The Unemployment Insurance Fund, better known as UIF, is a government-run program in South Africa that provides temporary financial assistance to workers who have lost their jobs or who are unable to work due to illness, maternity, or adoption. The program is funded through monthly contributions from both employers and employees.

In this way, the UIF acts as a safety net for workers who are facing financial hardship due to unforeseen circumstances out of their control. Understanding how UIF payments work and how to apply for benefits is crucial for people who find themselves in need of assistance, and the system can be complex to navigate. One of the questions that we often see around UIF payments is how they are calculated and for how many months you can receive assistance. Here’s what you need to know about these issues.

How Many Months Does UIF Pay Out?

If you have full credit days with the UIF, and you are claiming for the loss of work, not maternity leave or other potential UIF categories, you will receive UIF payments for up to 12 months. You will have full credit days with the UIF if you have paid into the fund (while working) for longer than 4 years.

If you have been working for less than 4 years, you will not have the full amount of credit days open to you and will receive a shorter pay out time. Be aware that this refers to earning an income and paying into the UIF fund, not working with a specific employer, so most salaried adults with continual working history in South Africa will qualify for the full pay period.

Does UIF Pay Monthly or Lump Sum?

For unemployment UIF claims, you will typically receive a monthly amount paid into your bank account for the 12 month period or until you resume work, not a lump sum. If you have heard of cases where people have been paid out a lump sum, it is very likely one of these two circumstances:

- They were claiming from the UIF for different reasons. Maternity leave and death of a provider can both be paid as lump sums, far more commonly than for unemployment UIF claims.

- There were delays in processing their UIF claim, and they received a lump sum comprising their backdated UIF amounts from their original date of application. They will now receive the remainder as monthly payments.

How Long Does it Take to Get Paid After Signing for UIF?

