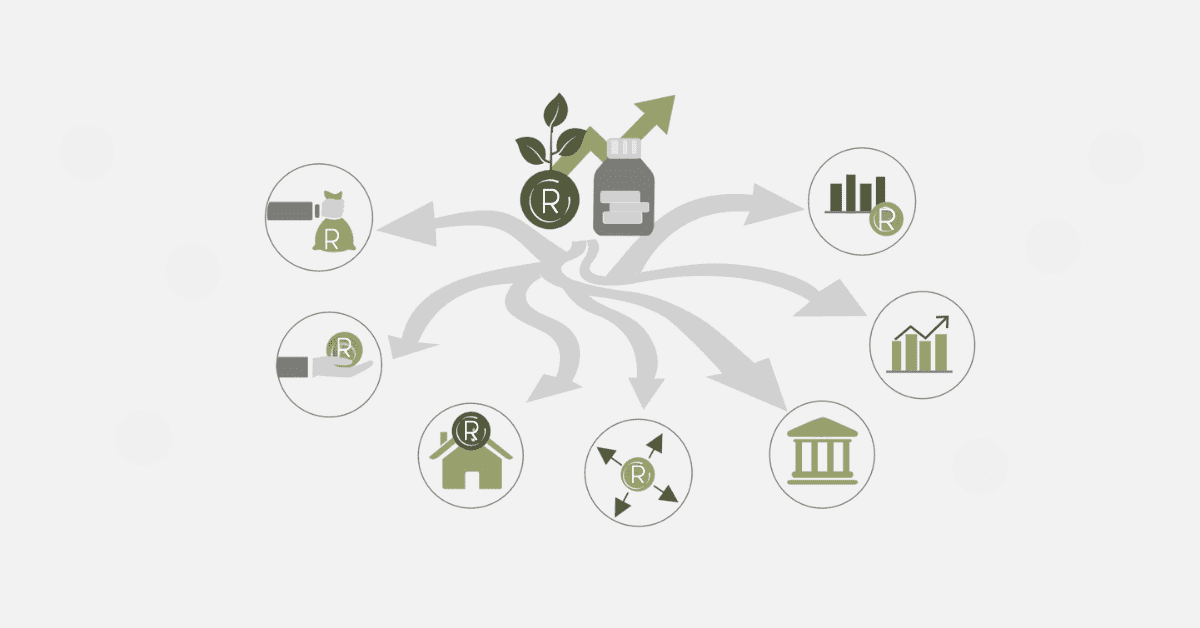

Mutual funds have grown to be one of the most viable avenues of investment available to individuals in South Africa because of the benefits accruable from pooling resources from several investors to generate wealth. Mutual funds, as managed by professional asset managers, are offered to permit access to a portfolio of such stocks, bonds, or other assets that are usually diversified. However, mutual funds have to be marketed and sold if they are ever to achieve any level of success. This would cover all those strategies that would inform the prospective investors about the mutual fund itself, the risks and returns associated with it.

Marketing and Selling of Mutual Funds

These are distributed in South Africa through various channels to penetrate different segments of the population. Banks, insurance companies, and other financial institutions are generally at the forefront in this regard. There is a definite leaning towards diversification, professional management, and the facility of investment in various asset classes. Mutual fund companies generally promote their products, informing investors through their campaigns in the print media, seminars, and websites.

It is also done in conjunction with financial advisors and brokers who provide the conduit between the mutual fund companies and the clients that may be potential customers. These professionals are important because they explain to the clients the different types of mutual funds in the market, the risk profile, and how such funds match their financial goals. Added to this is the fact that South African asset management houses are also varying some digital marketing methodologies to reach out and engage with their technophile investors through social media, webinars, and email marketing campaigns.

Can I Purchase a Mutual Fund with No Broker?

Yes, it is possible in South Africa to buy mutual funds directly from the house of mutual funds, thereby cutting out the brokers. Several asset management companies, like Allan Gray, Coronation, and Ninety One, have made buying mutual funds very easy on their websites or investment platforms.

