Capitec Bank is a leading South African financial institution providing people with various monetary services, and one of its main characteristics is checking a loan rating through an app. Therefore, such a characteristic ensures a person is assured of better financial health management. Your overdraft rating is the summary of your creditworthiness numerically and is a key factor to consider when applying for any type of overdraft. While Capitec does provide access to this score, it also offers several tools to improve it. The post will guide you on how to check your loan rating on the Capitec app, build your readings using Capitec, increase it, and how much advance Capitec can give you.

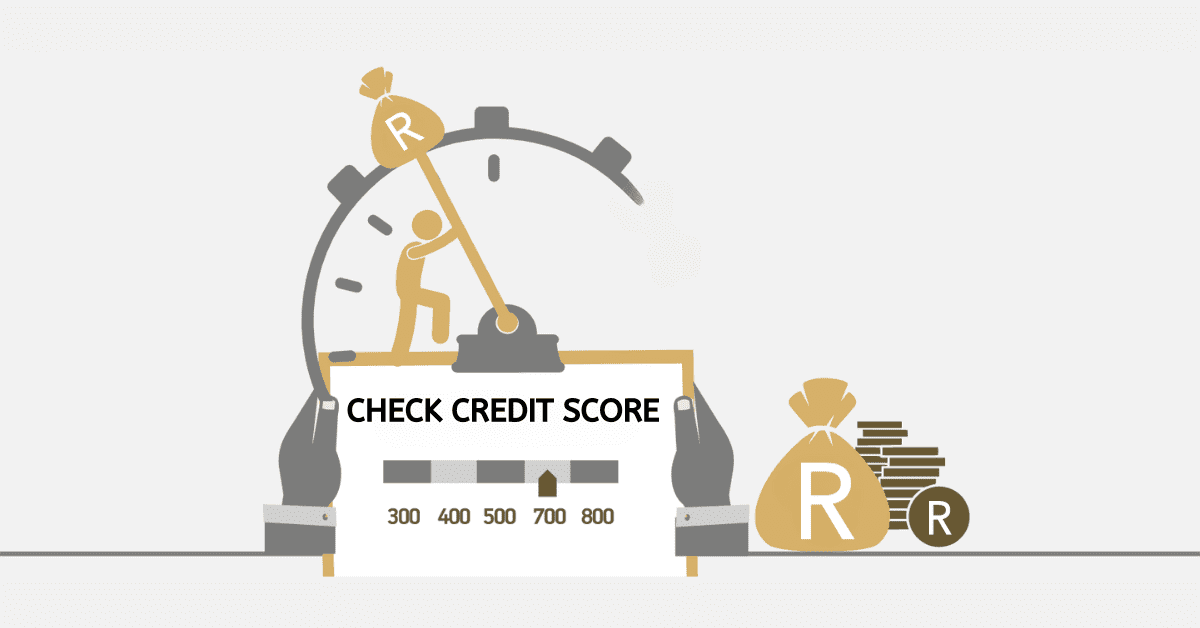

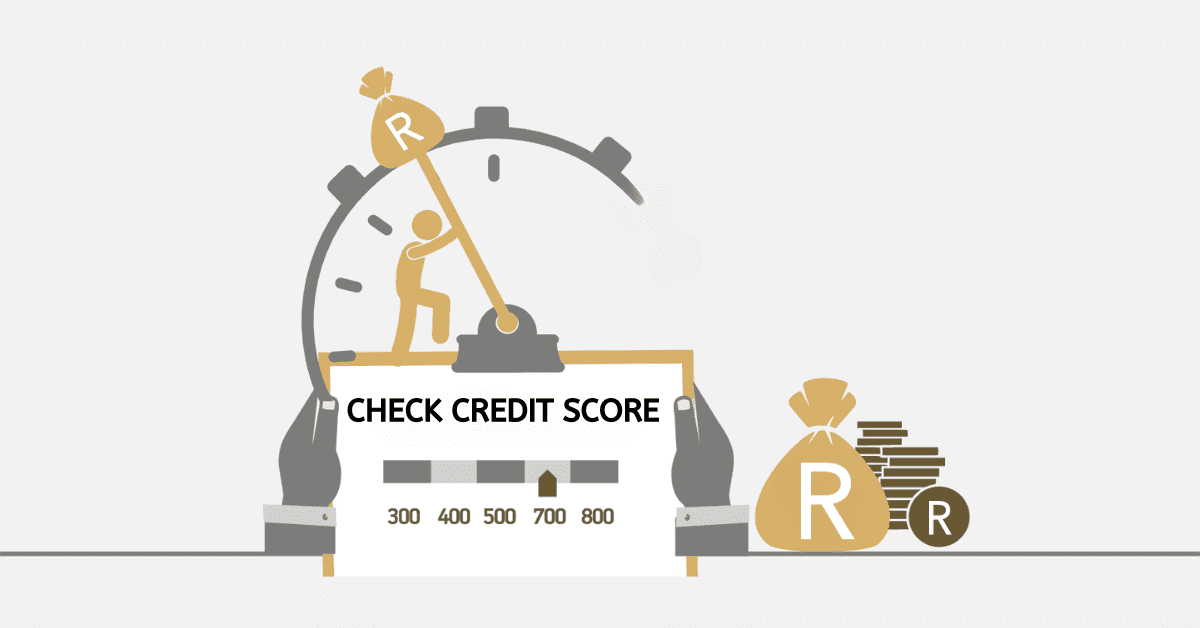

How To Check Credit Score On The Capitec Application

The process to check your credit score from the Capitec app follows these steps:

- Log in to your Capitec account via the app by filling in your details.

- Head over to the “Personal” tab.

- Upon a successful log-in, proceed to the ‘Personal’ icon section of your profile by clicking on it.

- Select the ‘Credit’ tab: The ‘Credit’ tab is in the ‘Personal’ part. Click it.

- Select the button for the credit estimate: After you click on the ‘Credit’ tab, select the button for the credit estimate.

- Input your info: The page will require you to key in a few of your details. Make sure you key them in right.

- Confirm your details: After keying in your details, confirm them. The app will then process your information and display your credit score.

Remember that the loan rating is a numerical measure of your creditworthiness, an important factor when getting overdrafts or credit. Regular checks and comprehension of your score are crucial for maintaining good financial health.