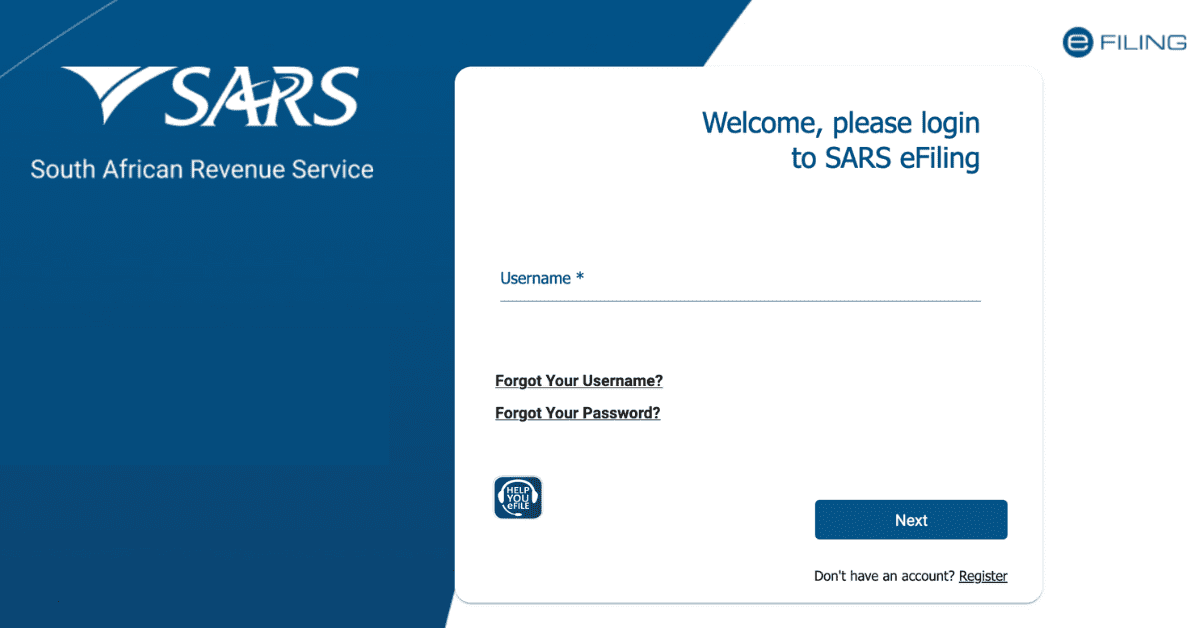

The processing time for UIF claims vary depending on a number of factors, including the completeness of the application, the accuracy of the information provided, and the volume of claims being processed at the time. However, their stated pay out times are 15 days for unemployment claims. As there is high demand for the UIF in South Africa, however, it often takes considerably longer.

It typically takes between 2 and 4 weeks for a UIF claim to be processed from start to finish, provided that all the required documents and information are submitted and there are no issues with the claim. Once the claim has been processed, the UIF will pay the benefits directly into the individual’s bank account on a monthly basis, in arrears. This means that the individual will receive the first payment at the end of the month following the month in which the claim was approved. So if you are approved in January, you may receive your first payment at the end of February.

Remember that if there are any issues with the application or if additional information is required, the processing time will be delayed. In such cases, the UIF may contact the individual to resolve the issue, which will further delay the payment of benefits. For this reason, try to respond timeously to any queries you receive. You should also take responsibility for tracking your UIF claim and follow up if there seems to be issues with it. This will help ensure the speediest resolution possible for your case and the quickest possible payment date.

Can I Claim UIF After 6 Months?

In most circumstances, unfortunately, you cannot claim UIF after 6 months. You must submit your claim for unemployment benefits within six months from the date of your unemployment. If you fail to submit your claim within this time frame, you will forfeit your right to claim any benefits from the UIF. Therefore, it’s important to submit your UIF claim as soon as possible after you become unemployed.

There are certain (and rare) circumstances in which you can make an appeal to have your case considered after 6 months. However, these are exceptional circumstances, and most will not be approved, especially if you have reached the cut-off date only because of negligence on submitting the claim on your side. So it pays to submit your UIF claim as early as possible and be vigilant during the application process.

How Are Monthly UIF Payments Calculated?

The calculation of monthly UIF payments is very personalized, and based on the worker’s earnings while employed. The maximum amount you can receive is 38% of the aggregate of your previous earnings over the last 6 months, or R17,712, monthly, whichever is less. The amount of days you have worked, and your earnings over that period, will both be used to calculate the final amount. While it is a complex calculation, this basic formula will help:

UIF amount = Daily Benefit Amount (DBA) x Income Replacement Rate (IRR)

So first, do the following:

- Calculate a monthly average: (Your monthly salary x 6 months) / 6 months

- Calculate your day rate from this: (Average monthly salary x 12 months) / 356 days

The UIF then uses what is called an IRR, or Income Replacement Rate, formula to arrive at your daily benefit amount, or DBA. This formula is currently 29.2 + (7173.92/ (232.92 + Y1). This ‘Y1’ figure causes a lot of confusion and has not been clarified by the department. However, you should know that the IRR will be a minimum of 38% and a maximum of 60% of your daily income. Your employment history over the last 4 years will impact it considerably.

Once they have arrived at this ‘day rate’, however, your credit days come into play. Every 4 days you contributed to the UIF will earn you one credit day. The maximum you can accumulate is 365, giving you the full year of support, after working and contributing for 4 years.

Here is an example for an applicant with a fixed salary of R5000 a month:

- Monthly Average: R5000x 6 /6 = R5000

- Day Rate: R5000 x 12 / 365 = R164.38

- They will then decide what IRR applies to the individual. Let’s say they will receive a 38% IRR, as this is the most common figure used.

- R164.38 x 38% (Minimum IRR) = R62.4 DBA.

- This will then be paid out according to the individual’s credit days.

While calculating the exact amount of UIF you will receive is a complex matter, at least you know that this social safety net is there to help you when you need it.