A credit report doesn’t just provide lenders with information about the existing credit you have. It also provides a wealth of personal information, including details such as your address and employer. While most of us worry about the accuracy of the financial information shown, it is important that your credit report accurately reflects all facts about you. Otherwise, you may miss out on opportunities or be incorrectly assessed for risk by potential lenders. What can you do if you spot inaccurate personal information on your credit report, like an incorrect employment status? We are here to guide you through everything today, so let’s get started.

How To Add Employment Status On Credit Report

Technically, you should never need to ‘add’ something to your credit report manually. Let’s recap how the credit reporting system works in South Africa:

- Individual lenders send the information they have about you and your credit lines to the bureaus.

- The bureaus collect data from multiple lenders across the country.

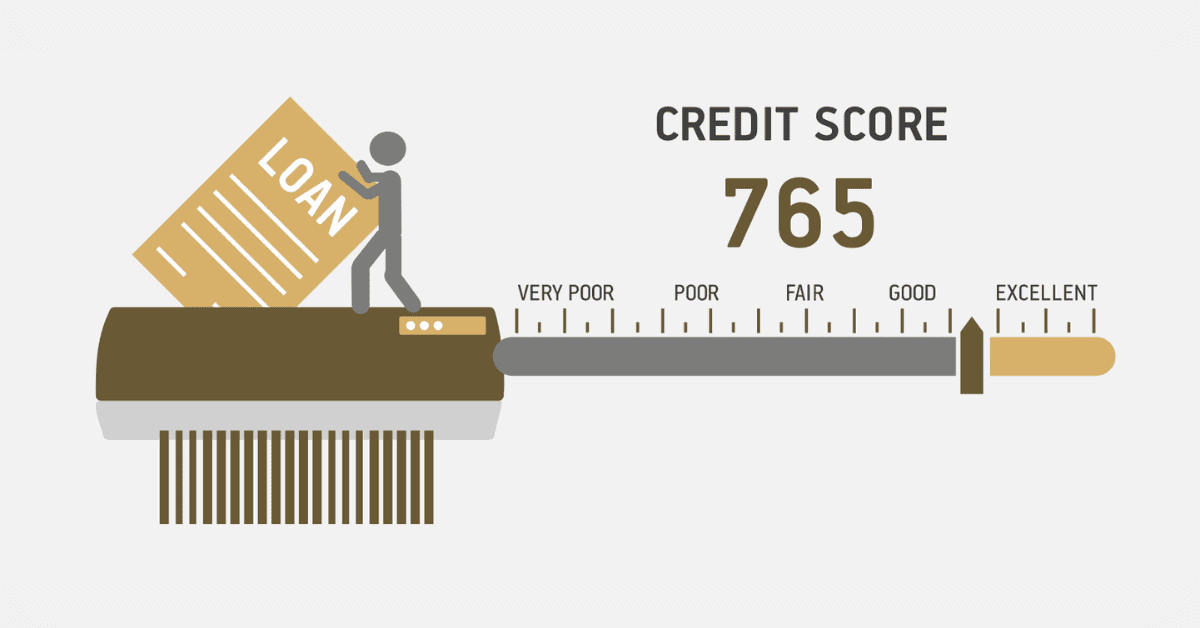

- They compile this data, and use financial models and algorithms to assign you a credit score based on all the factors reported

- This credit score (and the individual information on you and your accounts) is then used to compile a credit report

- Lenders can then access this report to evaluate your creditworthiness and financial behavior.

This means that, in theory at least, any change in your data will automatically make its way to the bureaus and be updated over time. No action is needed!

However, it is not uncommon for inaccurate or outdated information to still be shown on your credit report. The bureaus suggest that any inaccurate data you spot that isn’t updated after 60 days (2 calendar months) should be disputed with them, so they can update their records.

You will do this the same way you raise any other dispute on your credit report. Head to the bureau’s website, and look for the ‘dispute’ option. You will be directed to an online form, where you will explain the situation. Upload supporting documents and proof, and submit the dispute. The lender has 20 working days to get back to you on the matter. Something like updating your address or employer will be very simple- much more simple than actively disputing credit information, in fact!

How Do I Update My Income On My Credit Report?

