Capitec Bank is a well-known financial company that has been praised for the creative ways it does banking. Capitec has completely changed how people handle their money by making their services more open and easy to use. Capitec stands out since it stresses how important it is to keep things easy.

In banking, creditworthiness is very important because it tells lenders if a person or business can get a loan or other financial service. In the past, banks would check a customer’s image by hand and based on what they thought about them. These days, thanks to better technology, banks can use credit rating systems that work better and are more reliable. People know that one bank has a special way of figuring out credit scores.

Now that you have an idea about what Capitec offers, it is important to also get some insight into the credit score system developed by the bank. This way you would be able to check your credit score, know the status of your credit score and many more.

How can I check my credit score for free?

Lenders are typically interested in your credit history and how responsibly you have managed your finances in the past when considering lending you money. The information contained in your credit report is utilised for this purpose.

This includes details about your past bill payment history and any financial transactions you have made. Having a solid credit history holds significant importance as it demonstrates to potential lenders your ability to responsibly manage their finances. This is particularly crucial when you are in the process of purchasing a car or a house.

If you have a track record of managing your debts responsibly, there is a higher chance that you will be approved for a larger loan with more favourable interest rates. If you want to strengthen your credit history, it’s important to start as early as you can.

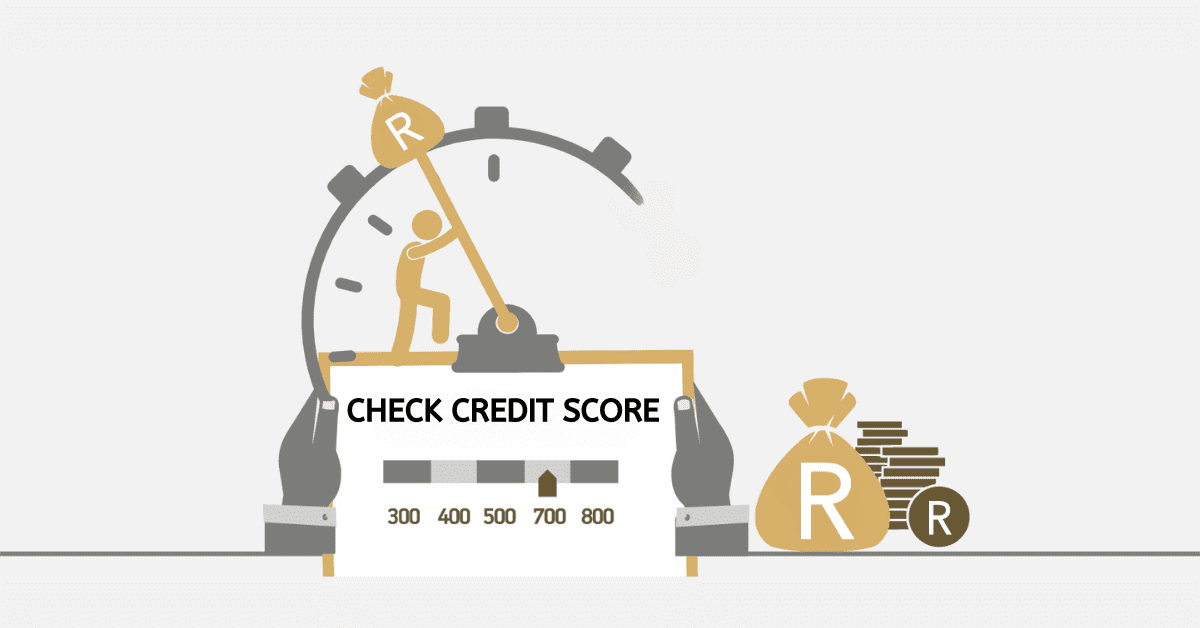

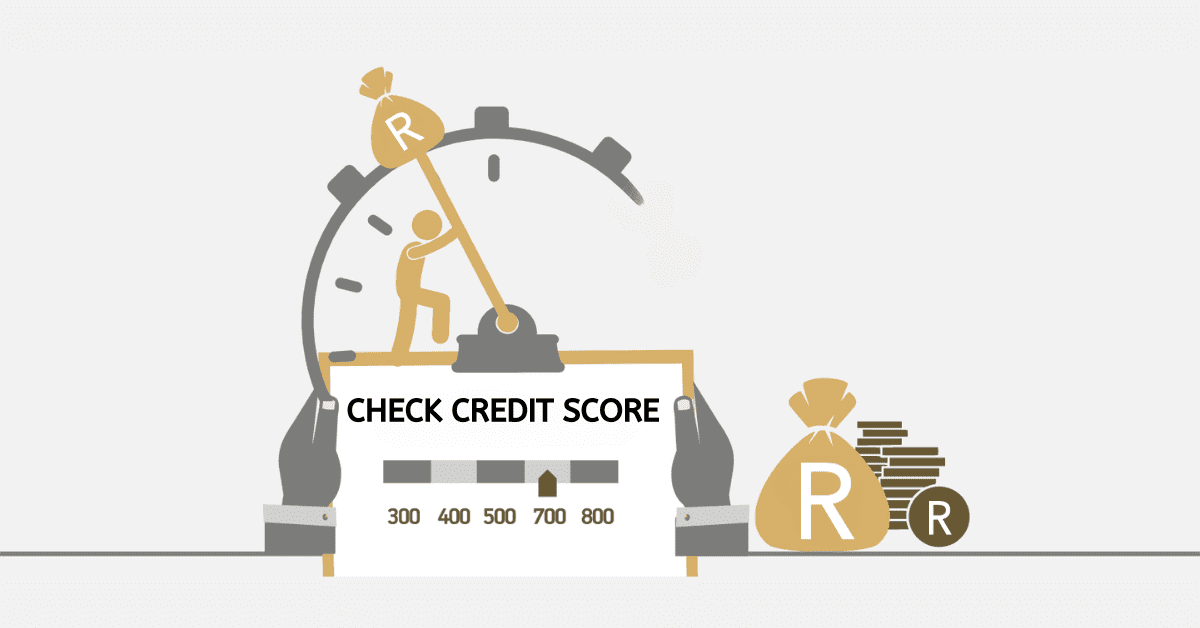

In all this, it is important to know how to check your credit score. Taking Captiec into account, here is how to check your credit score for free.

- Go to www.mycreditcheck.co.za to see the official My Credit Check website.

- This website uses information from the Experian Sigma database, which is the old database for the Compuscan service.

- The Experian Sigma database will be used to make your credit record and credit score.

- Remember that the credit score you get from this database might not be the same as the one you get from the Experian Database because the formulas and factors used to make the scores are not the same.

Can I check my credit score on capitec?

Knowing your credit score can give you a fair understanding of your financial discipline. Once you can manage your finances while banking with Capitec, you can raise your credit score. These are parameters set by lenders to determine the credibility of individuals. Credit scores can explain a lot about an individual, including spending habits, financial capabilities and many more.

You can check your credit score on Capitec through their app and online banking platform. It is just a simple step and you have your credit score and credit history.

What is a good credit score in SA?

Having a good credit score can greatly increase your likelihood of getting approved for a home loan. However, you may be wondering what exactly qualifies as a good credit score in South Africa.

