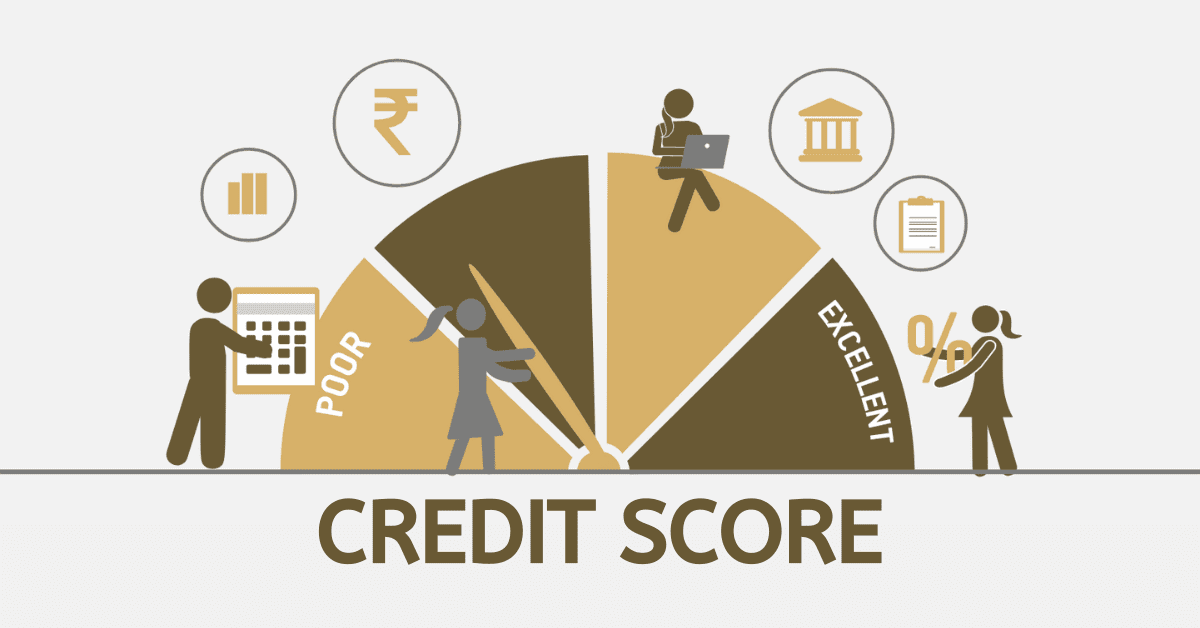

It is a frequent practice in the world of finance to borrow money, which enables individuals to gain access to funds for a variety of purposes. According to the conventional method, lenders carry out credit checks to evaluate the creditworthiness of borrowers by analyzing their previous financial behaviour. This is especially helpful for South Africans who are looking for financial aid because there are ways to obtain loans without having to go through the process of having their credit checked.

Even while it is possible to borrow money without having your credit checked, it is essential for borrowers to thoroughly evaluate the conditions, interest rates, and repayment schedules of the loan. Furthermore, establishing a positive credit history over time is still beneficial for future financial initiatives on your part.

Today, we will share some good news with those who are looking to secure a loan with no credit check. While we know the constraints that come with credit checks, it becomes ideal to understand how to borrow money without a credit check.

How to borrow money with no credit check

There are still ways to get a loan even if you do not want your credit to be checked. You can get a loan even though most standard lenders check your credit first.

People often get payday loans and cash advances to get cash fast and without having to worry about their credit. When you get your next wage, you can pay back these short-term loans with interest. You can borrow a small amount of money. Payday lenders do not usually check your credit like banks do, so you can get one even if you have bad credit or none at all. When you need cash quickly, payday loans can save the day. But be careful and pay them back quickly to avoid getting stuck in a debt trap.

Another way to get a loan without having your credit checked is to use a peer-to-peer lending service. Online markets like these make it easier for people who need money to connect with private lenders. In peer-to-peer lending, your credit score is not the only thing that counts. Your income and work history are also taken into account. That being said, if you can show that you can pay the loan back in other ways, you can still get one.

You should be very careful and responsible if you want to borrow money without first checking your credit. Before you ask for a loan, make sure you can pay it back when it is due and really think about the fees and terms.

Which type of loan does not require a credit check?

Getting a loan can save you when money is tight, but most of the time, you have to go through a background check. As an option, individuals can get loans that do not check their credit. Three common types will be looked at in more detail: asset loans, payday loans, and peer-to-peer loans.

- Payday loans are a quick way to get cash, and the user usually has until their next paycheck to pay back the loan. Loans with no credit check are easy to get, but the very high-interest rates can make people deeply in debt that they can not get out of.

- People or investors can give money to each other through online platforms. This is called peer-to-peer lending. They are flexible and do not charge too much, but they may still check your credit. Even so, they are usually less strict than traditional banks.

- Asset loans: For these loans, you do not need a good credit score because you use valuable things like jewellery, electronics, or cars as security. Even though it is helpful to have quick access to money, there is a chance of losing the asset if it is not paid back.

People who want loans without credit checks can get the money they need quickly with these options. To keep from getting into even more financial trouble, it is important to carefully look over the terms, your ability to pay, and any possible outcomes.

How big of a loan can I get with no credit?

The concept of “big loan” can be a bit ambiguous. But the whole agenda focuses on securing a greater among with no credit.

Securing a big loan without no credit can be done through mediums like payday loan applications, asset loans etc.

Depending on your credit history, and income, your loan amount plays a role. However, it is possible to secure a loan that can be greater than your monthly income.

For example, if you have a total income of R10,000 per month, without credit, you can secure 2 or 3 times more of that monthly income.

Which loan company is easiest to get with bad credit?

If you have bad credit and need a loan quickly, do not worry. Dotloans is thought to be the easiest company for people with bad credit to get loans from. Dotloans is a loan site for South Africans who know how important it is to get money quickly, especially for people with bad credit.

The easy application process at Dotloans, which can be done online in minutes, makes it stand out. Because their processes are so fast, you can get your loan the same day, which is great when you are having a hard time with money.