In South Africa, public benefit organizations-PBOs are supported significantly by the South African Revenue Service – SARS, which plays a vital role in the process.

PBOs rely on SARS to provide them with tax exemptions and other benefits that assist them in carrying out their missions to serve their communities better. SARS also works with PBOs to ensure they comply with tax laws and regulations. It provides these organizations with guidance and support to assist them in navigating the complex tax landscape.

This partnership between SARS and PBOs helps to ensure that these organizations can carry out the important work they do and positively impact society as a whole. SARS and PBOs can increase the likelihood that the nation’s most vulnerable populations will receive the assistance they require.

In this article, we will be sharing more information on how to apply for SARS PBO, the registration process for PBO, and other relative topics.

How do I apply for SARS PBO?

PBO status is important for more than one reason. First, it lets non-profits get tax breaks on their donations, making it easier for them to do their work. Second, PBO status also lets organizations get tax-deductible donations from individuals, which makes it easier for them to get the money they need to carry out their missions. Having PBO status can also help an organization look more trustworthy, which makes it easier for them to get volunteers, donors, and business partners.

The following is intended as a general guide and may be updated periodically to reflect changes in South African Revenue Service rules and regulations. Applying for PBO status can be complicated, so it’s best to seek advice from a tax expert or SARS for help.

Verify that your group satisfies the criteria for a Public Benefit Organization before applying. Your group must be a non-profit and engaged in public benefit activities as specified by SARS.

- You must submit your organization’s founding documents, financial statements, and proof of tax-exempt status to SARS in order to apply for PBO status.

- Get the SARS PBO application form here and fill it out. Make sure you’ve filled out everything correctly.

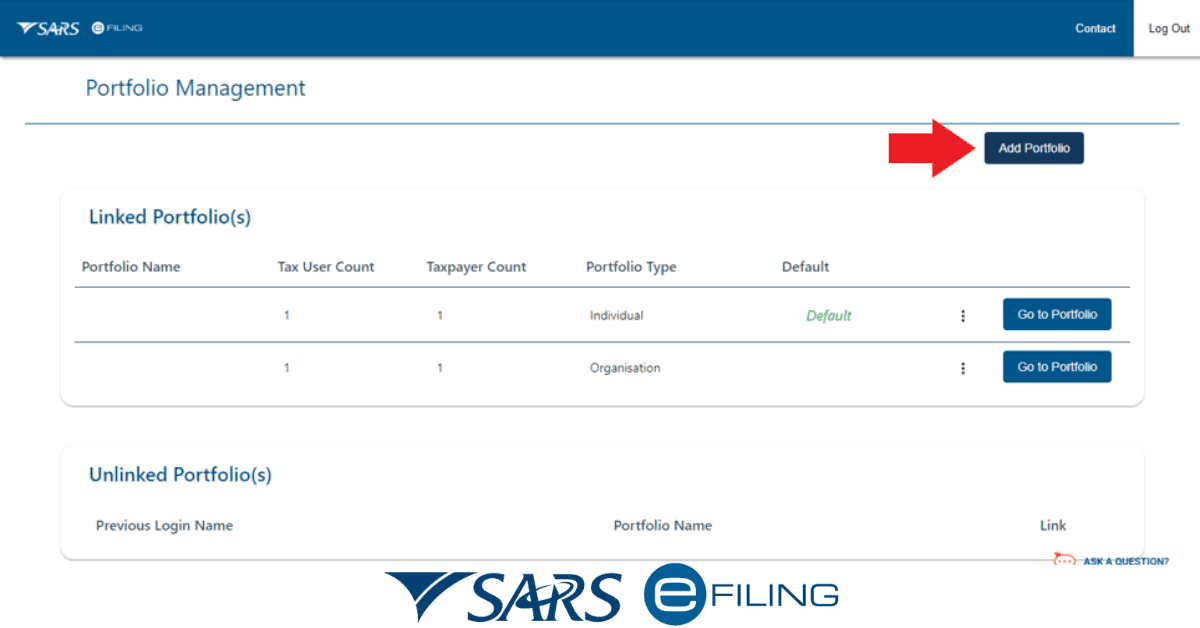

- After filling out the form, it should be delivered to your local SARS office along with the necessary supporting paperwork. Through eFiling, you can also electronically apply and provide supporting documents.

- SARS’s application processing time after submission can range from a few days to several weeks. In due time, you will hear back regarding the status of your application.

- To qualify for tax exemptions from SARS after receiving PBO status, your organization must first register with the agency. In this way, all donations to your organization will be exempt from taxation.

- Be sure to save documentation showing your organization qualifies as a PBO in addition to recording all financial transactions involving donations. This will be useful for showing that you’ve met a PBO’s standards.

Where do I register a PBO?

It is necessary to visit the South African Revenue Service in order to register a Public Benefit Organization. You must provide the SARS with an application form for the PBO that has been completed and is accompanied by all necessary supporting documentation. SARS will issue a certificate of registration to you once your application has been accepted; to function as a PBO, you are required to have this certificate.

How long does it take to register a PBO in South Africa?

In order to complete the registration process, you will need to provide the South African Revenue Service with a fully filled-out PBO application form and all of the necessary supporting documentation. Following that, SARS will conduct an evaluation of the application, which could take several weeks. In order to function as a PBO, SARS will issue a certificate of registration after it has been granted approval for the business.

Because it may take up to two months for the application to be approved, it is in your best interest to begin the process as soon as possible.

Does a PBO pay tax?

PBOs in South Africa are generally exempt from paying income tax; however, they may still be required to register for and submit tax returns to SARS. Even though PBOs in South Africa do not have to pay income tax, they may still be required to do so.

Regardless of whether or not the PBO has been approved to have no tax liability, all PBOs operating businesses or otherwise engaged in commercial activity are required to file annual income tax returns.