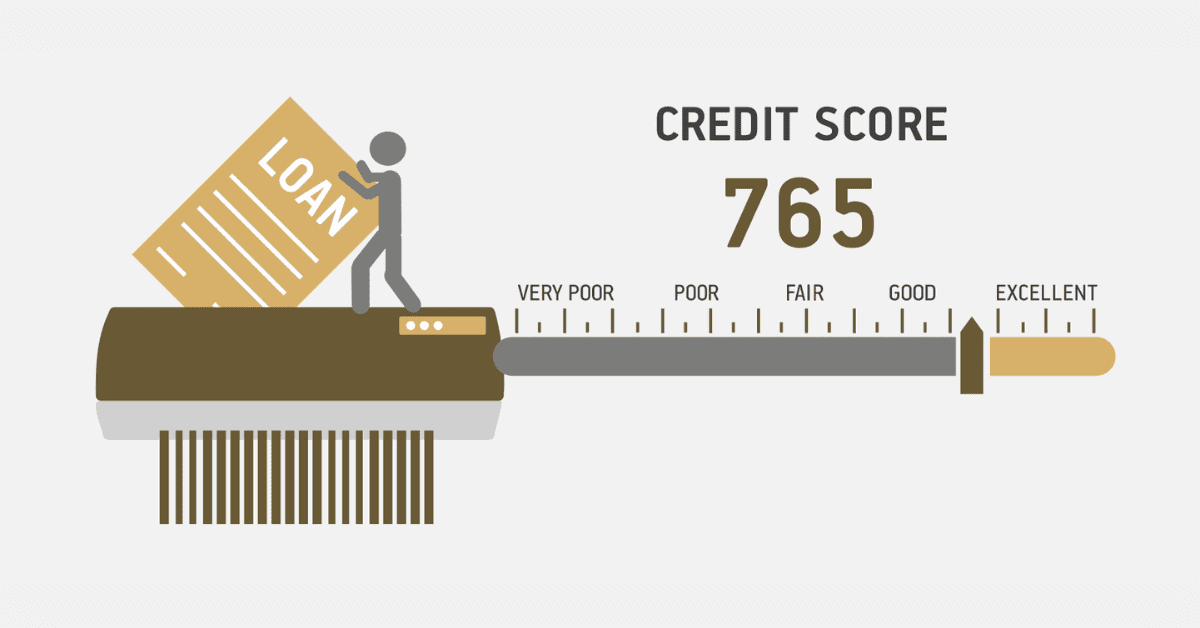

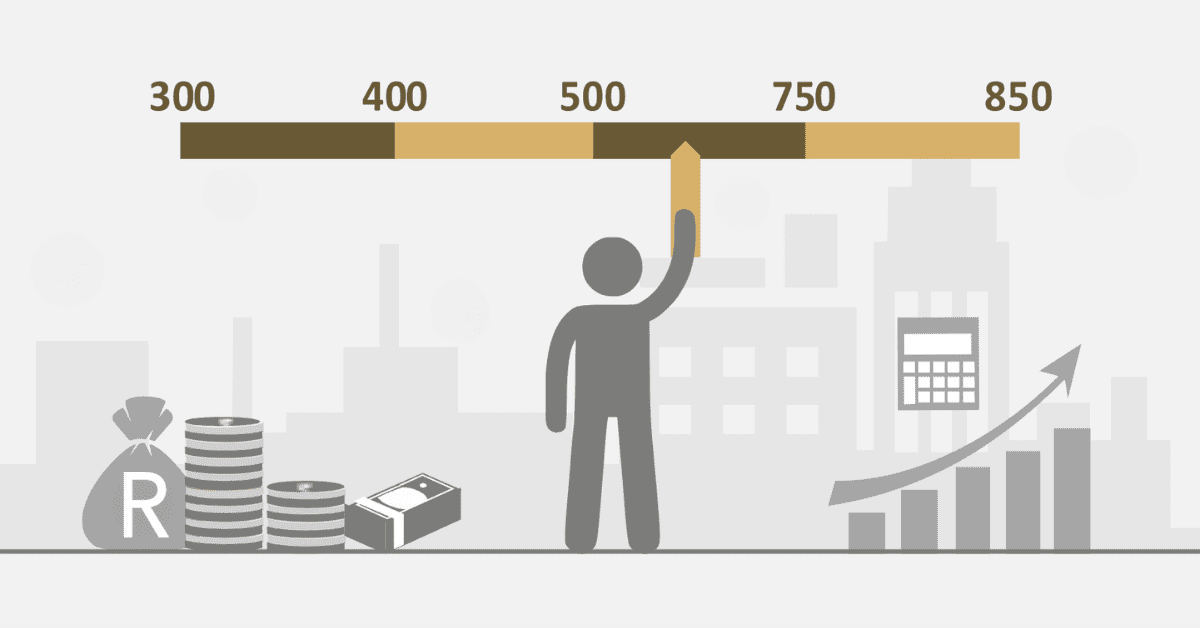

A credit score is a numerical representation consisting of three digits that provides banks with an indication of the level of risk associated with lending to you. Having a good credit score greatly increases your chances of getting approved for huge payments. It is advisable to aim for a credit score of at least 650. This is the minimum credit score you need to have to increase your chances of being approved for loans. A good credit score can range between 650 to 699. There are instances where during a recession or economic instability, a good credit score can range from 600 to 699.

How can I check if I have bad credit?

Occasionally, individuals engage in discussions regarding your credit. What they are referring to is your credit history. Your credit history is a record that reflects how you manage your finances:

Having bad credit can make it more challenging for you to obtain a loan or get approved for a credit card. If you are approved for credit, the interest rates you will be offered will likely be higher compared to standard products.

The numerical values set by the banks can explain your credit status to you. These numbers are in ranges and also in different scores. Each score represents your credit status and history.

Just as grading or results are standardised from very poor to excellent is the same way credit with banks is done. Having a credit score of less than 550 can indicate you have bad credit.

You can check if you have bad credit by logging into your banking system and viewing your credit details to know where you fall into.