Enabling tax categories within eFiling is crucial for individuals and businesses in South Africa to effectively handle their tax responsibilities. The South African Revenue Service (SARS) offers eFiling, an online platform that empowers taxpayers to submit returns, facilitate payments, and access various tax-related services. Grasping the process of activating tax categories on eFiling is key to seamless adherence to the nation’s tax regulations. This comprehensive guide navigates through the intricacies of tax types, explaining how to activate them on the eFiling platform, and provides insights into managing your tax affairs with ease.

How to Activate Tax Types on eFiling

Activating tax types on eFiling is a straightforward process that allows taxpayers to access and manage their specific tax obligations. Follow these steps to activate tax types on eFiling:

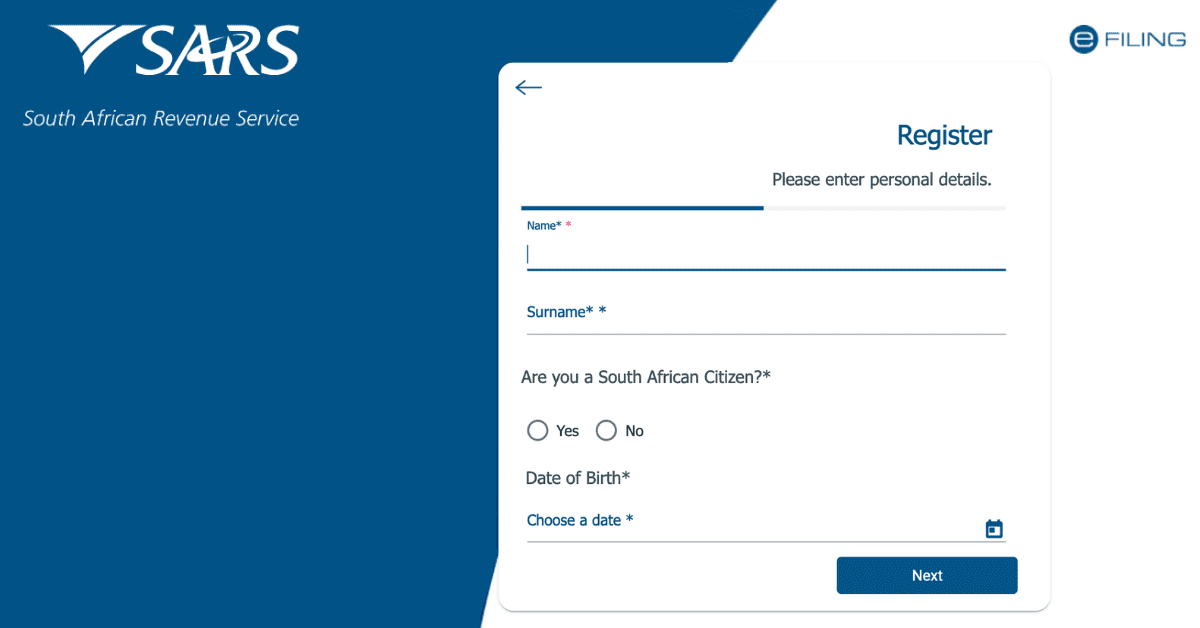

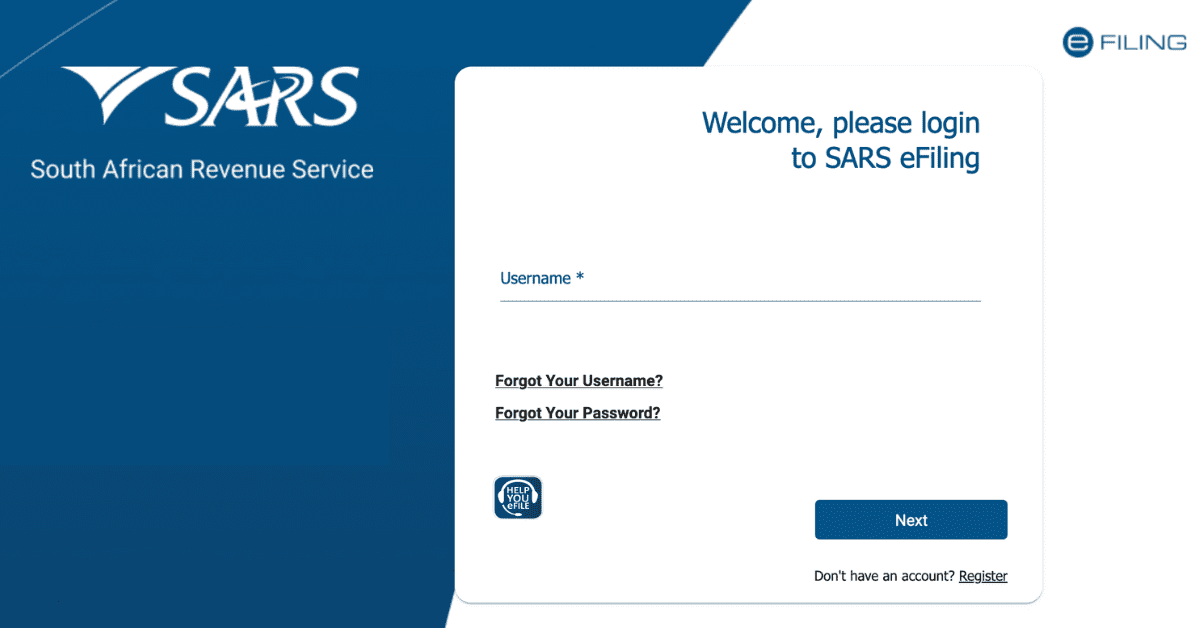

- Log In to eFiling: Visit the SARS eFiling website and log in using your username and password.

- Access the Tax Profile Page: Check your tax-profile page once signed in. This section provides an overview of your registered tax types and liabilities.

- Incorporate Tax Categories: To initiate fresh tax classifications, opt for “Add Tax Categories” or “Enroll for Taxation.” The system will direct you through a sequence of inquiries to identify the applicable tax categories.

- Furnish Essential Data: Depending on the tax category, you might require particulars like your revenue origins, enterprise particulars, or fiscal specifics.

- Dispatch the Request: Scrutinize your plea for precision and entirety, then transmit it via eFiling. You’ll be notified once your application is handled.

- Manage Your Tax Types: After activation, you can manage your tax types, submit returns, make payments, and access relevant documents through eFiling.

Note that the activation process might differ slightly based on your specific personal or business situation. Also, it’s vital to stay updated on your tax responsibilities, submit returns promptly, and adhere to tax laws.

What Are Tax Types on eFiling?

eFiling tax categories encompass the diverse tax responsibilities applicable to individuals and businesses in South Africa. These cover a wide spectrum of taxation facets, including income tax, value-added tax (VAT), and corporate tax. Every tax category corresponds to a tax duty or commitment hinges on your financial engagements and legal standing.

The key tax types you may encounter on eFiling include:

- Income Tax: This levies individuals’ and businesses’ income, including salaries, profits, and rental income.

- Value-Added Tax: VAT is applied to goods and services supply. When businesses reach a specific revenue level, they must enrol for VAT.

- PAYE: The Pay-As-You-Earn (PAYE) system necessitates employers to withhold PAYE from workers’ wages and send it to SARS on their account.

- Provisional Tax: There’s a provisional tax requirement for individuals and corporations with sizable taxable earnings.

