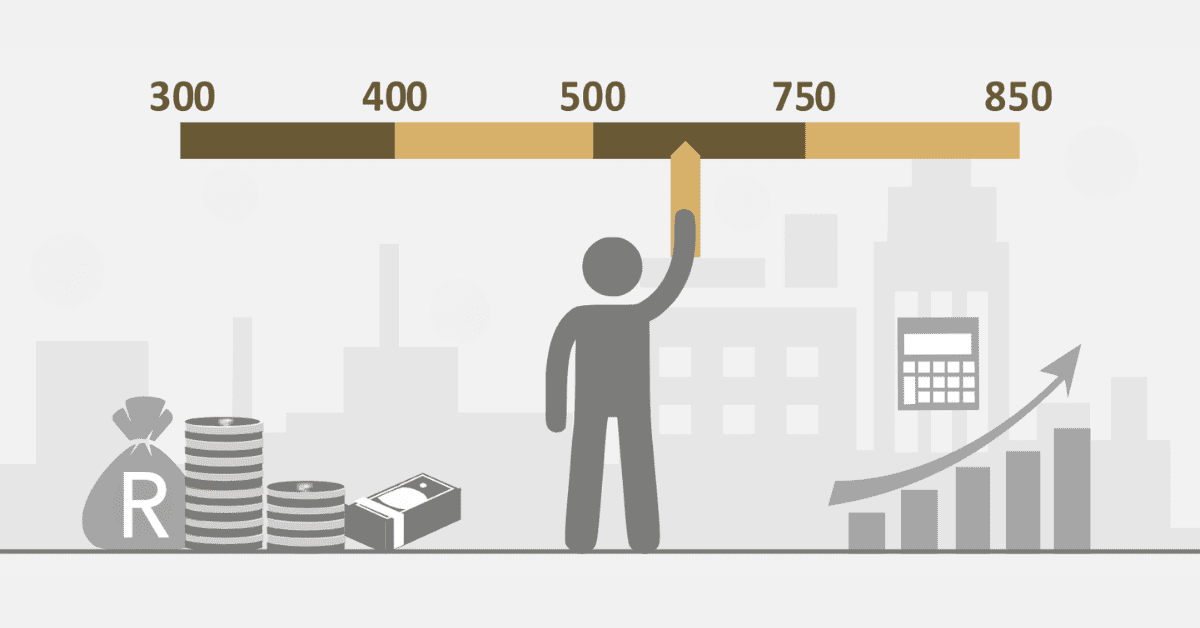

You’ll see a line spanned from red to green, showing at a glance how good or bad the credit score is. There’s also a blue marker on the line, indicating the current score. The higher the score, the easier to get approved for credit products with a lower interest rate.

In turn, your credit score is based on the last 2 years of your financial data from credit bureaus within South Africa and any other financial data that FNB can obtain. Updating your credit score is free once a month on the FNB app.

You may also click the “What credit do I qualify for” button to view different credit options and the likely success rate of getting approved for the selected credit product.

This can help you plan your finances and avoid applying for credit you might not get. Another reason to tap the section “How do I improve my credit status” is to get tips and advice on improving your score and keeping good credit records.

Some of these elements are the history of your payments, credit utilization, credit mix, and credit-related inquiries. With the FNB app, simply one easy check leaves you informed about your credit health and ahead of making those informed financial decisions.

How To Increase Credit Score With FNB

So, for those wishing to get their credit score up with FNB, here are a few easy steps:

- Keep monitoring your credit score using the FNB app, and make sure that the information about you is correct and updated.

- In case of any errors, dispute them with the bureaus.

- Always make payments to your creditors on time and in full, as failure in payment or late or missed payments will spoil your score and taint your history.

- The sooner you can settle your dues, the better. Make sure that you do not have a substantial utilization of what is offered to you. The amount of credit you are using, when depicted as a percentage of the credit limit, should not exceed 30%.

- Diversify your mix of credit. Holding different kinds of credit, such as installment and revolving credit, may demonstrate that you can handle different debt responsibilities.

- Avoid many applications for credit products in a short period. Every time one applies for a credit product, the lender checks one’s credit report through a hard inquiry. Many inquiries can signal that you are desperate for credit or, at the very least, a high-risk borrower.

Can I Get A Credit Report From FNB?

A credit report will reveal personal credit activity, including accounts, payments, debts, and inquiries. They help check one’s activities in credit and even spot any mistakes or fraud. A credit report is different from a credit score, which is a number quantifying your credit worth.

FNB does not issue credit reports directly to customers but has a free credit status tool on the app for displaying your credit score and other related information. However, to get the full loan statement, one must contact one of the registered overdraft bureaus in the Republic, like Experian, TransUnion, or Compuscan. One is free to request their record from the agency once a year, and one can do so online, via the telephone, or through an email request. One can also pay for other services and acquire other reports.

How Do You Know If You Qualify For A Credit Card FNB?

Here are the minimum requirements that you will need in case you want to apply for a credit card with FNB:

- Good credit score and clean record on credit history.

- Any annual income of not less than

- R84000 – Aspire Credit Card,

- R370000 – Premier Credit Card,

- R750000 – Private Clients Credit Card, or

- R1800000 – Private Wealth Credit Card.

- South African citizen or permanent resident possessing a valid ID document.

- Bank account holder with FNB or any other bank.

You can check if you qualify for a credit card FNB using the loan status tool on this bank App, at a branch, or by calling the banking contact center.