Whether we like it or not, all of us are required to fulfil certain obligations, and one of those obligations is to pay our taxes. But registering for income tax or filing your tax return doesn’t need to be onerous. Individuals in South Africa can now activate their personal income tax and electronically file their returns thanks to the South African Revenue Service’s (SARS) eFiling technology, designed to make the process as simple as possible. This tutorial will walk you through activating your personal income tax and submitting your tax return using SARS eFiling. Let’s dive in!

How do I activate my personal income tax?

To file your tax returns on time and per SARS rules, activating personal income tax is a necessary step. And there are various ways to acquire your IT150, which is required to begin filing your individual income tax.

eFiling is a viable option for triggering your individual income tax reporting requirements. After logging into your eFiling account, select the “Notification of registration” icon on the homepage to access your IT150. By doing so, you will receive your unique tax identification number.

Sending an SMS to SARS at 47277 is another option to initiate your individual income tax. With this, you can get an SMS with your IT150 (tax reference number) shortly after submitting your request. You can also get your registration notification as an eFiler through the SARS mobile app.

You can file your taxes with SARS once you get your tax identification number. Also, if you want to avoid fines and legal trouble from SARS, you must accurately report all of your income on your tax return.

Activating personal income tax will give you the confidence that you are following all SARS rules and contributing to the country’s growth.

How can I activate my income tax registration on eFiling?

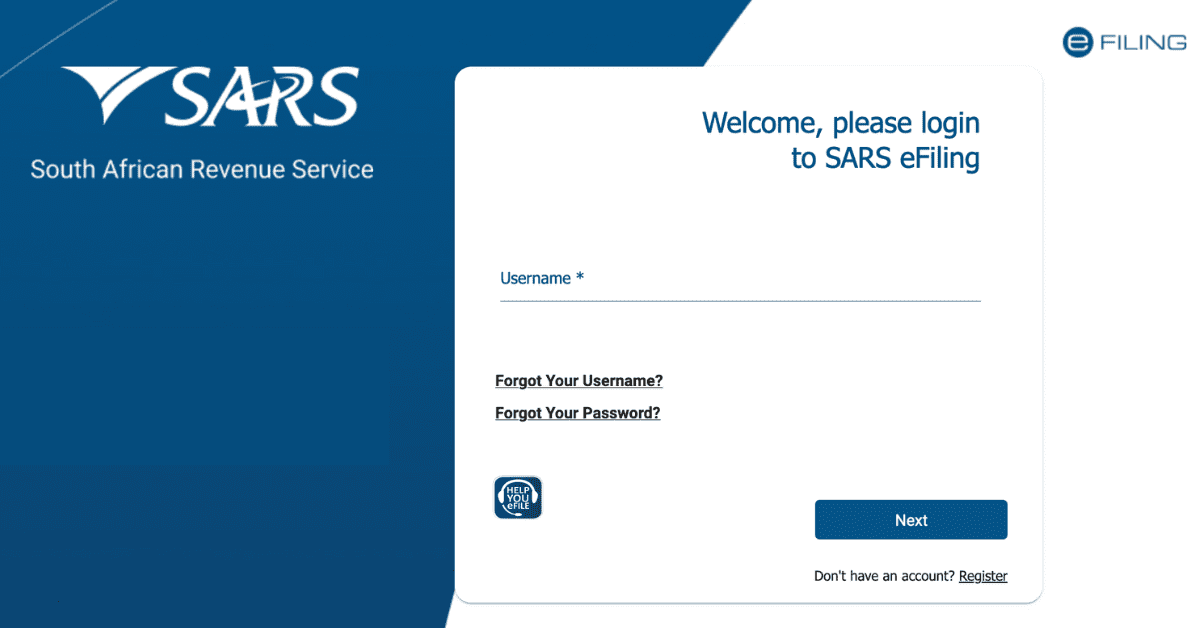

Registering for eFiling is a straightforward process that allows you to manage your income tax affairs easily. Once registered, you’ll be able to file your income tax return, make payments, and request tax clearance certificates, all from the comfort of your own home or office.

To activate your income tax registration on eFiling, you can either visit the SARS eFiling website or download MobiApp and tap “REGISTER.” Once registered, you can have different roles, depending on your requirements. For example, you can act as an individual taxpayer, an employee or registered company representative, or an agent on behalf of someone else.

SARS will verify the information you have provided during the registration process, and if it is successful, you will receive a One-Time-Pin (OTP) to complete your registration. The verification process takes up to 48 hours, and you will receive an email or a notification on your eFiling registration verification page. If the status is not successful, you will need to respond based on the correspondence received from SARS.

Suppose SARS does not process your eFiling registration within 48 hours and needs supporting documents. In that case, you can log in to your eFiling profile and go to “Pending Registration” under the “User” section on the “Home” page. This page will give you further information regarding processing your eFiling registration.

Overall, activating your income tax registration on eFiling is a simple and convenient process that can save you time and effort in managing your tax affairs.

How do I activate my SARS eFiling status?

Are you ready to activate your SARS eFiling status and become fully compliant? Great! In this section, we’ll show you how to establish whether you’re compliant with SARS so that you can obtain a tax clearance certificate.

First, log in to your eFiling account and click on the “Tax Status” option. You’ll see a page where you need to click on the “Tax Compliance Status” button, followed by the “Activation” button. Tick the box that says “Tax Compliance Status,” agree to the disclaimer, and click “Activate.”

Next, click on “Continue” when the next page appears. You’ll check another page where you must click “Continue” again. Scroll down to the bottom of the page, where you’ll find a declaration. Click “Yes” to confirm your command, and click “Submit Form.”

Finally, you’ll see a page displaying your tax compliance summary. If everything is green, congratulations! You fully comply with SARS and can apply for a tax clearance certificate. However, if you have any red flags, click on the plus sign next to each category to see what needs rectification.

If you’ve already gone through the activation process and want to check if you’re tax compliant, log in to your eFiling account and click on “My Compliance Profile” under “Tax Compliance Status.”

So, activate your SARS eFiling status today and become fully compliant to enjoy all the benefits of having a tax clearance certificate. And remember, the SARS eFiling Help Desk is always available to assist you if you encounter any difficulties.

How do I submit an individual tax return through eFiling?

Return filing may seem like a difficult task, but with eFiling, it’s easier than ever before. Read this section for a comprehensive breakdown of the eFiling process for filing an individual tax return.

First, get yourself signed up for eFiling and connected to the internet reliably. Remember, you can register for SARS on their website if you still need to complete that step.

After signing in, you’ll need to begin a new tax return. But first, verify that your contact details and other personal data are accurate and up-to-date.

The following step is picking the correct tax year and choosing the right one. Providing your details is the next exciting step. Have your IRP5, medical aid certifications, and any other paperwork that may be required handy.

After filling out the form, double-check that the data you entered is correct and comprehensive. Fill out the necessary paperwork and send it to SARS. If SARS requires further paperwork, they will notify you through eFiling so you can submit it electronically.

That’s all!