Capitec’s initiative to have that service available in person, within their app, is because it is convenient for customers to keep on top of their credit status such that if it is needed, it will assist them in making good decisions on what are the actions to be taken to better it.

Can I Check My Credit Score With Capitec?

Yes, you can check your credit score in South Africa with Capitec. The bank has a feature on its app that allows customers to access their credit scores.

Remember, various issues can increase or decrease your credit score, from how fast you repay the bills to the number of credits you hold. For instance, if you pay your bills on time, the information on your payment history will depict your proper payment habits and contribute positively to your credit score.

How To Build Credit Score With Capitec?

To create a good credit score with Capitec in South Africa, the following steps are required:

- Apply for Credit: One can start with a credit card. It requires one to be over eighteen, provide proof of address, and earn a minimum of R3000 to get a Capitec loan card.

- Open a Retail Account: Opening a profile with any reliable agency and paying your installments on time helps build your loan history.

- Utility Bills: Statements in your name, like water, electricity, rates, fixed landline charges, etc., can help build your record.

- Manage your credit: Don’t apply for too many credit lines simultaneously. Keep your credit balance about 25% to 50% of the limit in total, and pay on time.

- Debt consolidation: A Capitec Personal Loan can be applied for if you are indebted.

- Savings Account: Storing money in and out of a savings account now and then suggests the financial discipline of the account holder.

- Keep an Eye on Your Credit Rating: Your credit rating can be checked for free by the app Capitec.

