Have you ever made a mistake while making a payment on eFiling, or changed your mind about a payment after the fact? It can be challenging to realize that you need to cancel a payment, especially if you’re unsure how to do it. This post walks you through how to cancel a payment on eFiling. Whether you’re dealing with a mistake, a change of plans, or a technical issue, we’ve got you covered.

How Do I Cancel A Payment On eFiling?

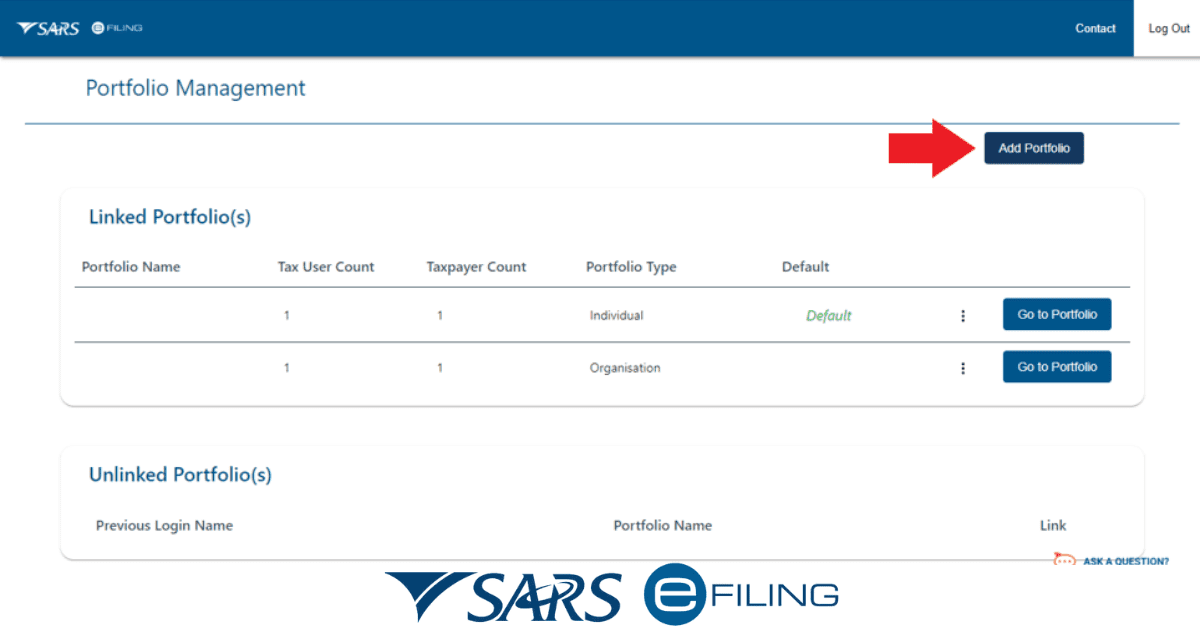

The eFiling platform provided by the South African Revenue Service (SARS) allows individuals and businesses to file their taxes and other documents electronically. If you desire to cancel a payment on the SARS eFiling platform, you can do so by following the steps below;

- Log in to your SARS eFiling account.

- Go to the “Payments” section of your account.

- Locate the payment that you want to cancel and select it.

- Click on the “Cancel Payment” button.

- Follow the prompts to confirm the cancellation of the payment.

If you cannot cancel the payment through the SARS eFiling platform, you may need to contact SARS directly to request a cancellation or refund.

How Do I Suspend Payment On SARS eFiling?

To request a suspension of payment on SARS eFiling, you will need to log in to your eFiling account and follow these steps:

- Go to the “Dispute” tab and select “New” to request a new dispute.

- Select the tax type and period you want to dispute.

- On the Selection screen, select the option for a suspension of payment and provide the reason for the request in the “Reason/Grounds” section.

- Click “Next” to continue.

- Review the information you have entered on the Summary page and upload any supporting documents.

- Click on the “Submit” button to submit the request to SARS.

It’s important to know that SARS will review your request and decide based on your provided information. If your submission gets approved, you will be told how the payment suspension will work and if there are any other requirements you need to meet.

If your request is turned down, you will be told why it was turned down and what you may need to do next.