- Customs and Excise: It’s indispensable for agencies importing, exporting, or producing items subject to excise levies.

How Do I Manage Tax Types at SARS?

Managing SARS tax types involves initial registration, ongoing compliance, and regular interaction with the tax authority. Here’s a comprehensive guide on how to manage your tax types effectively:

- Register for the Appropriate Tax Types: When you start earning income or establishing a business, register for the relevant tax types with SARS. This may include income tax, VAT, PAYE, and more.

- Keep Accurate Records: Maintain meticulous financial records, including income statements, expenses, and receipts. Accurate records are essential for calculating and verifying your tax liability.

- File Returns on Time: SARS requires taxpayers to submit regular tax returns, whether monthly, bi-annually, or annually, depending on the tax type. Ensure you meet the deadlines for filing returns.

- Make Timely Payments: Pay the correct amount of tax promptly. This includes PAYE deductions for employees, VAT payments, provisional tax, and other tax liabilities.

- Respond to SARS Communications: If SARS requests additional information or clarification regarding your tax affairs, respond promptly and provide the requested documentation.

- Regularly Update Your Information: Notify SARS of any personal or business information changes, such as contact details or legal structure.

- Seek Professional Advice: For complex tax situations or when unsure about your tax obligations, consult a tax professional or use SARS resources for guidance.

- Use eFiling: Take advantage of SARS eFiling for convenient online management of your tax types, including returns, payments, and communication with SARS.

By effectively managing your tax types at SARS, you can ensure compliance, avoid penalties, and contribute to the country’s revenue collection efforts.

What Are the Two Types of Taxation in South Africa?

South Africa employs a dual taxation system comprising direct and indirect taxes:

- Direct Taxes: These are taxes directly imposed on individuals and entities based on income or wealth. Income tax is the leading direct tax in South Africa, impacting both individual earnings and business profits. This tax follows a progressive rate, implying that those with higher incomes shoulder a greater percentage of the tax. Companies are taxed flatly, although there are provisions for small business tax rates.

- Indirect Taxes: Indirect taxes are levied on consuming goods and services. Value-added tax (VAT) is the most prominent indirect tax in South Africa. It’s applied to purchasing goods and services, and the burden falls on the end consumer. Customs and excise duties are also part of indirect taxation, primarily affecting businesses engaged in the importing, exporting or manufacturing of specific products.

This dual taxation system ensures that South Africa generates revenue from various sources while considering the ability to pay different taxpayers. Effective tax management and understanding the taxation landscape are essential for financial planning and compliance.