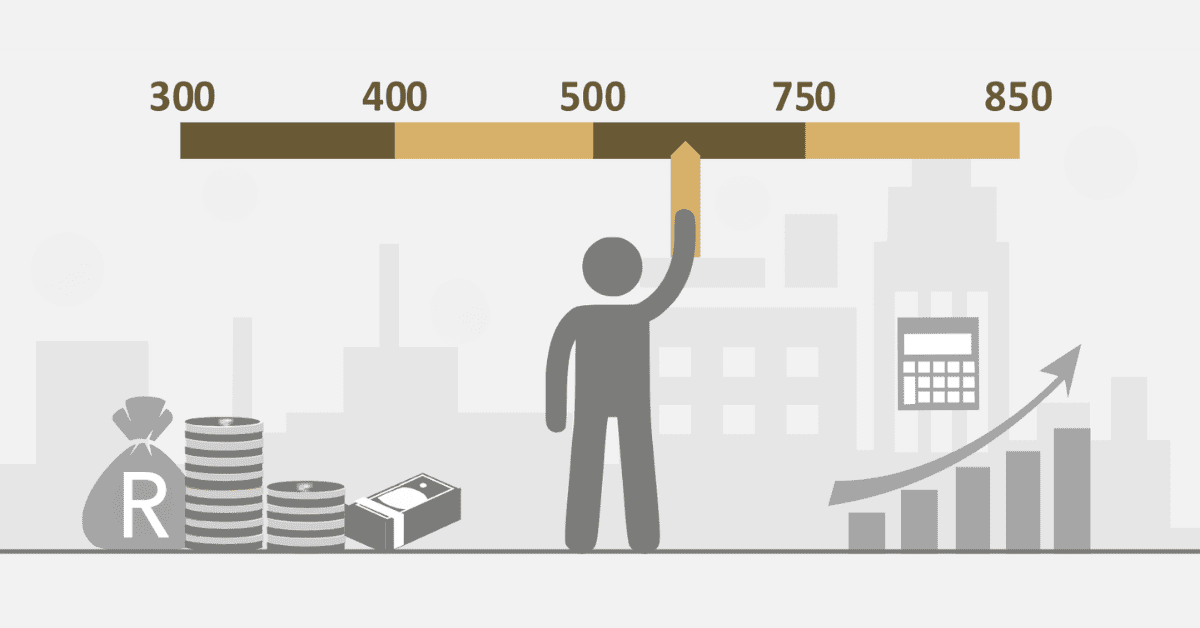

In South Africa, you do not need to update your income on your credit report. This is something that many US citizens may need to do. This is why you will often see it raised as a topic and may be under the impression you need to do it too. However, income is not something that the South African bureaus are interested in, or have a right to access. Income is not a factor used in your credit report. Only current credit lines and debts, payment history, your location, and your employer are relevant, not what you earn.

It is a good idea to make sure that your place of employment and other personal details are correctly reflected, however. This makes certain that only the right information is provided to the bureaus. A lender may, for example, be put off you as a prospective borrower if you claim to be employed in one place, and the bureaus show different data. While this should never be the ‘make or break’ factor in a lending decision, every little thing you can do to ensure an accurate report will work in your favor.

What Negative Information Can Be Added To Your Credit Report?

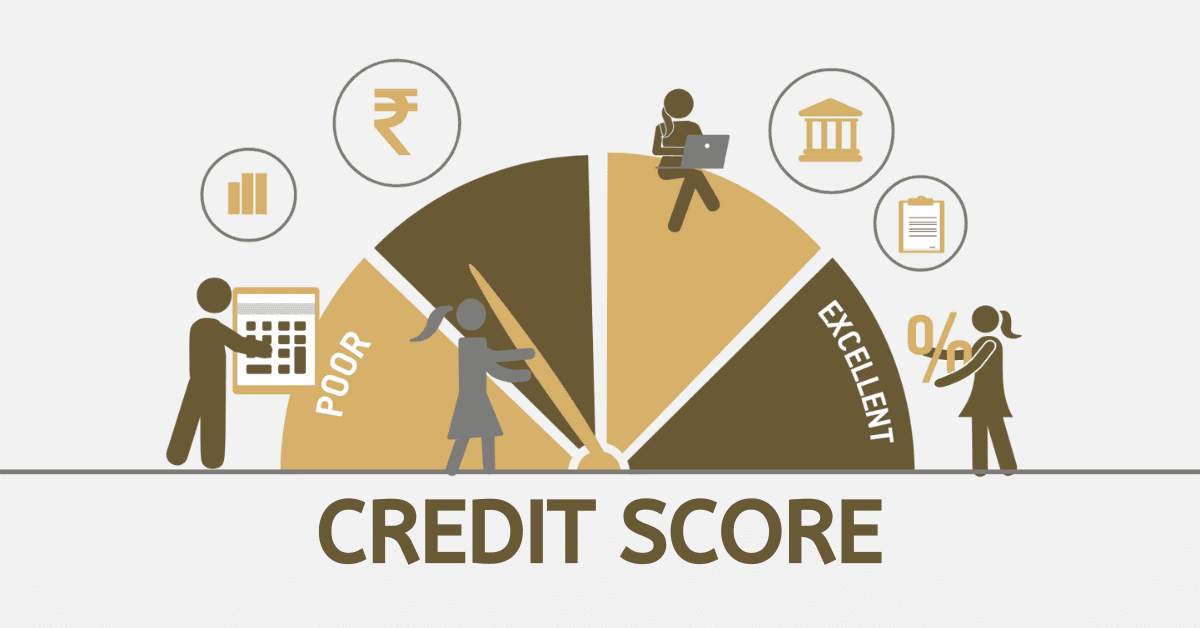

In South Africa, both positive and negative information about your credit is shown on your credit report. On the negative side, this means the following data is reflected:

- Missed and late payments

- Underpayments

- Accounts in arrears

- Defaulted accounts

- Court judgements

- Account closures forced by non-payment or defaults

- Repossessions

- Revoked, written off, charged off, and handed over debts

However, don’t forget the impact of positive credit behavior! Lenders will also be able to see how well you pay accounts, that you make full and timely payments, and other positive interactions with your credit. Your credit score is compiled with both positive and negative behavior in mind, not just the things you do wrong.

Does Updating Your Income Affect Your Credit Score?

Income does not affect your credit score in any way in South Africa. It is not a factor that lenders will report on, and it will not appear on your credit report in any way. That said, many lenders will also ask you for proof of your income in the form of 3 or 6 months of salary slips, to make certain that your debt-to-income ratio allows you to take on a new loan or credit offering. So a boost in income will help you in that way. However, this will not impact your credit score in any way.