You should only request a payment suspension if you intend to contest your tax liability. If you need to know how much tax you owe or think you were wrongly assessed, consider appealing the assessment before asking for a payment suspension. If you don’t agree with the assessment or decision, you can file an objection with SARS. An objection must be sent within 30 business days of the date of the assessment or decision, and it must explain why the objection is being made and include any supporting documents.

It is important to know that you will still be expected to pay the due tax while your dispute is being addressed unless SARS has granted a suspension of payment.

What kind of taxes can you apply for suspension of payment?

A request can be submitted for the following:

- Income tax, including CIT (Corporate Income Tax)

- Pay-As-You-Earn (PAYE) taxation of employees

- VAT (Value Added Tax)

- Excise and Customs

Requesting a payment suspension or waiver of penalties and interest does not guarantee that it will be granted. These petitions are reviewed individually and granted only if specific requirements are satisfied. SARS, for example, may consider issuing a payment suspension if the taxpayer can establish that they cannot pay the tax due to financial hardship.

In such circumstances, the taxpayer may be asked to show evidence of their financial condition, such as bank statements or pay stubs. It’s also worth noting that requesting a payment suspension does not stop the interest accrual on the overdue tax. Interest will accumulate until the tax is paid in full or SARS authorizes a payment plan.

How Do I Make Corrections on eFiling?

If you need to edit or amend a SARS-issued assessment, you can utilize SARS eFiling’s “Request for Correction” option to make the appropriate modifications. To do this, you will need to follow these steps;

- Log in to your eFiling account.

- From the main menu, select “Returns” and then “Returns History.”

- Choose the relevant tax type and tax period from the list of available returns.

- Click “Open” to access the work page for the selected return.

- Select the “Request Correction” button.

- Make the necessary changes to the assessment and save your changes.

- Submit the revised assessment for review by SARS by clicking the “Submit” button.

It would be ideal if you kept in mind that you must pay any additional taxes or penalties that are due as a result of the corrections that you have made. As part of the process of making a correction, you must provide SARS with proof or supporting documentation.

How Do I Release My SARSPayment?

After you process a payment through SARS eFiling, you will need to give SARS permission to get the money. How you do this depends on what kind of banking product you use. You can choose your banking product from this list to learn more about the exact steps you need to take.

You should only approve the payment once you’re sure all the information is correct since mistakes or differences could cause delays or other problems. You can ask your bank or the SARS Contact Centre for help if you have any questions or need help authorizing payment on SARS eFiling.

What Happens If I Miss The Sars eFiling Deadline?

From December 1, 2022, if you miss the deadline for submitting your tax return through SARS eFiling, you will be subjected to administrative penalties. When one or more tax returns for tax years from 2007 to 2020 are late, administrative fees will be charged. These penalties are levied under Section 210 of the Tax Administration Act (TAA) and are based on a fixed amount determined by the taxpayer’s taxable income. Previously, taxpayers only had to pay these fees for being late if they were missing two or more tax returns for these tax years.

You will pay a monthly penalty ranging from R250 to R16,000 if you fail to submit a tax return on time. Suppose you have missed the eFiling deadline and are concerned about incurring administrative penalties. In that case, you can request a suspension of payment or a waiver of the penalties if you can demonstrate financial hardship.

You can do this by submitting a Request for Remission (RFR) through SARS eFiling or by booking an appointment at a SARS branch. It’s important to note that the administrative penalties will continue to accrue until the tax return is submitted or SARS has approved a payment arrangement.

How Do I Apply For A SARS Deferment?

To get a deferment from SARS, you must show that you need help paying your taxes on time because of a lack of money or other special circumstances that make it hard for you to pay your taxes when they are due.

You can apply for a deferment by submitting a Request for Remission (RFR) through SARS eFiling or by booking an appointment at a SARS branch. When you send in an RFR, you will need to give comprehensive information about your finances and why you want the money. You must also need to show proof of your income, expenses, and any other information about your finances that is relevant.

You should note that whether or not SARS gives you a deferment is up to them and will depend on your specific situation. If your request for a deferment is granted, you can put off paying your taxes for a certain amount of time.