The goal of the South African Revenue Service eFiling platform is to give individuals and businesses an easy, safe, and quick way to handle their tax matters. The platform’s goal is to make it easier for taxpayers to meet their tax obligations and make the tax process easier to understand. By letting taxpayers fill out and send in their tax returns online, SARS eFiling is meant to cut down on the time and money needed for manual tax submissions and improve the accuracy of tax returns.

The platform also gives taxpayers access to their tax information in real-time, which makes it easier for them to keep track of where their tax returns and payments. By making the tax process easier, SARS eFiling helps reach the larger goals of ensuring tax laws are followed and making the South African tax system work better.

How do I add SARS representative to eFiling?

eFiling is an online service that lets taxpayers in South Africa file their tax returns and make payments. The South African Revenue Service (SARS) has required all tax professionals to use eFiling to file their clients’ tax returns.

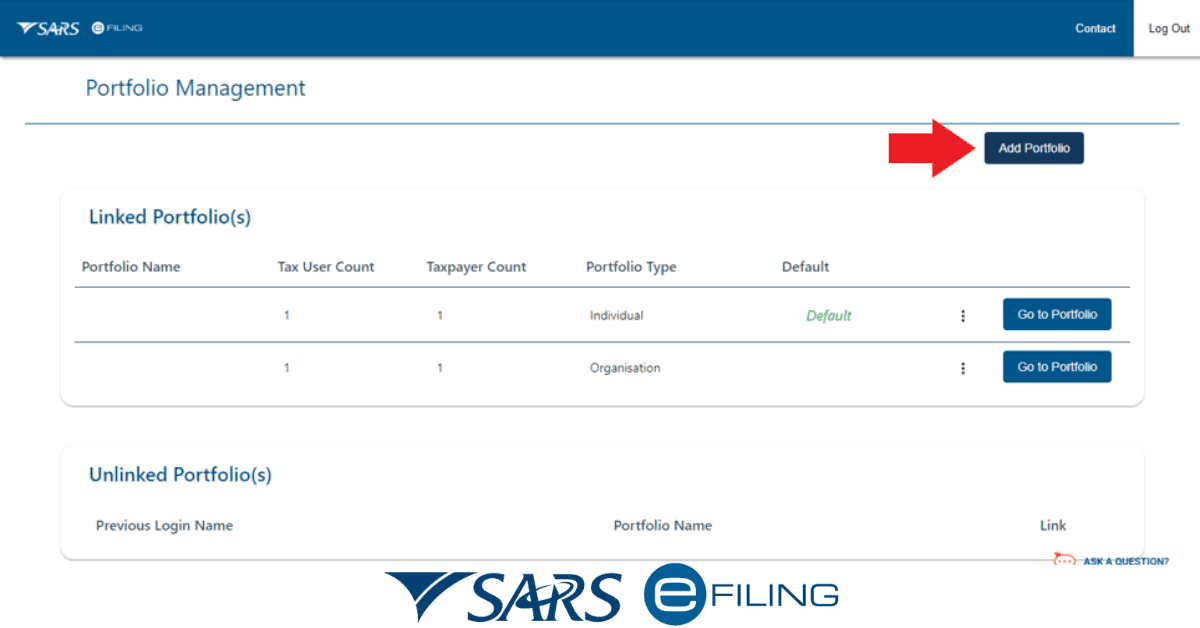

Follow these steps if you want to add a representative to your eFiling account:

- Sign in to your account for eFiling.

- Click on the tab that says “Representative.”

- Click the “Add a Representative” button.

- Fill in the required information, such as the representative’s name, email address, and tax reference number.

- Once you’ve put in the information, click “Save.”

- The instructions for setting up the eFiling account will be sent to the representative by email.

It’s key to know that adding a representative to your eFiling account allows them to file returns and access your client’s tax information. So, it’s important to only add representatives you can trust and who have the right skills and knowledge to do the job.

How long does it take to activate a Registered representative on eFiling?

The time it takes for a Registered Representative to become active in eFiling varies by the regulatory body and by the procedure. However, activation typically takes between two and four weeks to finish.

If all paperwork is filed on time and all conditions are met, the process c an move along more quickly. Plan ahead and allow adequate time for the activation process to conclude before using eFiling for official business.

What documents are needed for SARS Registered Representative?

For various reasons, having documents for a SARS-registered representative is crucial. It proves that they are registered with SARS and that they have permission to represent taxpayers. Additionally, it aids in staying out of hot water with the law by keeping you from breaking any rules or regulations. Submitting tax returns and communicating with SARS can go more smoothly if all necessary documents are on hand. Having documentation of a representative’s credentials is also a great way to show that they are dedicated to their client’s best interests and inspire trust in their ability to provide accurate and professional services.

Here are the required documents needed for SARS registered representative:

- Identification document (passport, ID book, or card)

- Proof of physical address (utility bill, bank statement)

- Tax clearance certificate or proof of tax compliance

- Curriculum Vitae (CV) or resume

- Proof of qualifications (degrees, certificates, or professional licenses)

- Police clearance certificate

- Consent form for background and credit checks

- Proof of membership in a professional body (if applicable)

- Completed application forms for SARS registration as a representative

Who can be authorised representative in income tax?

The question of who can be an authorised representative in income tax can be dicey. Having knowledge about the process may not give you full authorisation. It is important to know that the issues of tax are well monitored and regulated.

An individual, such as an accountant, lawyer, or tax professional, who is authorised to act on behalf of a taxpayer in dealings with the tax authorities is referred to as that taxpayer’s authorised representative in the context of income tax. They are able to act as the taxpayer’s representative in the process of filing tax returns, communicating with the relevant tax authorities, and resolving any issues that are associated with taxes.

Can someone go to SARS on your behalf?

It is possible for someone else to act as your first point of contact and represent you at SARS. On the other hand, they will need to have a written authorisation letter from you as well as appropriate identification, such as a power of attorney or any document that certifies that representative. It is always a good idea to check with SARS in advance to confirm their requirements.