Registered tax practitioners in South Africa can register and maintain eFiling profiles for their clients via a central eFiling profile they operate. This allows them to quickly and easily swap between client profiles and carry out tax duties on your behalf via a safe and secure centralized digital system. Today we dive deeper into how to do this, how to allow access to an existing eFiling profile, and more.

How do I link a newly registered client to my profile?

To add a newly registered client who has not had an eFiling profile before, first log in to your main eFiling account. Navigate to ‘Organizations’ and click ‘Register New’

- Enter the client’s personal details, including their name, identity number, and contact information.

- Select the type of tax return that the client will be submitting (e.g. Individual, Company, Trust).

- Enter the client’s tax reference number.

- Assign the client to a specific portfolio, if applicable.

- Click on the “Save” button to save the client’s information.

Once you have added a client to your profile, you will be able to view their tax information and submissions on the eFiling system. You can also submit returns and communicate with SARS on behalf of your client through the eFiling system. It’s important to keep your client’s information up to date on eFiling to ensure that their tax affairs are managed efficiently.

How do I Share my eFiling Profile with a Tax Practitioner?

Some clients may already have an operational eFiling profile created on the SARS system. You can migrate this profile to your own profile (as a tax practitioner) to enable you to access, load, and update their tax information as required from a central place. Do not follow the steps to create a new eFiling profile for the client (above), as that will create conflict on the system when the tax number is detected. Instead, do the following:

- Ensure the clients contact details are up to date, as SARS will request authorization from them on these channels.

- The tax practitioner will go to the eFiling page

- At the bottom of the menu is the option ‘Manage Tax Type Transfer’.

- They will have to fill in your ID number and tax number

- Respond to the confirmation request SARS will send to you to authorize the transfer

- You will receive an OTP to authorize the transfer. This must be used within 5 minutes, so have them make you aware when they will be requesting the transfer.

- Once you accept the SARS prompt, the profile will be migrated to the tax practitioner’s

As the client, you can also start the transfer from the ‘Invite Practitioner’ link under your account management options. Confirm their email and the tax types and access you want to grant, then click ‘invite’.

How do I Register an Employee for a Tax Number on eFiling?

Typically, companies will request a taxpayer number for younger/newer employees who have not had to submit tax returns previously. Mostly, this is done at the time you submit the EMP501 for your company.

- Log in to your account.

- Click on the “Services” tab in the top navigation bar.

- In the “Services” section, click on the “Individual” link.

- Click on the “Register a Person” link.

- This is based on the new eFiling layout, and may look slightly different for older versions, but the gist is the same.

- Enter the employee’s personal details, including their name, date of birth, and physical address.

- Enter the employee’s contact information, including their email address and phone number.

- Enter the employee’s employment details, including their start date, occupation, and employer.

- Read and accept the declaration, acknowledging that the information provided is correct and complete.

- Click on the “Submit” button to submit the registration request.

There is a batch option via e@syfile to make this easier if you have a lot of employees to do.

SARS will review the registration request and, if approved, will assign a tax number to the employee. The employee will receive their tax number and instructions on how to register for eFiling in the mail. Once the employee has registered for eFiling, they will be able to view their tax information and submit tax returns online.

It’s important to register your employees for tax numbers as soon as they start working to ensure that their tax affairs are in order and to avoid any penalties or interest charges.

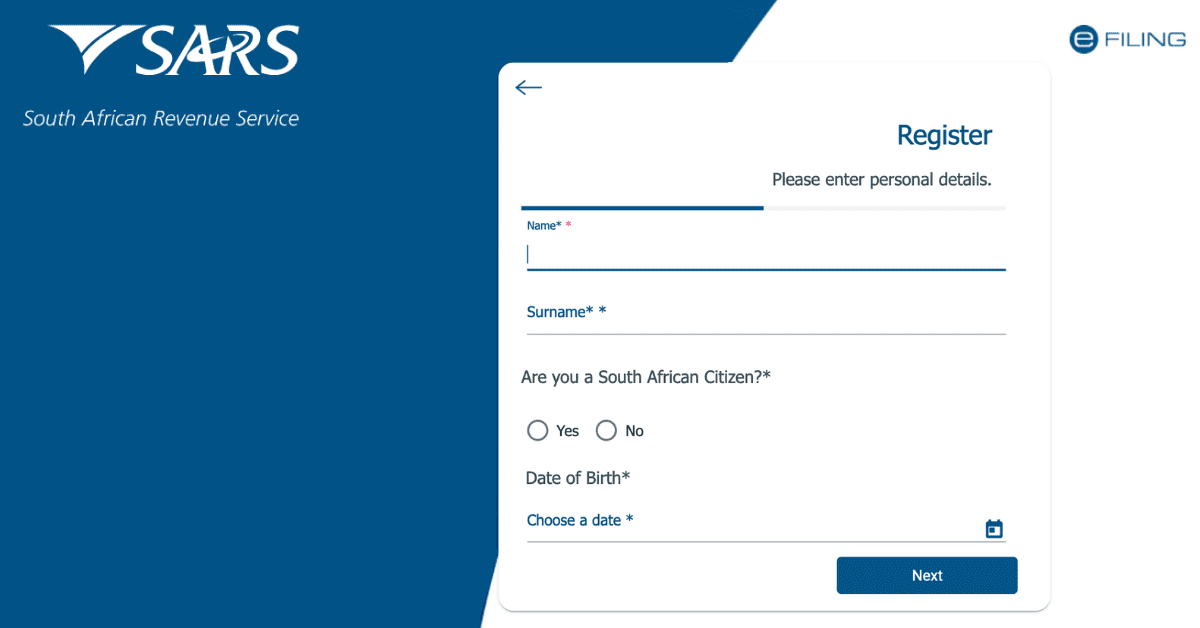

How do I Create an eFiling Profile for a Company?

Creating an eFiling profile for a Company is very similar to doing so for an individual. You will simply register a different type of profile (Organization).

- Go to the eFiling website

- Click on the “Register” option.

- Select the “Organization/Company” option from the list of registration options.

- Enter the company’s registration number, as indicated on your CIPC registration certificate.

- Enter the company’s personal details, including the company name, physical address, and contact information.

- Enter the details of the company’s authorized representative, including their name, physical address, and contact information.

- Read and accept the declaration, acknowledging that the information provided is correct and complete.

- Click on the “Submit” button to submit the registration request.

The authorized representative you nominated will receive an email with instructions on accessing the company’s eFiling profile. Once the profile has been accessed, the authorized representative can use the eFiling system to submit tax returns, view tax information, and communicate with SARS on behalf of the company.

How Long Does it Take for SARS to Approve eFiling Registration?

Typically eFiling registration is live within 48 hours of your request- you may even get near-instantaneous access. Lack of required supporting documents can slow the process down, so make sure to upload everything correctly as prompted by the system. If your registration takes longer than 48 hours, head to Home>User>Pending Registration to see if there’s a reason for the delay.

Being able to manage multiple clients or employees in one place makes using eFiling incredibly convenient. Luckily, registering them is a simple process and very similar to the procedure for an individual taxpayer.