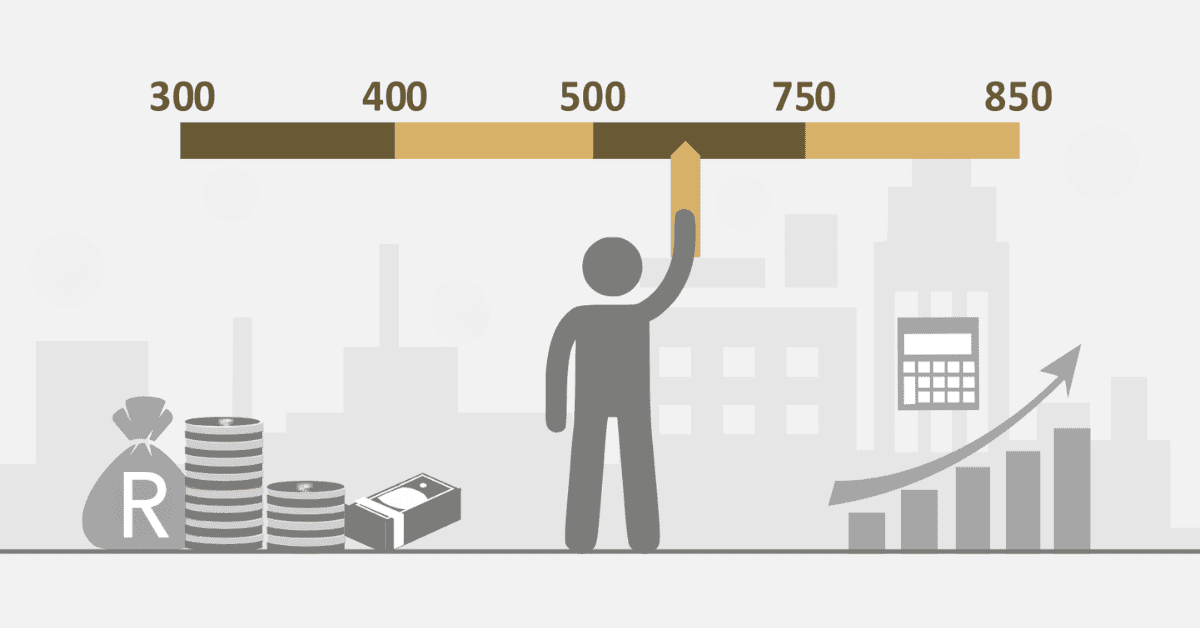

How Do I Increase My Capitec Credit Score?

To increase your Capitec credit score in South Africa, you will have to go through these steps:

- Payment History: Pay your accounts in full and on time. Paying accounts on time is evidence that a borrower is reliable.

- Keep your balances low. Lenders look at the total amount you owe compared to the original amount of the loan or your credit limit.

- A long history of the accounts is better, as it will help to show your long-term credit behavior.

- Types of Credit: Show that you can manage various credit products.

- New Credit: Limits opening the number of new credit accounts simultaneously.

- Affordability: Increase your affordability by managing your income and reducing your expenses.

Thus, remember that your credit score is just a reflection of your behavior. Do these things, and you’ll grow your Capitec credit score.

How Much Loan Can I Get In Capitec?

The amount of loan one can obtain from Capitec in South Africa will depend on several factors. Capitec gives personal loans to as much as R500,000, and the terms for payment may be quite elastic, lasting up to a maximum of 84 months. The amount you’re approved for depends on your credit risk and what you need the money for.

Capitec starts with an interest rate of 12.9% with a flexible amount capable of meeting a wide scope of financial needs. The bank approves the credit quickly, and the money is available immediately.

By the way, you may use the online Capitec loan calculator to calculate the money you need by specifying the details. To do that, input the loan amount, choose the loan term, and click calculate.

This loan offer is based on your affordability and credit profile, banking and credit history, and income and expenses. What it means is that properly managing these things would mean that you have raised the loan sum that you can derive from Capitec.