Direct buying is very suitable for those kinds of people who love independence in their investment decisions and will not pay broker commissions. This means that in the case of buying mutual funds independently, one has to research and do the selection of funds that fit their financial goals.

Most management firms simplify life for investors with user-friendly online platforms on which one can even register an account, view available funds, and buy directly. While in their accounts, investors can see the growth of their mutual funds and continue to contribute more or withdraw their money.

How Do You Entice Customers to Invest in Mutual Funds?

Attracting consumers to invest in mutual funds, therefore, requires an approach that has to do with education, trust-building, and access. The most logical probable strategy to engage these potential investors would be to explain in a very transparent manner the possible benefits and risks of mutual funds. Normally, asset management companies in South Africa implement some sort of educational campaign that explains to the customer how mutual funds work, how diversification takes place, and how such investments could help them reach their long-term financial goals.

Apart from this, trust can also be one of the major reasons for the attraction of customers towards themselves. Mutual fund promoters typically emphasize performance records through the promotion of successful funds that are outperforming year after year. Partnerships with trusted financial advisers and institutions build credibility in that investors would most likely trust recommendations from professionals they already know and trust.

The marketing campaigns can also be addressed to any of the customer segments in terms of their financial goals, such as retirement planning or savings for education, wealth preservation, and others. Therefore, mutual fund companies have relatable and compelling reasons for potential investors to engage in offering them personalized investment solutions and success stories of real investors. Online platforms and mobile apps further facilitate investment in mutual funds through easier research, comparison, and investment.

How Much Money Does it Take to Open a Money Market Fund?

Initial investment amounts for creating money market funds within South Africa are small and can be afforded by almost all types of investors. Most money market funds in South Africa allow an investor to invest as little as R 500 to R 1,000 at the beginning. For example, large asset management companies like Allan Gray and Coronation have money market funds where the minimum limit to invest is merely low and accommodates even the most unsophisticated investor to join in.

Money market portfolios are normally low-risk investments, usually made in high-liquid, very short-term, high-quality debt securities such as treasury bills or government bonds. They promise a reasonably stable and predictable return; hence, they attract conservative investors who would preserve their capital while earning a modest return. Being among the investments that usually require relatively small initial investments, money market funds are usually the gateway for every investor to enter the world of mutual funds in a manner that doesn’t require them to commit a great amount at the beginning.

What is the Commission of a Mutual Fund Distributor?

In South Africa, mutual fund distributors are typically paid some form of commission based on the overall amount of money their clients place in the fund. This commission structure can be variable, based on the particular type of mutual fund, as well as upon the distribution contract between the fund firm and the distributor.

Typically, commissions come in two forms: upfront fees, otherwise known as front-end loads, or ongoing fees, otherwise referred to as trailing commissions. The one-time commission is that which is charged at that particular point in time when the investor buys into the mutual fund shares and normally ranges between 1% and 3% of the investment. The trailing commission is an ongoing fee that becomes payable to the distributor every year as long as the investor is in the fund, and such a commission usually ranges between 0.5% to 1% per annum.

How Do I Sell My Mutual Fund as an Agent?

Selling mutual funds in South Africa is a job that requires knowledge, strategy, and relationship-building skills. One should have in-depth knowledge about different types of mutual fund products that exist on the market: risk profiles, history of performance, and who it was created for. This will also place them in an excellent position to match the right mutual fund with the prospective clients’ specific financial goals.

A rapport with the client is the mainstay of mutual fund sales. The agent should take the time to understand their client’s financial needs, risk tolerance, and long-term goals and advise them on suitable mutual funds accordingly. Personal advice and satisfaction of queries by the client will instil trust and indirectly make the customer invest in it.

Agents equally need to be enlightened on the current market trends and performance of every mutual fund they are selling. That is, keeping the clients up to date with current market conditions; periodic portfolio reviews will keep the clients confident in their investment decisions. Finally, good communication, follow-ups, and educational resources guarantee a sound relationship between them, which is the ultimate desired goal for selling mutual funds.

![What are ETF [Exchange-Traded Funds]?](https://www.searche.co.za/wp-content/uploads/etf.webp)