Keeping an eye on your credit score is an important part of handling your money and deciding if you are creditworthy.

Checking your credit score regularly can tell you a lot about your financial situation. This can help you make smart choices and take action to improve or keep your credit profile in good shape.

You can find and fix possible problems early on when you check your credit score, which is a big plus. Getting rid of mistakes, like mistakes in your credit report, can keep your score from going down and help you keep better financial records.

Also, keeping an eye on your credit score lets you see how it changes over time, which shows you how your finances are doing and point out areas that may need your attention.

How often can you check your credit score without hurting it?

A good credit score can lead to many financial possibilities. When you ask for loans, credit cards, or mortgages, lenders will often look at your credit score to see how creditworthy you are. A higher credit score makes it more likely that you will be approved and may help you get better interest rates and terms.

By checking your credit score often, you can make plans to raise it, which will give you more financial options in the future.

Knowing the things that affect your credit score, like how well you have paid your bills in the past, how much credit you use, and how long you have had credit, gives you the power to make smart financial decisions.

Some things you can do to improve your credit score over time are making payments on time and using credit wisely. A good credit score can also help you stay financially stable, which can give you peace of mind and a sense of security.

Finally, if you want to be financially independent, you need to check your credit score.

It lets you take charge of your credit health, deal with potential problems before they happen, and set yourself up for better financial possibilities.

Your financial future will be safer and better off if you keep an eye on your credit score and work to improve it smartly.

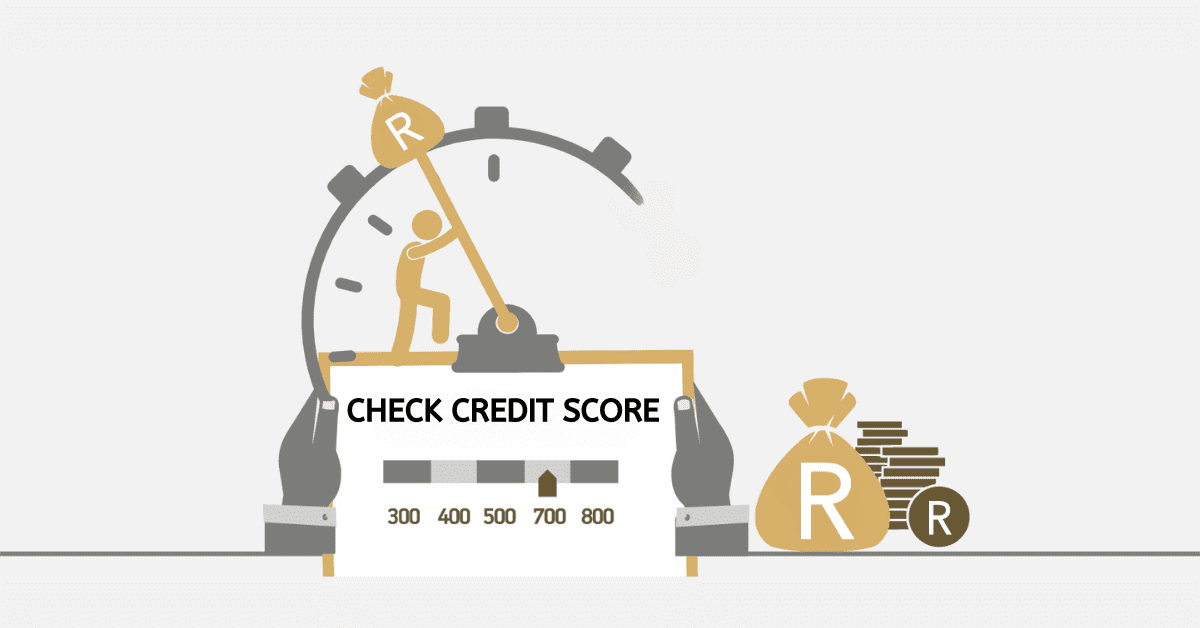

What is the best way to check your credit score?

To find out your credit number, the best thing to do is use a reputable credit agency in South Africa, like Experian, TransUnion, or Equifax.

These companies will give you a report that is reliable and includes everything about your credit past and score. You can be sure that your credit report is correct and safe by getting to it through the credit bureau’s official website.

In South Africa, people are legally allowed to get one free credit report a year from each of the three main credit companies.

At this point, you can check your cash situation without spending any more money. Regularly checking your credit score can help you find any issues or potential problems early on, so you can fix them when it is most convenient for you.

What affects your credit score?

Here are the things that affect your credit score and we will be sharing them with you.

- Taking court action could hurt your credit score because it might make people think you are less likely to pay your bills on time. These may not have as much of an effect on your credit score after two years.

- While it is possible for your credit score to go down if you have a lot of debt, it may give the impression that you rely on borrowing a lot.

- Not making payments on time can hurt your credit score because it makes lenders doubt that you will be able to pay back future debts as planned.

- If your amount changes, your lenders will know that you have changed how you spend your money, which could cause your score to go down.

- Should you choose to open a new credit account, you should know that your credit score may go down for a short time. This is because an inquiry could be added to your report, which would make the average age of your credit deals shorter. As you show that you can responsibly handle your credit, your score will probably creep up over time.

- Because your credit usage rate changes when you close an account, your credit score may go up or down because of it. This may lower the number of credit accounts you have and the average age of those accounts. In the same way, if an account is taken off your report, it may lose the good effect it had on your score.

- A request shows up on your credit report when a lender looks at it. This is a normal thing that happens when you apply for credit or sometimes when you apply for a new job or a place to live. Part of the process is done all the time. The amount of credit checks that show up on your report should be kept to a minimum. This could hurt your credit score because it shows that you count on credit and might have trouble paying it back.

Why is my credit score going down when I pay on time?

This is a common question most people who are not familiar with credit score reduction ask. When you make a payment, your credit score adjusts but mostly decreases. This could happen for various reasons.

Even if you pay your bills on time, your credit score could go down if you use a lot of credit, get new credit inquiries, or have creditors report late payments or other bad information. Changes in the types of credit you have and the average age of your accounts can also affect your score.