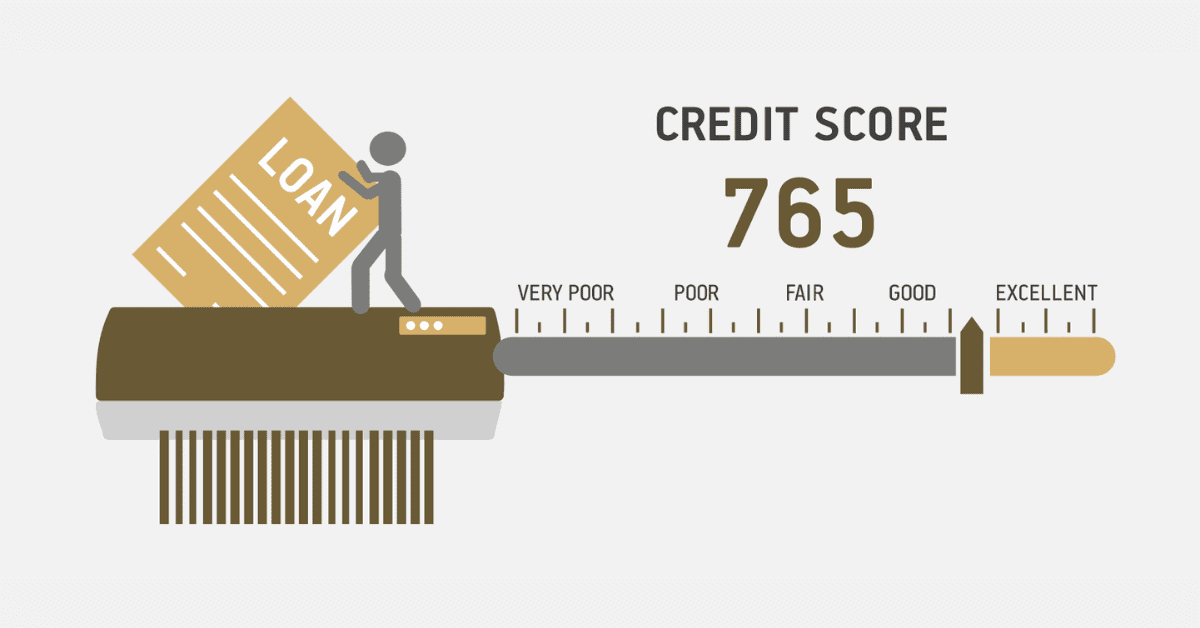

Your credit score is a number, a point set to provide the representation of your creditworthiness based on the record of your history of crediting, including your behavior in the payment of your obligations, indebtedness level, and diversity of your credit portfolio. A good score can lead to an opportunity for better interest rates, loan terms, and credit products, which will not only save money but also bring peace of mind financially. A bad loan score could limit an individual’s access to advance and, in one way or another, affect their financial future. Therefore, it’s important to check the rating from time to time and improve it if it needs to. This article discusses how to check your loan rating online in South Africa, calculate your rating, what app shows your real loan rating, and where the best place to check your rating is.

Is It OK to Check My Credit Score Online?

Yes, it is okay to check your rating online, provided that you land on a reputable and secure site where they guarantee accurate loan reports and ratings for free. Checking your loan rating online does not affect your score, as it is considered a soft inquiry. But do not share personal or financial details to such websites, which might be unauthorized or fraudulent and affect your peace of mind.

How To Check Credit Scores Online In South Africa

Your credit score is just a click away in South Africa. The four main bureaus that have gone online services are Experian, TransUnion, Compuscan, and XDS. While each uses a unique scoring range and formula, they consider similar factors such as payment history and credit mix.

My Credit Check portal by Experian brings free reports, scores, and insights to raise your score. TransUnion is free for viewing annual reports and scoring; other services, such as credit monitoring and fraud prevention, are available. Compuscan’s My Credit Status offers free annual reports and scores, credit education, and identity theft protection. The XDS Credit Report provides free annual reports and scores with extra credit management services.

These services require registration with your email and identity verification. After that, you can check your loan rating and view the report.

How To Calculate My Credit Score In South Africa

Every bureau in South Africa calculates and determines credit scores differently. However, Sigma’s database of Experian reveals some ideas regarding the process.

Your payment history (40%) is the most important factor because it shows one’s ability to pay bills and arrears on time. Credit utilization (20 percent) is the debt-to-credit ratio, which should be below 30 percent to point out responsible loan use.

Another considered factor is the average age of your credit (15%), which is how old your accounts are. Having a long age of credit will be helpful in scoring, while a short credit age might affect your score. They also consider credit mix (10%), which is having different types of accounts. A good mix will boost your score, while a poor mix can lower it.

Finally, they weigh inquiries (15%), the number of times you’ve applied for new credit in the past year. Too many hard inquiries can hurt your score, while soft inquiries don’t affect it.

Which App Shows Your Real Credit Score?

Not all applications will be reliable in the sea of apps that promise to show your credit score. Some may use outdated data or score your credit with a different model. Hence, it is a must to check the source and validity of the information.

One free app that exists in this space is ClearScore. It fetches your credit score and report from one of the leading credit bureaus in South Africa—Experian. The platform will also provide personal insights to increase your score and offer personalized services. Download it from the Google Play or App Store, sign up, and access your credit score anytime.

Compuscan also offers its credit score and credit report through CreditGenie, another mobile application offered free of charge. This app provides credit education, identity theft protection, and debt counseling. Download it, sign up, and track your credit score anywhere.

Where Is The Best Place To Check Your Credit Rating?

The best place to get your details about loan scores is directly from the advance bureaus, as they are actual and direct sources of your overdraft information. Note that South Africa has four major bureaus: Experian, TransUnion, Compuscan, and XDS. You can receive your credit score with the websites or applications of any of the above. The National Credit Act accords one a right to a credit report and a score from each credit bureau in a year for free. You can also request further reports and scores for a fee.

But you should not depend on only one credit bureau to confirm your credit score since differences or even errors in your credit data among different bureaus are likely. One advice would be to check your rating from all four bureaus at least once a year, compare, and confirm the information. In case you see errors or inaccuracies in your statement, it is crucial to contact the agency without delay. This would help improve your score and avoid all adverse results.