You want to be a proactive and empowered credit user, so you have signed up for a free credit monitoring service. Perhaps you also know that you can get credit reports from the credit bureaus themselves. You are allowed one free report annually and can access others as you need for a very small sum- typically between R20 and R30 per report. Now, someone you know has told you that pulling your credit will negatively affect your credit score, and you’ve done the wrong thing! Are they right? Today we unpack this common question and everything you should know about pulling credit reports.

Does Pulling a Credit Score Lower It?

Let’s start with the great news. Pulling a credit score won’t lower it. Unless you happen to be a lender yourself!

Two types of credit inquiry can be made. This is why this common misconception occurs. So-called soft inquiries do not have any impact on your credit score at all. They are just requests for information, not active attempts to get credit. So you can pull as many personal credit reports as you like. In fact, you should be regularly monitoring your credit score as a proactive measure to detect potential errors or fraudulent activity on your credit report.

The inquiries that will negatively impact your credit score are hard inquiries. These are the inquiries that lenders make when they are actively seeking to approve you for new credit. These have a small negative impact on your overall credit score.

Why do hard inquiries impact your credit score negatively? Unlike the information-monitoring soft inquiry, hard inquiries are a sign you are hoping to be approved for new credit. One hard inquiry from one lender won’t have too big an impact on your score. However, if you have a flurry of hard inquiries, this is a signal to lenders that there is a coming change in your financial circumstances. If approved, there’s a new line of credit open in your name that could change your debt profile and creditworthiness. The data around it, especially your payment history, is not yet available and could impact what they see.

If you have had many hard inquiries in a short period, it could also mean you are ‘shopping around’ for credit. This isn’t inherently wrong, and could just mean you are comparing your options between lenders, perhaps to find a better interest rate. However, it could be a future red flag that you are expecting a change in financial circumstances. Maybe you are trying to open credit before you lose a job or retire. Or you may have come into money through an inheritance or promotion, and may not be using it smartly. These inquiries won’t otherwise show on your report unless the bureaus log them, so the small negative decline is there as a warning sign to them that the report may not be accurate to your new circumstances.

How Much Does Pulling Your Credit Affect Your Score?

So, now you know! Pulling your credit score yourself will have no impact at all on your credit score. Nor will other casual soft inquiries from other parties. What about those credit score-reducing hard inquiries, however?

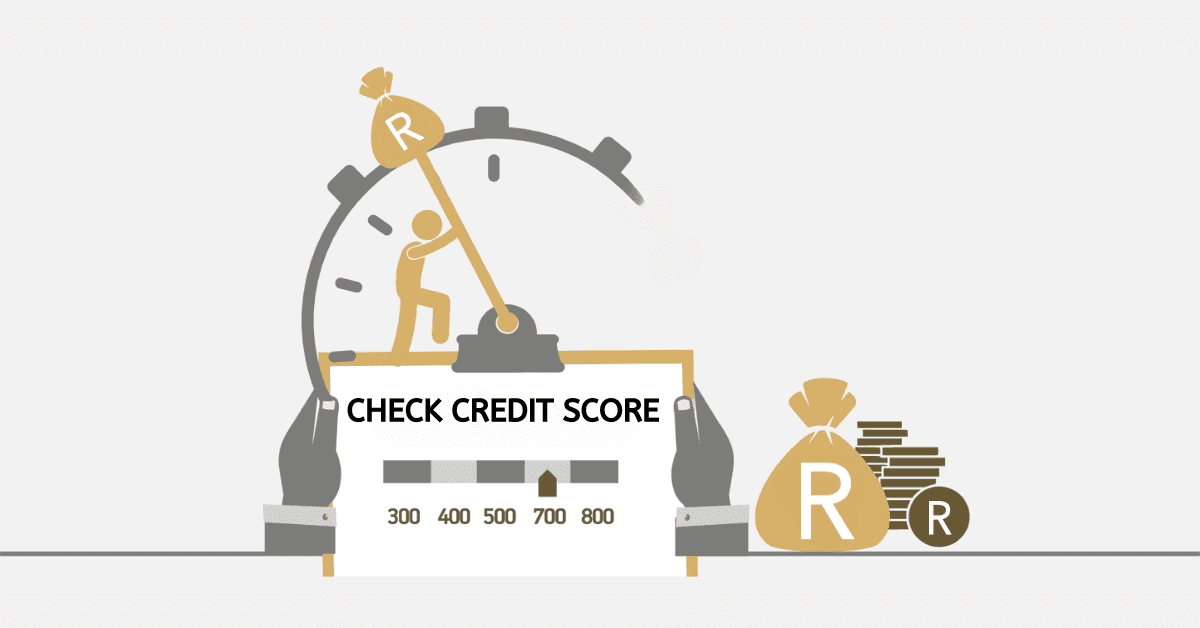

In South Africa, each hard inquiry made on your credit report will drop your credit score by between 5 and 10 points on average.

How Badly Does Pulling Your Credit Affect Your Score?

As you can see, even a hard inquiry doesn’t have a huge impact on your credit score individually. Each hard inquiry is relatively minor and typically lasts for only a short duration. However, multiple hard inquiries within a short period, such as when applying for multiple loans or credit cards simultaneously, can signal to lenders that you are actively seeking credit and may pose a higher risk. Consequently, frequent hard inquiries can have a more significant negative impact on your credit score.

Let’s again reiterate that soft inquiries, which are the only type you can make on your own credit report, will not affect your credit score badly at all. Even if you have had someone tell you this! Soft inquiries have no impact on credit scores, and anyone who thinks otherwise is confusing them with hard inquiries.

How Many Times Can You Pull Your Credit Score Without Hurting Your Credit?

So, as an individual looking to pull their credit score, there is no limit to the number of times you can pull your credit score without negatively impacting it. As mentioned earlier, soft inquiries do not affect your credit score at all. Therefore, you can access your credit report as frequently as you need to monitor changes in your credit profile or track your progress toward your financial goals. There will be no negative repercussions.

Now you should feel utterly confident in the differences between hard and soft inquiries, and how often you can pull your credit report without affecting your credit score. While hard inquiries resulting from credit applications may temporarily lower your credit score, soft inquiries, including self-checks, have no impact whatsoever. By understanding the distinction between hard and soft inquiries and monitoring your credit report responsibly, you can effectively manage your credit score and make informed financial decisions.